Understanding the Financial Landscape for U.S. Veterans

Transitioning from military to civilian life involves more than a change in occupation — it also requires a major financial shift. According to the U.S. Department of Veterans Affairs, as of 2023, nearly 57% of recently separated veterans reported struggling with budgeting and long-term savings. The military provides structure, benefits, and predictable income — elements that often vanish in civilian life. This guide aims to bridge that gap by introducing veterans to the fundamentals of personal finance, using real-world examples and proven strategies.

Step 1: Assessing Your Post-Service Financial Status

The first step in any financial journey is understanding where you stand. Veterans should start by identifying income sources, fixed expenses, debts, and assets. For example, a retired Army Sergeant First Class receiving $2,350/month in pension and $1,800 in VA disability benefits ($4,150 total) must plan carefully to avoid overspending.

Technical Focus: Net Worth Calculation

Formula:

Net Worth = Total Assets – Total Liabilities

Example:

If a veteran owns a home worth $250,000, has a $180,000 mortgage, $10,000 in savings, and $5,000 in credit card debt:

Net Worth = ($250,000 + $10,000) – ($180,000 + $5,000) = $75,000

Knowing your net worth gives a clear picture of financial health and helps set realistic goals.

Step 2: Building a Monthly Budget

Budgeting is crucial, especially when transitioning into civilian employment where income may fluctuate. The 50/30/20 rule is a widely-used budgeting method:

– 50% for needs (housing, food, utilities)

– 30% for wants (entertainment, travel)

– 20% for savings and debt repayment

Let’s consider a Marine Corps veteran working as a security contractor earning $60,000/year. After taxes (~$48,000), applying the 50/30/20 rule leads to:

– $2,000/month for needs

– $1,200/month for wants

– $800/month for savings/debt

Technical Focus: Budgeting Tools for Veterans

Several apps cater to veteran financial needs:

1. You Need A Budget (YNAB) – Offers military-specific budget templates.

2. Mint – Integrates VA payments and tracks credit score.

3. VA eBenefits Budget Planner – Government tool tailored for benefit recipients.

Step 3: Managing VA Benefits and Retirement Income

Understanding and optimizing VA benefits is vital. As of 2024, the average monthly VA disability compensation was $1,483, up 6.4% from 2022. Veterans eligible for the Post-9/11 GI Bill can also receive housing stipends averaging $1,700/month, depending on location.

Real example: A Navy veteran attending college full-time can combine a $1,700 BAH (Basic Allowance for Housing) with $1,200 in disability pay, totaling $2,900/month — enough to cover rent and modest living expenses.

Technical Focus: Taxation of VA Benefits

VA disability benefits are non-taxable, unlike military retirement pay. Veterans should account for this difference when filing taxes or applying for income-based assistance.

Key Tip: Use IRS Form 1040 and exclude VA compensation from “total income” to avoid overpaying taxes.

Step 4: Eliminating High-Interest Debt

Debt is a significant challenge. A 2023 report by the CFPB found that 38% of veterans carry credit card debt over $5,000, often at interest rates exceeding 19%. Veterans should prioritize paying off this debt using either the avalanche or snowball method.

1. Avalanche Method – Focus on the highest interest rate first

2. Snowball Method – Pay off smallest balances first for psychological momentum

Example: An Air Force vet with $6,000 in credit card debt at 21% APR could save over $1,250 in interest by paying it down aggressively over 12 months.

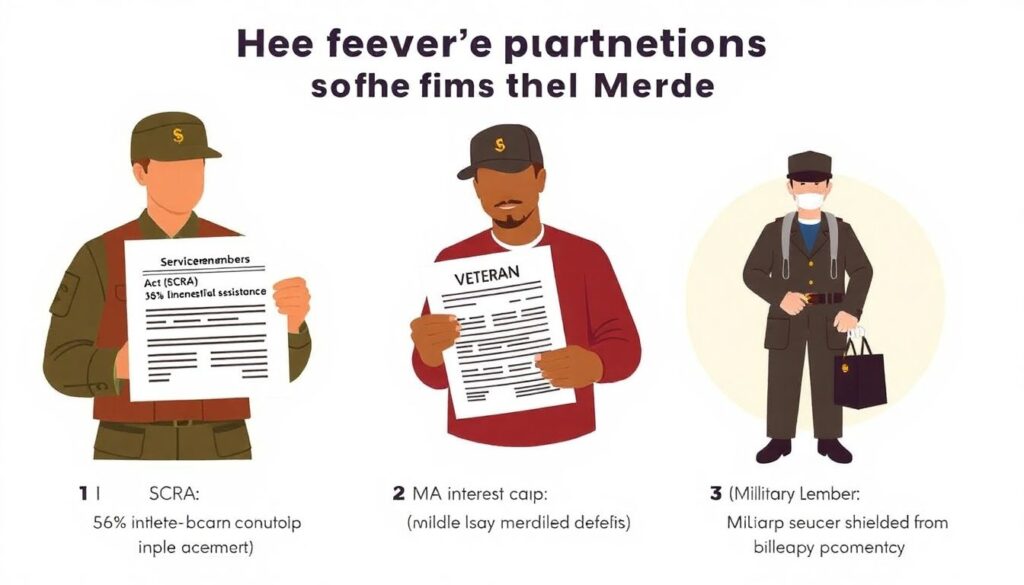

Technical Focus: Military-Specific Debt Relief Programs

– Servicemembers Civil Relief Act (SCRA): Caps interest at 6% on pre-service debt

– VA Financial Hardship Assistance: Adjusts medical copays and benefit overpayments

– Military Lending Act (MLA): Protects from predatory lending (36% APR cap)

Step 5: Saving and Investing for the Future

Long-term financial health depends on consistent saving and smart investing. Veterans can contribute to Roth IRAs (ideal for tax-free growth) and open brokerage accounts for additional wealth-building. In 2025, the annual IRA contribution limit is $7,000 for those under 50, and $8,000 for 50+.

Consider a Coast Guard retiree investing $500/month in an S&P 500 index fund averaging 7% annual return. In 20 years, this grows to over $260,000 — enough to supplement retirement income significantly.

Technical Focus: Thrift Savings Plan (TSP) for Veterans

While TSP is mostly for active-duty personnel, separated service members can roll over their funds into IRAs or keep investing within TSP.

Key Advantages:

– Ultra-low fees (expense ratio ~0.043%)

– Lifecycle funds (L Fund) auto-adjust risk over time

Step 6: Using VA Home Loan Benefits Wisely

One of the most valuable benefits is the VA-backed home loan. In 2023, over 740,000 loans were issued under the program. VA loans require no down payment, no private mortgage insurance (PMI), and offer competitive rates (~6.5% in 2024 vs. 7.1% conventional).

Example: A veteran purchasing a $300,000 home with a VA loan saves roughly $12,000 upfront (no 4% down payment) and avoids ~$150/month in PMI.

Technical Focus: VA Loan Eligibility Criteria

To qualify, veterans must have:

1. 90 days of wartime active duty or 181 days during peacetime

2. Honorable discharge

3. Certificate of Eligibility (COE) via VA.gov

Tip: Always compare lenders — VA loans still vary in closing costs and service quality.

Final Thoughts: Building a Financial Mission Plan

Just like a mission in service, financial success requires strategy, discipline, and adaptation. Veterans must take ownership of their financial future by tracking spending, leveraging benefits, minimizing debt, and investing consistently. According to a 2024 Pew Research survey, veterans who actively manage their finances are 42% more likely to report financial satisfaction than those who don’t.

Whether you’re recently discharged or long retired, it’s never too late to create a financial mission plan tailored to your civilian life. Start small, stay consistent, and remember — your service earned you benefits. Now, use them to build the life you deserve.