Understanding the Importance of a Family Emergency Fund

Historical Perspective: Lessons from Economic Uncertainty

The concept of a family emergency fund isn’t new, but its urgency has become more pronounced in recent decades. Historically, moments of financial turmoil — such as the 2008 global financial crisis, the COVID-19 pandemic starting in 2020, and subsequent inflationary pressures into the early 2020s — exposed the vulnerabilities of households that lacked emergency reserves.

By 2025, with lingering effects of economic disruptions and geopolitical instability, families around the world increasingly recognize the necessity of financial preparedness. In fact, according to a 2024 global financial behavior report, over 60% of families experienced at least one unplanned expense that disrupted their budget in the past year.

Step 1: Define Your Emergency Fund Goal

Every family’s needs differ. To decide how much you need to save:

– Calculate 3 to 6 months of essential expenses, including housing, food, healthcare, utilities, and transportation.

– Take into account dependents, existing debts, and regional cost of living.

For example, a family of four living in a metropolitan area might need a fund of $15,000 to $30,000, while a rural-based couple might need significantly less.

Tip for Beginners:

Start with a micro-goal. Even $500 can cover minor emergencies like car repairs or appliance failure. Small wins build momentum.

Step 2: Audit and Reallocate Your Budget

Look at your current expenses. Identify non-essential spending that can be redirected into savings without severely impacting quality of life. For instance:

– Dining out

– Streaming services you rarely use

– Unused gym memberships

Redirecting even $10 a day can accumulate over $3,600 in a year — a solid start for your fund.

Quick Wins: Where to Cut Costs Immediately

– Switch to generic brands for groceries and household items

– Negotiate insurance rates or switch providers

– Cancel auto-renewing subscriptions

These subtle shifts are easier to implement than drastic lifestyle changes and can yield surprisingly fast results.

Step 3: Open a Separate, Accessible Account

Psychologically and practically, separating your emergency fund from your main account prevents the temptation to dip into it casually.

Choose a high-yield savings account or a money market account that:

– Offers quick access (within 24–48 hours)

– Has no monthly fees

– Provides FDIC or government-backed protection

Beginner Mistake to Avoid:

Don’t invest your emergency fund in stocks or long-term bonds. Volatility and lack of immediate liquidity make them unsuitable for emergency resources.

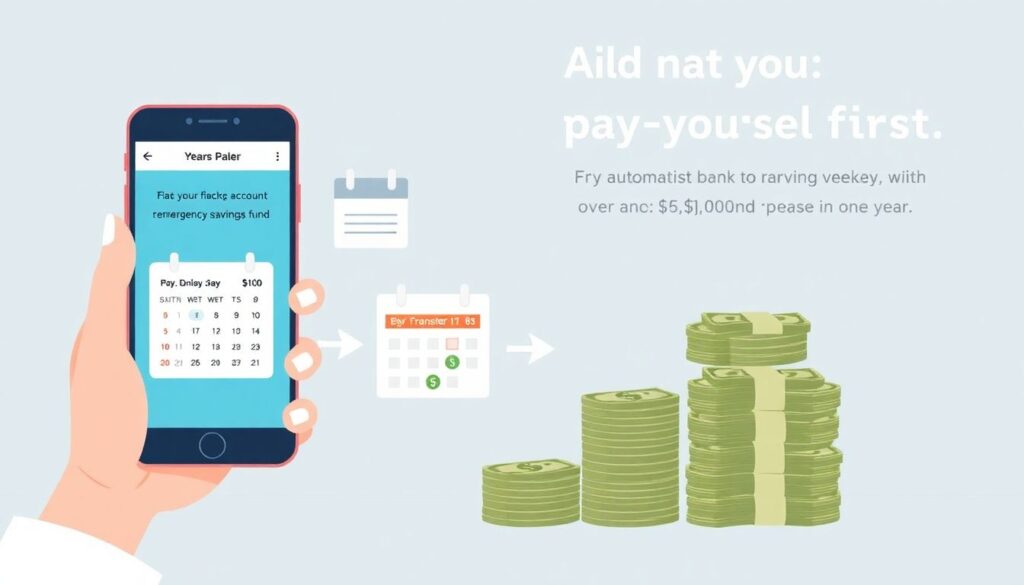

Step 4: Automate Savings to Accelerate Growth

Set up automatic transfers from your checking to your emergency fund right after payday. This “pay yourself first” strategy ensures consistency and removes willpower from the equation.

Even a transfer of $100 per week builds over $5,000 in one year — faster than most realize.

Boost Contributions with Windfalls

Whenever you receive unexpected income, such as:

– Tax refunds

– Work bonuses

– Cash gifts

Commit at least 50–75% of these amounts to your emergency fund. These windfalls can significantly accelerate your progress without affecting your daily budget.

Step 5: Supplement Income Strategically

To build your emergency fund quickly, explore ways to earn more in addition to saving more.

Options for families include:

– Freelance or part-time work (e.g., tutoring, delivery driving)

– Selling unused items online

– Renting out a room or vehicle

Each additional income stream, even temporary, can cut months off your saving timeline.

Warning:

Avoid payday loans or high-interest credit lines as a shortcut to create an emergency cushion — they often cause long-term debt cycles rather than solve problems.

Step 6: Track Progress and Adjust as Needed

Review your emergency fund status monthly. Life changes — such as having a child, moving, or a job loss — should prompt a reevaluation of your savings goal.

Celebrate milestones: reaching your first $1,000, then $5,000, and so on, reinforces discipline and motivation.

Use Visual Tools

– Graphs and apps can help you visualize progress

– Shared family dashboards encourage accountability and engagement

Final Thoughts: Security Is Built, Not Bought

Creating a family emergency fund quickly doesn’t require overnight sacrifices — it requires consistent, informed action and a shift in mindset. In the wake of recent global challenges, families who prioritize preparedness gain not just financial stability, but peace of mind.

In essence, the emergency fund is not just a financial tool — it’s a form of resilience. And resilience is priceless.