Understanding Municipal Bonds: What Are They?

Municipal bonds, often referred to as “munis,” are debt securities issued by state and local governments or their agencies to finance public projects such as highways, schools, or water treatment facilities. When you invest in a municipal bond, you are essentially lending money to a government entity. In return, the issuer agrees to pay interest (known as the coupon) at regular intervals and to return the principal amount on a specified maturity date.

There are two primary types of municipal bonds:

– General Obligation Bonds (GO Bonds): Backed by the full faith and credit of the issuing municipality, including its taxing power.

– Revenue Bonds: Supported by revenues from specific projects (e.g., toll roads, utilities, airports), not taxes.

The Tax Advantage: A Key Benefit

One of the most compelling reasons investors turn to municipal bonds is their tax-exempt status. In many cases, the interest income earned from munis is exempt from federal income tax. If the investor resides in the state where the bond is issued, the income may also be exempt from state and local taxes.

This tax benefit can significantly enhance the effective yield of municipal bonds. For example, a 3% yield on a tax-free muni bond could be equivalent to a 4.5% taxable yield for someone in the 33% tax bracket.

Visualizing Tax-Equivalent Yield

Imagine a simple diagram: two vertical bars side by side. One bar represents a 3% yield from a tax-free municipal bond. The second bar, taller, represents a 4.5% taxable bond yield needed to match the after-tax income of the muni bond for a high-income investor. This visual underscores how munis can be more lucrative than they initially appear.

Comparing Municipal Bonds to Other Fixed-Income Investments

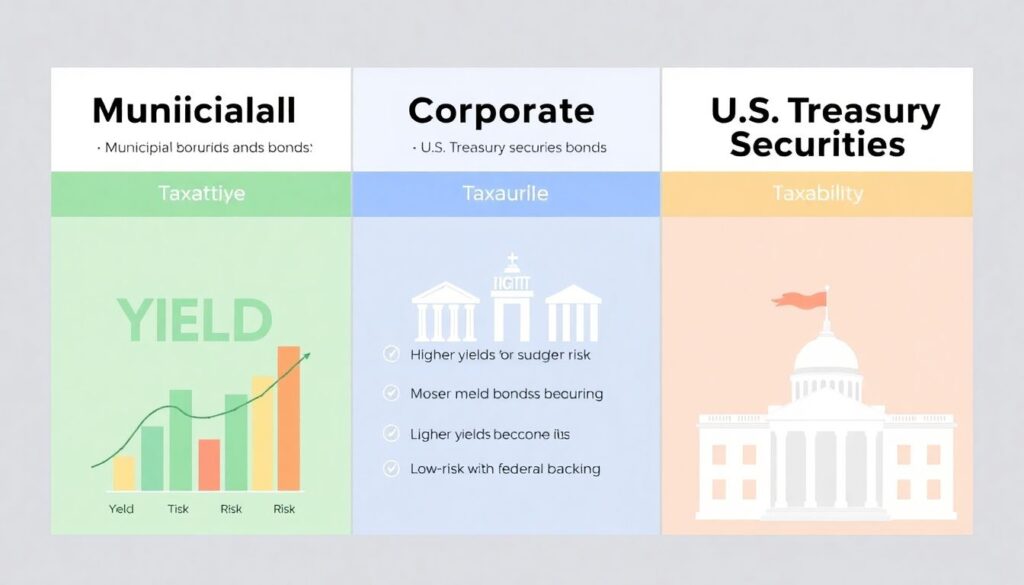

While municipal bonds are often viewed as conservative investments, it’s essential to compare them against other fixed-income instruments like corporate bonds and U.S. Treasury securities.

Corporate Bonds:

– Offer higher yields due to increased credit risk.

– Interest is fully taxable at federal and possibly state levels.

– Greater default risk compared to GO municipal bonds.

U.S. Treasury Bonds:

– Backed by the federal government, considered virtually risk-free.

– Interest is exempt from state and local taxes but taxed federally.

– Typically lower yields than both munis and corporates.

In contrast, municipal bonds strike a balance between risk and reward, especially for investors in higher tax brackets. Their tax-advantaged income and historically low default rates make them an appealing choice for wealth preservation.

Practical Applications: Where Munis Fit in a Portfolio

Municipal bonds serve several practical functions in a diversified investment portfolio:

– Income Generation: Ideal for retirees or income-focused investors seeking predictable, tax-free cash flow.

– Risk Mitigation: Their lower volatility and high credit quality can offset riskier equity positions.

– Tax Efficiency: Especially beneficial for high-net-worth individuals looking to reduce taxable income.

Example: Tax-Aware Portfolio Construction

Consider a 60-year-old investor in the 35% federal tax bracket with a $1 million portfolio. Allocating 30% to municipal bonds could provide a stable income stream while minimizing tax liability. If the muni portion yields 3%, that’s $9,000 annually in tax-free income—equivalent to about $13,850 in taxable income from corporate bonds.

Risks and Considerations

Despite their reputation for safety, municipal bonds are not risk-free. Key concerns include:

– Interest Rate Risk: Bond prices fall when interest rates rise.

– Credit Risk: While defaults are rare, they can occur—especially with revenue bonds tied to underperforming projects.

– Liquidity Risk: Some municipal bonds trade infrequently, making them harder to sell quickly at favorable prices.

Investors can mitigate these risks by:

– Diversifying across different issuers and sectors.

– Using bond funds or ETFs to gain broad exposure.

– Staggering maturities (laddering) to manage interest rate exposure.

Accessing the Market: Direct vs. Indirect Investment

There are two main ways to invest in municipal bonds:

– Direct Purchase: Buy individual bonds through a brokerage. Offers control over maturity and credit exposure but requires research and larger capital.

– Municipal Bond Funds or ETFs: Provide diversification and professional management, though they may carry management fees and less predictability in income.

Checklist for Choosing Munis

Before investing, consider:

– Your tax bracket and state of residence.

– The bond’s credit rating (AA or higher is generally preferable).

– Type of bond (GO or revenue) and its underlying revenue source.

– Maturity date and duration sensitivity.

Conclusion: Are Municipal Bonds Right for You?

Municipal bonds offer a unique blend of safety, income, and tax efficiency. Particularly for high-income investors, they can provide superior after-tax returns compared to taxable fixed-income alternatives. While not entirely without risk, their conservative nature and tax-exempt status make them an essential tool in any well-rounded investment strategy.

As with any investment, due diligence is key. But for those seeking a low-volatility, tax-smart way to grow their wealth, municipal bonds can be a reliable—if underappreciated—ticket to long-term financial stability.