Why Your 2025 Paycheck Feels So Complicated

If your first reaction to a new job is “why is my paycheck so low after deductions”, you’re not alone. Вetween remote work, side gigs and stock options, a 2025 pay stub packs far more information than it did even ten years ago. Taxes, health plans, student‑loan repayment, retirement savings and a pile of “codes” turn the stub into a mini‑spreadsheet. At the same time, governments push more transparency, and apps promise to decode everything instantly. This mix of complexity and digital tools makes understanding deductions less about memorizing rules and more about knowing where to look and what questions to ask.

From War Taxes to App‑Driven Payroll

Modern paycheck deductions grew out of 20th‑century tax experiments. Mass income tax withholding really expanded during World War II, when governments needed steady cash flow and couldn’t wait for annual payments. By the 1970s, automatic retirement contributions and health insurance premiums joined the list, turning employers into financial intermediaries. In the 2000s, direct deposit and online portals made stubs mostly digital. By 2025, payroll systems integrate with tax agencies in real time, and many countries use pre‑filled returns, relying almost entirely on data taken from each paycheck you receive during the year.

Basic Principles: What Gets Taken Out and Why

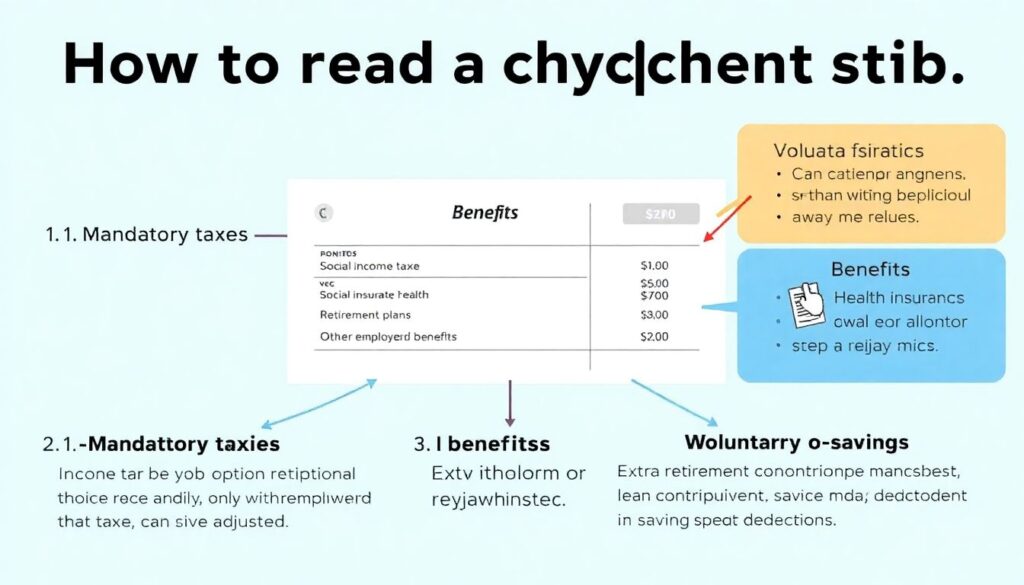

Understanding how to read my paycheck stub deductions starts with separating three big buckets: mandatory taxes, benefits, and voluntary savings or repayments. Mandatory items are income tax, social security‑type programs, and sometimes local taxes; you can’t opt out, only adjust your withholding. Benefits include health, dental, disability and sometimes life insurance, usually subsidized by the employer. Voluntary items are retirement plans, extra savings, union dues, and wage garnishments. Each item has its own rules on limits and tax treatment, which is why a “small” change in your form or benefits election can noticeably change your take‑home pay.

Key Lines You Should Always Check

Most digital stubs in 2025 show a similar structure, even if the design differs. Focus on these spots:

– “Gross pay”: what you earned before any deductions

– “Pre‑tax deductions”: items that lower your taxable income (e.g., 401(k), health premiums)

– “Taxes”: federal, state, local and social contributions

Also watch for “year‑to‑date” (YTD) columns, which track totals across the year. Those YTD figures are what tax agencies and many payroll services for employee paycheck deductions rely on when syncing data. If the YTD numbers look off, that’s a strong signal to contact HR or payroll before issues snowball into a tax‑season headache.

Digital Tools and Calculators in 2025

You no longer have to reverse‑engineer your stub with a spreadsheet. A good paycheck tax deductions calculator can simulate your next paycheck if you change your tax form, adjust retirement savings, or switch insurance tiers. Many fintech apps now plug directly into your employer’s system or bank account to estimate your net pay in real time. The better ones let you model “what if” scenarios: a raise, a bonus, moving to another state, or adding a second job. This turns your stub from a static document into a planning tool you can use before committing to bigger financial decisions.

Payroll Software and AI: How Employers Manage Deductions

Behind the scenes, HR teams depend on the best software to manage employee paycheck deductions, because the rulebook changes constantly. In 2025, AI‑assisted payroll platforms automatically update tax tables, monitor contribution limits, and flag inconsistencies, like deductions exceeding legal caps. For employees, that usually means fewer errors and faster corrections. However, automation isn’t magic: if your data is entered incorrectly—wrong marital status, outdated address, missing dependent info—the system will confidently calculate the wrong numbers. That’s why onboarding forms and periodic reviews of your profile matter more than most people think.

Real‑World Examples: Raises, Bonuses, and Side Gigs

A classic surprise comes with a promotion. You celebrate the raise, then your first post‑raise stub arrives and the net pay looks underwhelming. Crossing into a higher tax bracket, boosting retirement contributions, or upgrading health coverage can all eat into the increase. Another example: one‑time bonuses. Because they’re often taxed using special methods or higher flat rates, people often ask why is my paycheck so low after deductions when they finally get a bonus. Side gigs add another twist, since many platforms don’t withhold taxes at all, leaving you to manage estimated payments manually.

Where People Commonly Misread Their Stubs

A lot of anxiety comes from mixing up pre‑tax and post‑tax deductions. When you add a new benefit and your take‑home shrinks, it may still be saving you money overall if it lowers taxable income. Other frequent misunderstandings include:

– Assuming a higher tax bracket means all your income is taxed at that higher rate

– Treating refunds as “free money” instead of over‑withholding you gave the government

– Ignoring YTD caps, like retirement plan limits, that can change your net pay mid‑year

Clearing up these points makes the numbers on the stub feel less arbitrary and more like a system you can control.

Strategic Use of Payroll and Planning Services

Many companies now bundle financial wellness tools with payroll services for employee paycheck deductions. These portals often show plain‑language explanations next to each line item, links to benefit details, and sliders to preview how changes affect net pay. Some even integrate a built‑in paycheck tax deductions calculator so you can tweak contribution rates and instantly see new take‑home estimates. Used proactively—before open enrollment or a big life event—they can help you balance current cash flow with long‑term goals, instead of discovering too late that you’ve overcommitted part of your paycheck.

How to Build a Simple Personal Checkup Routine

Treat your pay stub like a monthly health check. Every few pay periods, quickly review:

– Are your name, address, and tax filing status still correct?

– Do YTD totals roughly match your expectations for income and savings?

– Have any “mystery” deductions appeared you don’t recognize?

If something seems off, take screenshots, note dates, and contact HR or payroll with specific questions, not just “this seems wrong.” In 2025, support teams usually have detailed logs from their systems and can trace when a setting changed. A calm, data‑driven question is the fastest route to a clear, helpful answer.

Bringing It All Together

Understanding your paycheck in 2025 is less about memorizing tax rules and more about learning to navigate tools and data. Once you can confidently say you know how to read my paycheck stub deductions, you’re better positioned to decide whether to raise or lower retirement savings, tweak withholdings, or adjust benefits. The combination of smarter payroll platforms, AI‑driven planning apps, and accessible calculators means the information is finally on your side—if you use it. Your stub isn’t just a receipt; it’s a live dashboard of your financial life, updated every payday.