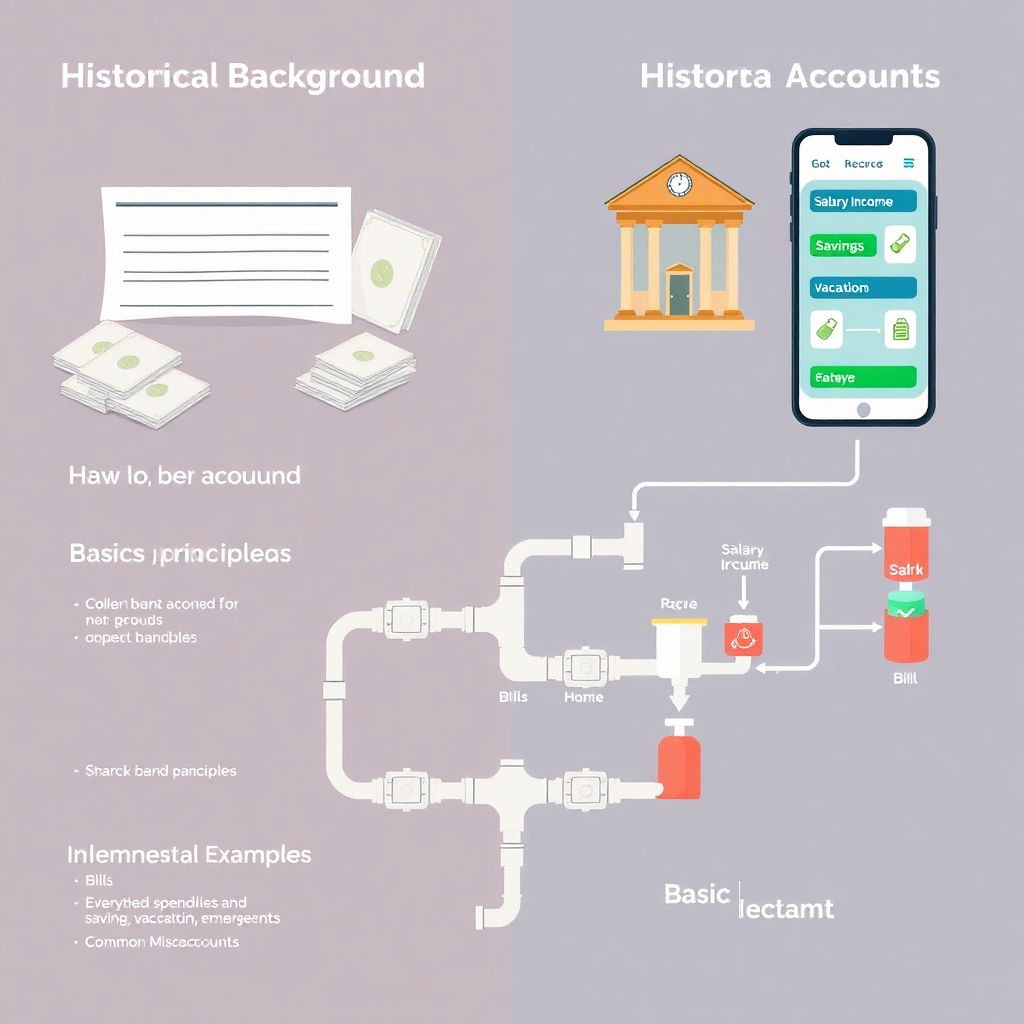

Historical background

Before we all carried smartphones, most people ran everything through one checking account and maybe a separate savings pot. Bills, rent, emergency fund, vacations — all tangled together, tracked on paper or not tracked at all. As banking went digital, it became easier to open extra accounts, and online banks that allow multiple checking and savings accounts started to promote “bucket” systems: one account for rent, one for taxes, one for goals. At the same time, budgeting software and envelope methods moved from cash to screens, and people realized that extra accounts could act like psychological walls, not just technical containers. The result is today’s norm: using several accounts as a practical tool to control behavior rather than a sign of financial complexity for its own sake.

Basic principles

Running several accounts without chaos comes down to a few core rules. First, give every account a clear job: bills, everyday spending, long‑term savings, taxes, or irregular expenses. Second, fix the money flow: salary lands in one hub account, then scheduled transfers feed the others. When you think about how to organize multiple bank accounts for savings and bills, treat it like plumbing — leaks appear where flows are ad‑hoc. Third, cut friction: the best bank accounts for managing multiple accounts offer instant transfers, decent interest, and low fees, so you’re not punished for splitting your money. Finally, document your system in one place so you can adjust it later instead of rebuilding from memory.

– Name each account in online banking according to its role, not the bank’s generic label

– Align transfer dates with paydays to reduce the feeling of “empty” weeks

Implementation examples

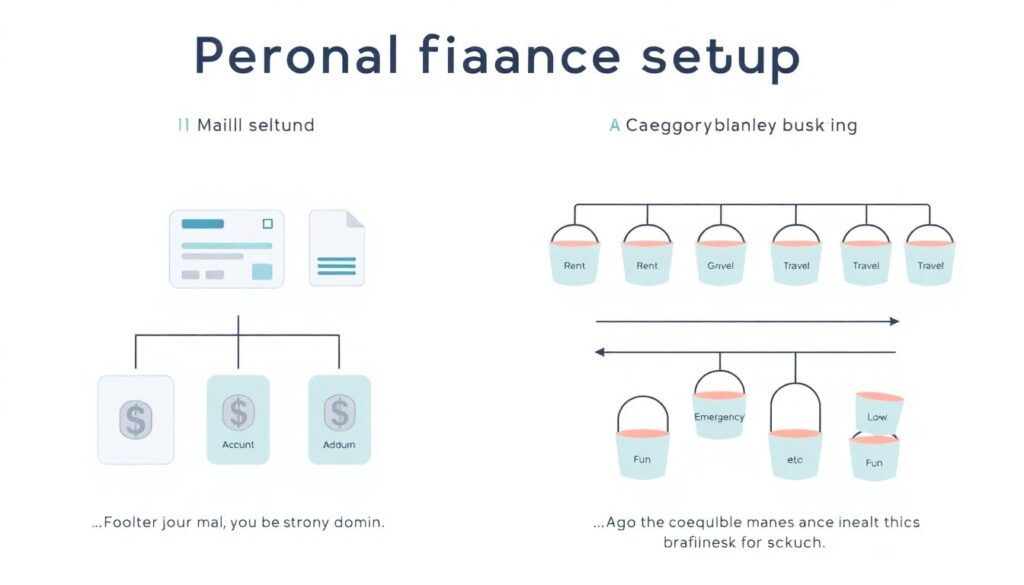

People usually land on one of three setups. The minimalist approach keeps one main checking account, one savings account, and maybe a small “fun” account; this limits admin but relies heavily on self‑control. A category approach uses several labeled savings and checking buckets, often linked to a multi account banking app for budgeting that automates transfers and alerts. Finally, a hybrid approach is popular with freelancers and small firms that need a business bank account for managing multiple sub accounts: one master account receives income, then money is routed to tax, operating expenses, and owner’s pay. None of these is objectively “best”; the right choice depends on how much manual tracking you tolerate and how often your income and bills fluctuate over the year.

– Minimalist: fewer accounts, more spreadsheet or app work

– Category‑based: more accounts, less mental load day to day

– Hybrid: separates personal, business, and taxes to avoid messy year‑end cleanup

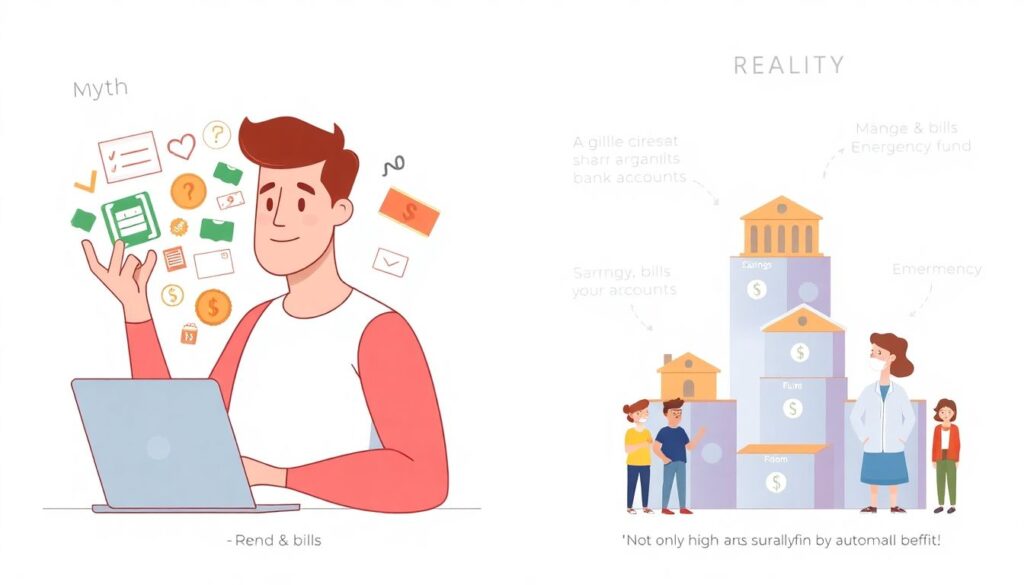

Common misconceptions

Several myths keep people from using multiple accounts effectively. One is that more accounts always mean more confusion; in practice, clear labels and automation make three to six focused accounts easier to manage than one giant, noisy balance. Another myth is that only high earners benefit; in reality, smaller incomes often gain the most from enforced boundaries. People also assume all banks handle this the same way, but fee structures and interfaces vary widely, so it pays to compare online banks that allow multiple checking and savings accounts with traditional branches. Finally, many believe that an app alone will fix everything; technology helps, yet the real power comes from deciding in advance what every dollar is supposed to do and letting the system quietly enforce those decisions.

– Avoid opening accounts for vague goals; ambiguity erodes discipline

– Review your setup twice a year and close any account that no longer has a clear purpose