Why a “Toolkit” Beats Yet Another Budget

If you’re constantly juggling deadlines, family, and a half-charged phone, a traditional budget spreadsheet is just one more thing screaming for attention. Thinking in terms of a personal finance toolkit for busy people works better: instead of willpower and guilt, вы опираетесь на набор инструментов и автоматик, которые quietly handle the boring stuff. The goal isn’t to become a money nerd; it’s to build a minimalist system that survives bad weeks, travel, and late-night takeout without you having to “reboot” your financial life every month.

A Short Historical Detour: From Ledgers to Background Automation

For a long time, “personal finance” meant paper ledgers and envelopes with cash. You balanced a checkbook on Sundays and hoped there were no surprises. With the rise of home computers, money management software for personal use like early desktop programs made number‑crunching easier, but they still demanded you sit down and “do finances.” Today’s mobile‑first world flipped that logic: banks push data in real time, and algorithms can categorize spending before you even lock your phone. What used to require discipline is now mostly an integration problem — connecting the right apps and accounts so the system quietly hums in the background while you’re in meetings or on the train.

Basic Principles: Minimum Effort, Maximum Automation

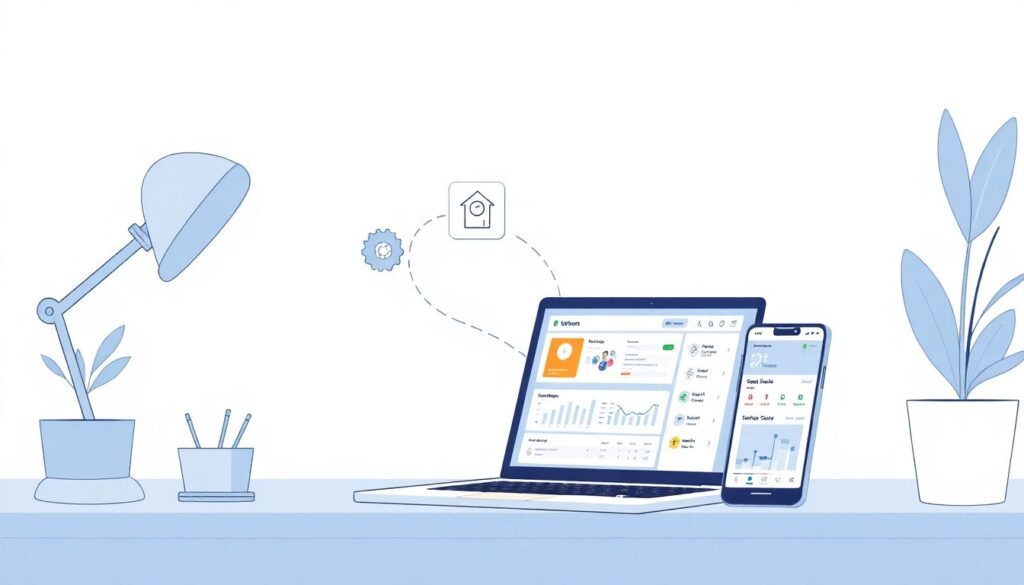

Instead of chasing perfection, busy professionals need a toolkit shaped around three principles: automation, simplification, and visibility. Automation means bills, savings, and investments run on autopilot, so you’re not relying on 9 p.m. motivation. Simplification means fewer accounts, fewer rules, and fewer decisions: one main spending card, one savings hub, one investing “pipe.” Visibility is about getting fast, accurate feedback without digging in spreadsheets. When you combine these, personal finance tools for working adults stop being one more hobby and start acting like a quiet operating system in the background of your life.

Core Components of a Personal Finance Toolkit

The toolkit idea borrows from engineering: each component has a clear job and connects to others with minimal friction. For most busy people, the essentials look like this: an all‑purpose spending account with a debit or credit card, a high‑yield savings hub, an automated investment pipeline, and a tracking layer that shows you what’s happening without demanding manual input. The best budgeting apps for busy professionals don’t try to micromanage every coffee; they focus on cash‑flow snapshots, gentle guardrails, and smart alerts instead of daily homework.

• A reliable “money hub” account (for income, bills, and transfers)

• A separate savings or “safety” account for short‑term goals and emergencies

• A simple investment account you can automate, not babysit

Historical Mindset Shift: From Monthly Budgets to Real-Time Cash Flow

In the paper‑ledger era, people thought in monthly cycles: paychecks came twice a month; bills arrived by mail; budgets were static. Modern incomes are messier: side gigs, bonuses, cash apps, and irregular freelance invoices. That’s why the new toolkit leans on real‑time cash‑flow monitoring instead of rigid 30‑day plans. A good mix of online financial planning services for individuals and app‑based analytics can show you, mid‑month, how much you can safely spend without waiting for a “budget review weekend.” This mindset shift matters more than the specific app: you’re moving from predicting the entire month to constantly nudging a living system in the right direction with small, easy adjustments.

Choosing Apps: Don’t Collect, Curate

One of the most common traps is downloading five different tools and using none of them well. Instead, think like a product manager: every tool must have a clear job and should replace a manual habit. When people talk about the best budgeting apps for busy professionals, what they often mean are apps that connect to bank feeds, categorize spending intelligently, and surface a small set of decisions each week. Avoid all‑in‑one monsters that require a course to operate. If you can’t explain how an app earns its space on your phone in one sentence, it probably doesn’t belong in your toolkit.

• Pick one primary budgeting/tracking app and commit to it for 90 days

• Limit yourself to 3–5 core tools; anything beyond that must replace an old one

• Regularly prune “zombie” apps that no longer add value or duplicate features

Automated Savings: Let Algorithms Be the Annoying Responsible One

If you’re busy, relying on optimism to save money is a losing strategy. This is where automated savings apps for beginners shine: they skim small amounts from your checking account based on cash‑flow patterns, round up card purchases, or move money every payday before you even see it. Think of them as a background tax you happily pay to your future self. The clever twist is to combine this with goal‑based accounts: one for travel, one for big purchases, one for a rainy‑day fund. The more your toolkit can hide surplus cash from your day‑to‑day spending view, the less willpower you need to “behave.”

Nonstandard Move #1: Treat Time, Not Just Money, as a Budget Line

Here’s a weird but powerful idea: track which parts of your financial life steal the most time, not just money. For instance, if you’re constantly hopping between banking apps to remember which card auto‑pays which subscription, that time cost is real. Simplify aggressively: consolidate subscriptions onto one card, set a single “money admin” slot on your calendar, and structure your toolkit so most tasks happen during that window. Suddenly, money management software for personal use isn’t just about optimizing net worth; it’s also about compressing financial chores into a predictable 15–20 minutes a week, freeing mental bandwidth for work and life.

Nonstandard Move #2: Use Friction Strategically, Not Just Convenience

Everyone loves convenience, but sometimes small frictions actually help. Put “speed bumps” between you and destructive habits. For example, connect your everyday payments to one card with a normal limit but stash your long‑term savings and investments in another institution with a 1–2 day transfer lag. That delay becomes a cooling‑off period for impulse splurges. In your toolkit, combine ultra‑easy automations for good behaviors (savings, investing, bill pay) with purposeful friction for harmful ones (credit line increases, buy‑now‑pay‑later, instant withdrawals). That subtle design choice often does more than yet another motivational quote.

Nonstandard Move #3: Build a “Firewall” Checking Account

Many people run everything through a single checking account: income lands there, bills leave from there, and discretionary spending happens there. That’s like coding without version control. A more resilient toolkit uses a “firewall” spending account. Your paycheck arrives in a main hub account; then you automatically send a fixed “allowance” to a separate card used only for variable expenses like food, fun, and shopping. Even if you misjudge, rent and savings remain untouched. This sort of structure, combined with smart personal finance tools for working adults, keeps damage contained when life goes sideways or you have one chaotic month.

Online Services: A Fractional CFO for Real Life

You don’t need a private banker to get strategic advice anymore. Many online financial planning services for individuals now offer subscription or one‑time sessions, functioning like a part‑time CFO who helps design your system, not just sell products. This is especially useful for busy people hitting transition points: promotions, stock options, relocating, or starting a family. Instead of hoping YouTube videos cover your specific situation, you can pay for focused guidance once, then let your largely automated toolkit run the playbook for years, with an occasional tune‑up when your life significantly changes.

Building the Toolkit: A Simple Implementation Path

To avoid overwhelm, build your toolkit in small, clearly defined steps. First, stabilize: list your accounts, kill unused ones, and choose a main hub bank. Second, automate: set paycheck‑based transfers to savings and investments before bills and spending. Third, add visibility: pick a tracking app and set a weekly 10‑minute review ritual. This is where filtering through reviews of the best budgeting apps for busy professionals makes sense: you’re not chasing features, you’re looking for clear dashboards, low maintenance, and reliable syncing rather than advanced charts you’ll never open twice.

• Week 1–2: Consolidate accounts and set up automatic bill payments

• Week 3–4: Turn on savings and investing automations, even with tiny amounts

• Week 5–6: Fine‑tune alerts and reports so you see trends without notification overload

Common Misconceptions That Sabotage Busy People

One misconception is that you must “get organized” before using tools — as if apps are a reward for already having your life together. In reality, a decent toolkit helps create order from chaos; you start messy and let automation clean the edges over time. Another myth: serious money management software for personal use is only for people with high incomes or advanced investing needs. In practice, the biggest gains for busy people usually come from boring wins: never missing due dates, smoothing cash flow, and steadily auto‑investing small sums, long before you worry about optimizing every tax nuance.

Misconception: More Data Equals More Control

Modern apps can show you graphs for everything, but information overload can paralyze you. You don’t need to see a pie chart of your coffee spending if it doesn’t change your behavior. A lean toolkit emphasizes the few metrics that meaningfully affect your options: savings rate, debt payoff trajectory, and runway (how many months you can live on your cash). Many personal finance tools for working adults now offer “focus modes” or simplified dashboards — use them. The goal is quick, clear feedback, not a second job as your own financial analyst at midnight on Sundays.

Misconception: Automation Means Losing Control

People sometimes fear that automation will make them less aware of where their money goes. The opposite tends to happen when you design the system well. Automatic transfers and bills free your attention from firefighting, so you can actually think strategically during your brief weekly check‑in. With automated savings apps for beginners and recurring investment rules, you decide the rules once, then switch your energy from micro‑tracking transactions to periodically adjusting the system when your goals change. Control comes from clear rules and predictable outcomes, not from manually approving every bill payment like it’s a high‑stakes negotiation.

Putting It All Together: A Toolkit That Survives Your Calendar

A solid personal finance toolkit for busy people doesn’t look glamorous: it’s a small network of carefully chosen accounts, automations, and apps that talk to each other with minimal drama. You’re not chasing the perfect app combo; you’re designing a low‑maintenance environment where good outcomes happen by default. As your career and life get more complex, this toolkit scales with you: you can swap individual tools, upgrade from beginner to advanced services, or bring in online financial planning services for individuals for a specific project, all without tearing down the whole system. In that sense, your toolkit becomes less like a fragile budget and more like infrastructure — quiet, boring, and exactly what you need when everything else in life is loud.