Historical Context of Market Crashes

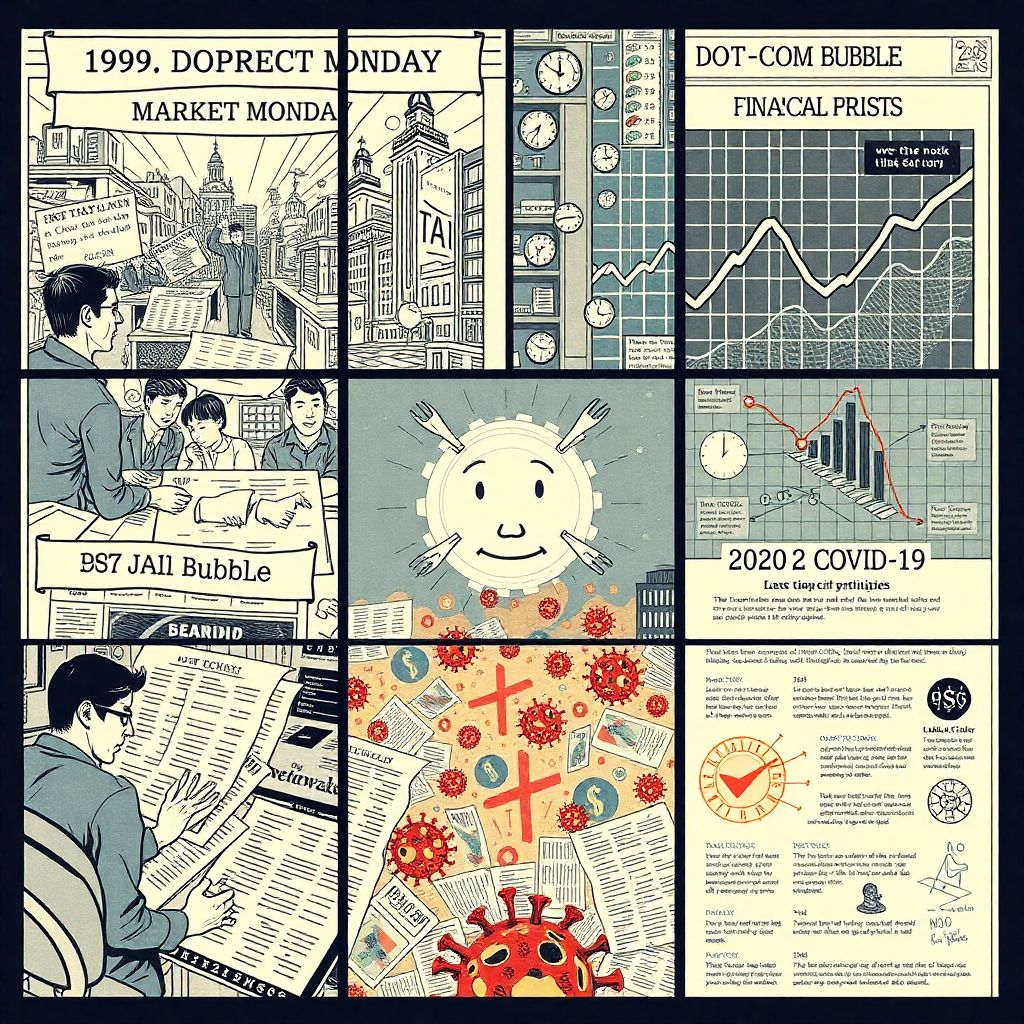

Throughout financial history, global markets have experienced numerous downturns, often triggered by macroeconomic imbalances, geopolitical crises, or systemic failures. The Great Depression of 1929, the Black Monday crash in 1987, the Dot-com bubble burst in 2000, the Global Financial Crisis of 2008, and the COVID-19-induced volatility in 2020 serve as stark reminders of how fragile investor confidence can be. Each of these events caused not only equity sell-offs but also liquidity contractions, credit freezes, and widespread investor panic. Understanding the catalysts, propagation mechanisms, and recovery trajectories of past crashes is essential for crafting modern financial defense strategies.

Core Principles of Financial Risk Mitigation

The cornerstone of financial protection during a crash lies in diversification, liquidity management, and risk-adjusted asset allocation. Diversification entails distributing capital across uncorrelated asset classes, such as equities, fixed income, commodities, and real estate, to reduce portfolio volatility. Moreover, maintaining a sufficient liquidity buffer — in the form of cash or easily convertible instruments — ensures solvency during forced selling environments. Risk-adjusted allocation involves assessing metrics like beta, Sharpe ratio, and maximum drawdown to align investment profiles with an individual’s risk tolerance and time horizon. These principles, when applied consistently, fortify portfolios against systemic shocks.

Practical Implementation Strategies

Applying theoretical risk models in real-life portfolios requires a dynamic, multi-layered approach. Tactical asset allocation can be employed to reduce equity exposure in overheated markets by rotating into defensive sectors like utilities or healthcare. Implementation of stop-loss orders and portfolio rebalancing rules provides automated defense mechanisms during turbulence. Moreover, inverse ETFs and options contracts, such as protective puts, offer hedging solutions for experienced investors. For example, during the 2020 market downturn, portfolios that had a 60/40 equity-to-bond allocation and included long-duration Treasuries experienced significantly less drawdown, due to the inverse correlation between these asset classes during crises.

Common Misconceptions Among Investors

A major fallacy among retail investors is the belief that market crashes necessitate total liquidation of holdings. Panic selling, driven by behavioral biases such as loss aversion and recency effect, often results in locking in losses and missing subsequent recoveries. Another misconception is that gold or cryptocurrency alone can serve as reliable crash hedges. While these assets may provide diversification benefits, they possess their own volatility profiles and should be integrated judiciously. Moreover, the idea that timing the market is a viable long-term strategy has been statistically refuted; attempting to exit and re-enter markets based on short-term forecasts tends to erode returns due to timing errors and transaction costs.

Expert Recommendations for Crisis-Proofing Finances

Financial advisors and institutional strategists advocate for the adoption of scenario planning and stress testing as part of a resilient investment process. Scenario planning involves modeling portfolio performance under different market crash simulations — such as a liquidity freeze or interest rate shock — to identify vulnerabilities. Experts also emphasize the importance of building “all-weather” portfolios, which combine growth and defensive assets to perform across economic cycles. Additionally, maintaining a disciplined investment policy statement (IPS), reviewed semi-annually, helps investors adhere to predetermined guidelines during emotional market events. Tax-loss harvesting during downturns can also be employed to offset capital gains and enhance after-tax returns.