Understanding Financial Transition: Challenges Immigrants Face

Relocating to a new country often involves not only cultural and social adaptation but also a significant financial transition. Financial planning for immigrants can be especially challenging due to unfamiliar tax systems, fluctuating currencies, and different cost-of-living standards. According to a 2023 OECD report, over 58% of first-generation immigrants in developed countries report difficulty managing their daily expenses during their initial two years. This highlights how crucial budgeting for newcomers is, especially when traditional financial behaviors from their home countries may not align with the economic environment of the host nation.

Many immigrants must build credit history from scratch and may lack access to affordable financial products. This creates barriers to long-term saving or investment. Understanding these limitations is key to creating a sustainable personal finance plan.

Core Definitions in Immigrant Financial Planning

To navigate the financial systems of a new country, it’s important to define key concepts. Budgeting is the process of forecasting income and expenses over a set period to ensure that spending aligns with one’s financial goals. Credit history refers to an individual’s record of borrowing and repaying debts, which is vital in accessing housing or loans. Emergency fund is a dedicated savings reserve, usually 3–6 months of living expenses, set aside for unexpected costs.

In the context of personal finance tips for immigrants, these concepts serve as foundational tools. They are critical not only for daily money management in a new country but also for long-term stability, such as preparing for homeownership or managing education costs.

Diagramming Financial Priorities: A Conceptual Overview

When visualized, immigrant financial priorities can be represented as concentric layers:

1. Core Layer – Immediate needs: housing, food, transportation.

2. Stability Layer – Building credit, setting up a bank account, understanding taxation.

3. Growth Layer – Saving strategies for immigrants, investing, retirement planning.

This diagram reflects a progression from survival to stability to growth. Budgeting for newcomers should prioritize the core layer but quickly evolve to embrace the stability and growth aspects for sustainable financial health.

Comparative Budgeting: Local Citizens vs. Newcomers

A comparative look at budgeting reveals stark differences between native citizens and recent immigrants. While locals often have established credit histories and access to employer-sponsored retirement plans, newcomers may face volatile income or job insecurity. For example, a 2022 study by the Migration Policy Institute found that immigrants are 33% more likely to work part-time or in underpaid jobs during their first 24 months in a new country.

Unlike citizens who may allocate significant portions of their income to savings or investments, immigrants might prioritize remittances or immediate family support. This necessitates unique saving strategies for immigrants, such as using digital remittance services with low transaction fees or community-based rotating savings groups (ROSCAs), often used in Latin America and Africa before migrating.

Effective Budgeting Tools and Strategies

To ensure successful integration into a new financial ecosystem, newcomers can adopt targeted strategies:

– Use localized budgeting apps that account for regional cost of living and tax structures.

– Automate savings to gradually build an emergency fund without active effort.

– Allocate funds weekly instead of monthly to better manage cash flows in unstable employment situations.

Implementing these financial planning for immigrants not only improves short-term money management in a new country but also lays the groundwork for asset accumulation and long-term financial security.

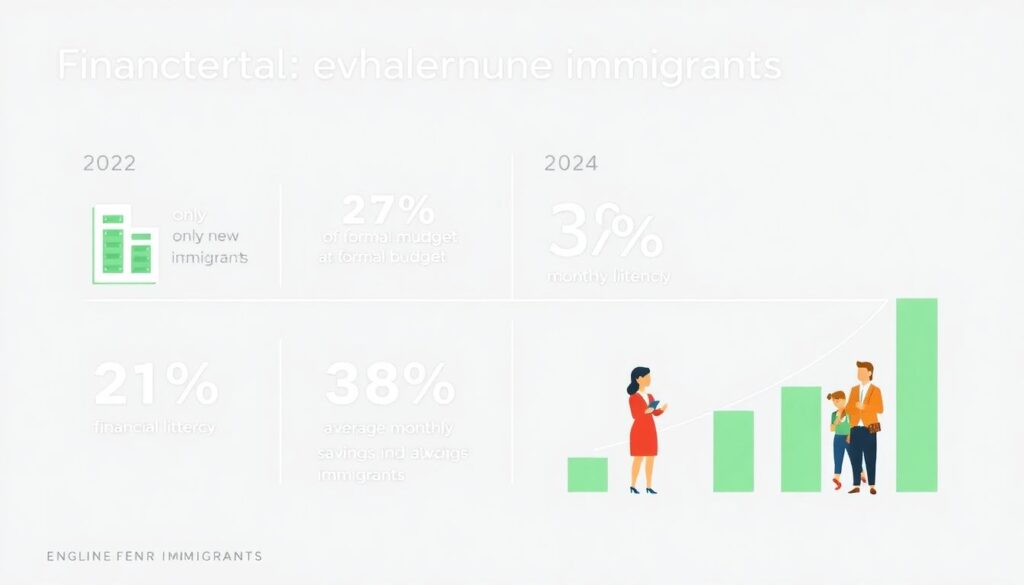

Data Insights: Financial Behavior Trends (2022–2024)

Recent data reveals evolving patterns in immigrant financial behavior. According to a Pew Research analysis:

– In 2022, only 21% of new immigrants maintained a formal budget. By 2024, this figure rose to 38%, indicating greater financial literacy.

– Average monthly savings among immigrants increased from $180 in 2022 to $270 in 2024, despite inflationary pressures.

– Usage of mobile banking by new immigrants jumped from 46% in 2022 to 68% in 2024, showing growing integration into formal financial systems.

These trends reflect not only greater access to financial tools but also a shift in mindset towards long-term planning. Personal finance tips for immigrants now emphasize digital inclusion and proactive habits.

Case Study: From Cash-Based to Digital Budgeting

Consider the example of Rashid, an immigrant from Pakistan who arrived in Canada in 2022. Initially operating on a cash-only basis, he struggled to track his spending accurately. After attending a free financial literacy program, he began using a bilingual budgeting app connected to his local bank, allowing him to categorize expenses and schedule automatic savings. Within 12 months, he built a six-month emergency fund and improved his credit score by 120 points.

Such examples underscore the power of tailored budgeting for newcomers and the importance of accessible financial education in facilitating immigrant success.

Conclusion: Building Financial Resilience in a New Country

Establishing financial security as an immigrant requires more than earning income—it demands structured planning, cultural adaptation, and persistent learning. By understanding core concepts, leveraging technological tools, and integrating saving strategies for immigrants, newcomers can create resilient personal finance systems. As financial literacy rates rise among immigrant populations, so does their capacity to contribute to and benefit from the host economy. Whether navigating housing costs or planning for retirement, informed budgeting empowers immigrants to take control of their financial future.