Why Bond Ladders Deserve a Spot in Your Portfolio

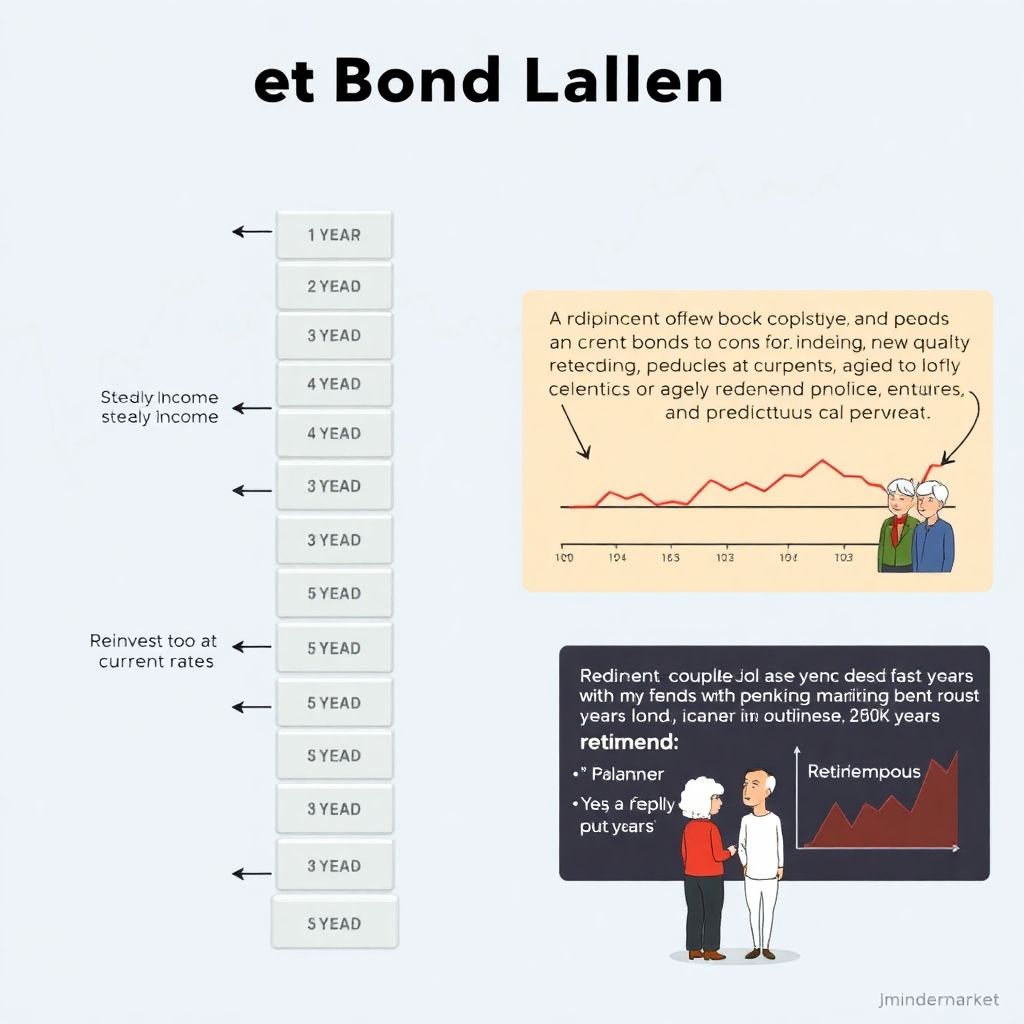

When people think about investing, they usually picture stocks jumping up and down on a chart, not a calm, predictable stream of interest payments. Bond ladders sit firmly in that calmer camp. A bond ladder is simply a series of bonds with staggered maturities: one year, two years, three years, and so on. As each bond matures, you get your money back and can reinvest it at current rates. This structure helps you dodge the risk of locking all your cash into one interest-rate moment in time. For many new investors who want growth but can’t stomach big swings, the best bond ladder strategy for beginners is often one that focuses on safety first, with clear rules for which bonds to buy, how long to go, and when to roll over maturities.

Put simply, a bond ladder trades drama for discipline. You give up the thrill of chasing hot stocks and gain the comfort of a rule-based system that works quietly in the background.

What Exactly Is a Bond Ladder?

Think of a bond ladder like a row of rental properties where each lease ends in a different year. Instead of homes, you own bonds. Each “rung” on the ladder is a bond with its own maturity date. As time passes, one bond matures, you take the principal, and either spend it or buy a new long-term bond at the top of the ladder. Over time, you keep the number of rungs constant, but the entire ladder rolls forward with you. This helps blend different interest-rate environments, smoothes your income, and reduces the pressure of guessing whether rates will go up or down next year.

In practice, that means you don’t need to predict the future of interest rates; you just need to stick to your ladder rules and let time do the heavy lifting.

Real-World Example of a Simple Bond Ladder

Imagine you have $50,000 you want to keep relatively safe for medium-term goals—say, supplementing income while you build your career or covering a child’s college window. Instead of buying one five‑year bond and hoping interest rates cooperate, you split the money into five rungs of $10,000 each: one‑year, two‑year, three‑year, four‑year, and five‑year bonds. Each year, when a bond matures, you take the $10,000 and buy a new five‑year bond. After the first four years, your ladder becomes “steady state”: you always have one bond maturing in a year, and always have exposure out to five years. This setup offers regular access to cash plus some protection if interest rates move sharply.

That routine—maturity, reinvest, repeat—is the engine that makes a ladder both boring and surprisingly powerful.

Why Beginners Gravitate to Bond Ladders

New investors often underestimate how emotionally draining volatility can be. It’s one thing to nod along with a risk profile questionnaire; it’s another thing to see your account drop 20% in a bad month. Bond ladders lower that emotional temperature. You know roughly what interest you’ll receive, and you know when your principal will come back. Instead of checking stock prices daily, you shift focus to the calendar: which bonds mature this year, how much income arrives every six months, and whether current yields justify reinvesting farther out. That framework alone can prevent many panic‑driven decisions. Professionals who coach first‑time investors often highlight bond ladders as a “training ground” for understanding fixed income while keeping risk controlled and goals clearly defined.

For people who like structure and dislike surprises, a ladder often feels more like a plan than a gamble.

Key Benefits You Actually Feel in Real Life

In real portfolios, the benefits aren’t abstract. If you lose your job, having a bond maturing every year (or every quarter, if you build it that way) gives you predictable cash to bridge the gap. If interest rates spike, you’re not stuck; your next maturing rung can be reinvested at the new, higher yields. If rates fall, you still have older bonds locked in at better coupons for a while. Experienced planners often describe bond ladders as a way of “smoothing the ride” so that clients can keep their stock positions long term without losing sleep. Instead of selling stocks in a downturn to cover living expenses, your ladder can shoulder some of that burden.

That’s why many experts pair ladders with stock funds: the ladder funds life, the stocks fund long‑term growth.

Technical Corner: How a Ladder Tames Interest‑Rate Risk

> TECHNICAL DETAIL

>

> Interest‑rate risk = the risk that the value of your bonds falls when rates rise.

>

> In a classic ladder:

> – Short‑term rungs (1–2 years) have low price sensitivity but lower yields.

> – Long‑term rungs (5–10 years) have higher price sensitivity but higher yields.

>

> By holding a mix, your *average duration* (a measure of rate sensitivity) lands somewhere in the middle. As each bond matures at par value, you “reset” part of the portfolio to current rates. Over a full interest‑rate cycle, this can dramatically reduce the regret of investing everything at the wrong moment.

In less technical language: a ladder spreads your bets across time, so you’re never wildly wrong about rates for your entire bond allocation at once.

How to Size and Space Your Rungs

Two questions define the backbone of your ladder: how long it should be and how tightly spaced the rungs are. For many beginners, a five‑year ladder with yearly maturities is a comfortable starting point: it’s long enough to get meaningfully better yields than a checking account, but short enough that you’re never more than a year away from a chunk of principal. Investors with more experience—and more tolerance for rate swings—might extend out to 7–10 years or move to semiannual or quarterly rungs for smoother cash flow. Financial advisors specializing in bond ladder portfolios usually start from the client’s “cash need timeline” and then reverse‑engineer the ladder length and spacing around those dates.

If you’re unsure, err on the shorter side first; it’s easier to extend a ladder later than to be stuck in maturities that feel uncomfortably distant.

Building a Ladder for Retirement Income

For someone approaching or entering retirement, the ladder becomes less about learning and more about survival. The question isn’t just how to invest in bond ladders for retirement income; it’s how to line up those maturities so they match your actual bills. A common approach among seasoned planners is to build a “cash flow ladder” that covers the first 5–10 years of essential expenses in bonds, while leaving the rest of the portfolio in diversified growth assets. For example, if you need $30,000 a year beyond Social Security and pensions, you might build a 10‑year ladder with $30,000 maturing each year. That way, a stock market crash in year two of retirement doesn’t automatically derail your lifestyle, because your spending money is already scheduled to arrive via bond maturities.

That psychological buffer is huge; it reduces the urge to sell stocks at terrible moments just to pay the bills.

A Practical Retirement Case Study

Consider a 62‑year‑old couple with $600,000 in retirement savings and a modest pension. Their planner identifies they need $25,000 per year, on top of pension and Social Security, for the next decade. The advisor sets aside $250,000 to build a 10‑year ladder of high‑quality government and investment‑grade corporate bonds, each rung maturing in sequence with their spending needs. The remaining $350,000 stays in a balanced portfolio tilted to stocks for growth. During a market downturn in year three, their stock holdings drop, but their lifestyle doesn’t change—because the next seven years of required withdrawals are already “pre‑funded” by the bond ladder. Experts consistently point out that this type of structure reduces what’s called “sequence of returns risk,” which can make or break a retirement plan.

It’s not magic; it’s just aligning your investment timelines with your real‑world cash timelines.

Choosing the Right Bonds for Your Ladder

This is where beginners often get stuck. You’ll usually be choosing among government bonds, municipal bonds, and corporate bonds, plus possibly CDs. Conservative investors and planners who focus on capital preservation tend to anchor the lower rungs of a ladder—those maturing soon—in the safest instruments: Treasury bonds or insured CDs. Longer rungs might venture into high‑quality corporate bonds or well‑researched municipal bonds to pick up extra yield. The trade‑off is simple: higher yield usually means higher risk. Many experts recommend that your first serious ladder stick with investment‑grade ratings (BBB/Baa or higher), especially if you’re doing this without professional help. You’re not trying to beat the market; you’re trying to build a shock‑absorber for your finances.

As your experience grows, you can fine‑tune the mix based on taxes, risk tolerance, and interest‑rate views.

Technical Corner: Yield, Credit Quality, and Taxes

> TECHNICAL DETAIL

>

> Key knobs you’re turning when you pick ladder bonds:

>

> 1. Yield to Maturity (YTM) – the annualized return if you hold the bond until it matures and all payments are made as promised.

> 2. Credit rating – agencies like S&P and Moody’s estimate default risk. “AAA–BBB” is typically considered investment grade.

> 3. Tax treatment – municipal bonds may be tax‑free at the federal and/or state level; Treasuries are state‑tax‑free; corporates are fully taxable.

>

> For many middle‑income investors in moderate tax brackets, a simple mix of Treasuries and investment‑grade corporate bonds is an efficient starting point.

If taxes are a big concern, a tax‑aware planner can run the numbers to see whether municipals meaningfully improve your after‑tax yield.

DIY vs Professional Help: What Makes Sense for You

You can absolutely build a simple ladder on your own. Many brokerages let you screen individual bonds by maturity, credit quality, and yield, and then purchase each rung in just a few clicks. Some even offer pre‑packaged ladders that you can customize. If you’re tech‑comfortable, you might decide to buy corporate bond ladder online, mixing in Treasuries and CDs to keep risk in check. On the other hand, as your ladder gets larger or more complex, the value of expert oversight grows. Professionals can monitor credit risk, evaluate call provisions, and rebalance when yields shift meaningfully. They also have the experience to spot hidden traps in “too good to be true” yields that sometimes tempt beginners.

If you’re moving six figures or more into a ladder, at least a one‑time consultation with a qualified advisor is usually worth the fee.

What Advisors Who Use Ladders Tend to Recommend

Advisors who regularly use ladders in client portfolios tend to repeat a few themes. First, they stress clarity of purpose: know whether your ladder is for income, safety, or a specific goal date. Second, they emphasize staying within your circle of competence—simple, transparent bonds over exotic structures. Third, they often prefer plain‑vanilla, low risk investment bond ladder services offered by major brokerages rather than complex packaged products with hefty fees. And finally, these advisors remind clients that bond ladders aren’t a replacement for a diversified portfolio; they are one tool for stabilizing it. When you talk to financial advisors specializing in bond ladder portfolios, you’ll hear variations of the same message: “Use your ladder for predictability, not for speculation.”

The more your ladder resembles a quiet machine rather than a trading playground, the better it’s likely to serve you.

Step‑by‑Step: Designing Your First Bond Ladder

Let’s walk through a straightforward process you can adapt. Step one: define your time horizon and purpose. Is this money for retirement in 5–10 years, a home purchase in 7 years, or general stability? Step two: choose ladder length—five years is a sensible minimum, ten years common for retirement‑oriented investors. Step three: decide on rung spacing; annual is simplest, but semiannual or quarterly gives smoother cash flow. Step four: pick your bond types and credit standards, for example, “Treasuries and investment‑grade corporates only.” Step five: allocate your dollars evenly across rungs, or overweight near‑term rungs if you expect to spend some principal soon. Step six: schedule a yearly “ladder review” to reinvest maturing bonds and check whether your goals or risk tolerance have shifted.

Once set up, maintaining the ladder is surprisingly low‑maintenance—a few decisions per year instead of daily market watching.

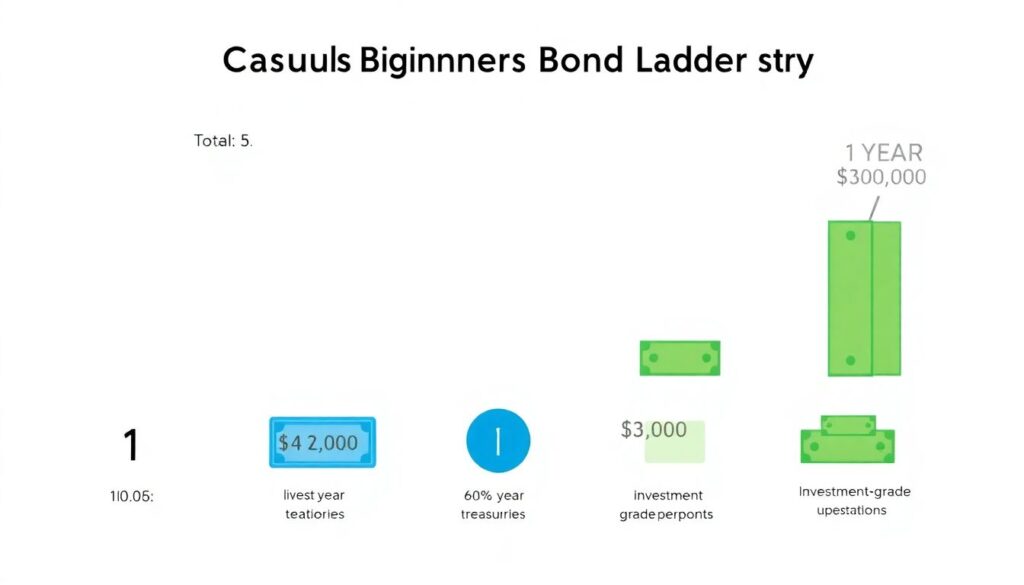

Technical Corner: A 5‑Year, $100,000 Starter Ladder

> TECHNICAL DETAIL

>

> Example structure for a cautious beginner:

>

> – Total: $100,000

> – Rungs: 5 (1, 2, 3, 4, 5 years)

> – Allocation: $20,000 per rung

> – Mix: 60% Treasuries / 40% investment‑grade corporates on each rung

>

> So your 1‑year rung might be $12,000 in a 1‑year Treasury and $8,000 in a 1‑year A‑rated corporate bond. Same ratio out to 5 years.

>

> Each year, when the 1‑year rung matures, you buy a new 5‑year rung with the proceeds. Over time, your ladder “rolls” while keeping your risk profile consistent.

You can adjust this template by swapping in CDs or tax‑free municipals depending on your situation.

Where Online Platforms Fit In

Modern brokerage platforms make it easier than ever to manage fixed income. Instead of calling a bond desk and haggling, you can browse inventories, compare yields, and execute trades with a few clicks. Many investors now use platforms that let them filter for maturity date, credit rating, and yield, then save those screens as templates for future rungs. Some brokerages also provide ready‑made ladders, but read the details carefully; they may mix in callable bonds or lower‑quality credits to pump the advertised yield. If you want automation without complexity, consider platforms that offer straightforward ladder‑building tools rather than opaque products. For beginners, transparency usually matters more than squeezing out the last 0.2% of yield.

Think of technology as your assistant, not your autopilot—you still need to understand what you own and why.

When to Consider Managed Ladder Services

If you’re juggling a busy career, a family, and multiple financial goals, you may not want to babysit a ladder yourself. That’s where managed solutions come in. Many firms now offer professionally designed and maintained ladders that handle screening, diversification, and reinvestment automatically. These can be appealing if your ladder is large or spans many years. When evaluating these options, dig into three things: fees, credit standards, and how strictly they stick to the ladder concept versus drifting into more active trading. Managed services can be a good compromise for investors who appreciate the discipline of a ladder but don’t have the time or desire to manage individual bonds.

Just remember: outsourcing the work doesn’t mean outsourcing the responsibility to understand your overall risk and goals.

Pulling It All Together

Bond ladders aren’t glamorous, but they do something most investors secretly crave: they impose order on uncertainty. They turn the vague fear of “what if rates move against me?” into a sequence of planned maturities and reinvestments. Whether you’re learning the basics of fixed income, stabilizing a family portfolio, or planning how to invest in bond ladders for retirement income, the underlying principles stay the same: diversify across time, focus on quality, and let rules—not emotions—drive your decisions. As you gain confidence, you can refine your ladder, integrate it with your broader asset allocation, or even pair it with professional guidance.

If you’re ready to start, begin on paper: sketch your years, your cash needs, and your preferred bond types. Once the plan makes sense in plain language, then—and only then—turn it into trades.