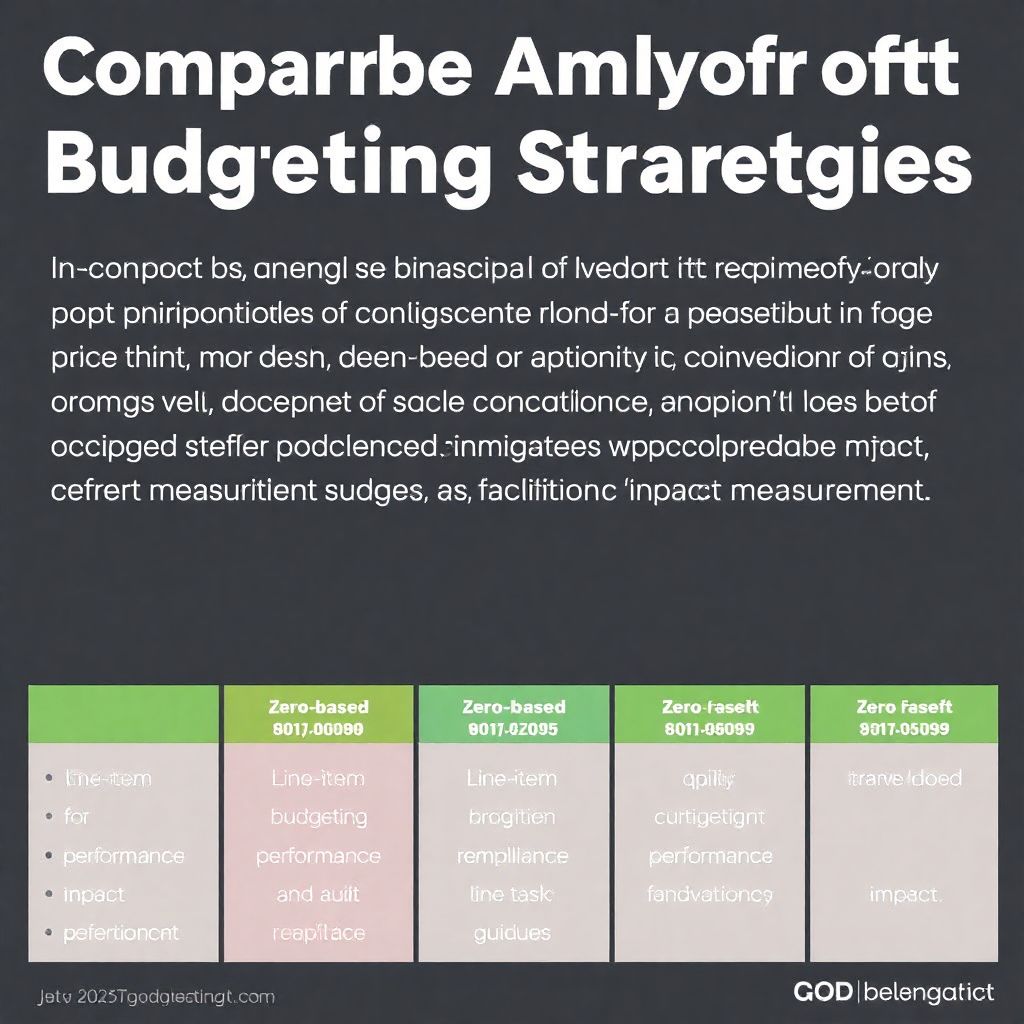

Comparative Analysis of Nonprofit Budgeting Strategies

In the realm of financial management for charities, organizations in 2025 are increasingly adopting hybrid budgeting models that combine traditional line-item budgeting with performance-based and zero-based approaches. Line-item budgeting remains prevalent for its simplicity and transparency, especially for grant compliance and audit readiness. However, its rigidity often limits strategic adaptability. In contrast, performance-based budgeting aligns expenditures with programmatic outcomes, facilitating impact measurement—a critical metric for donor reporting and strategic planning. Zero-based budgeting, though resource-intensive, has gained traction among data-driven nonprofits seeking to justify every expense from the ground up. This method fosters cost discipline but demands a mature financial infrastructure and skilled personnel.

The comparative advantage lies in the ability to tailor budgeting methodologies to organizational maturity, funding complexity, and stakeholder expectations. For instance, large international NGOs often implement a dual-layer model: a baseline operating budget for core functions and a dynamic programmatic budget that adjusts based on real-time funding inflows. This layered approach enhances responsiveness and long-term sustainability. Meanwhile, smaller charities may prioritize cash flow forecasting and grant cycle alignment, using simplified templates that emphasize liquidity management over granular performance metrics.

Technological Tools: Benefits and Limitations

The evolution of nonprofit financial planning tools has significantly reshaped charity financial stewardship. Cloud-based platforms such as Sage Intacct, QuickBooks Nonprofit, and Blackbaud Financial Edge NXT offer integrated dashboards, automated reporting, and donor-restricted fund tracking. These systems support real-time budget variance analysis and facilitate multi-program financial consolidation. One of the key advantages is the ability to synchronize financial data with donor CRM systems, enabling a holistic view of income streams and expenditure patterns.

Despite their benefits, these technologies present challenges. High implementation costs and subscription-based pricing models can strain the budgets of small to mid-sized organizations. Additionally, the learning curve associated with advanced features may hinder adoption among staff lacking financial expertise. Data security and compliance with international financial reporting standards (IFRS or GAAP) remain critical concerns, especially for charities operating across multiple jurisdictions. Therefore, while these platforms enhance accuracy and transparency, their full potential is realized only when supported by adequate training and governance protocols.

Recommendations for Strategic Budget Planning

Effective budget planning for nonprofits requires a structured yet flexible framework that incorporates both historical data and predictive analytics. Organizations should begin with a comprehensive needs assessment aligned with their mission-critical objectives. Integrating scenario analysis into the budgeting process allows nonprofits to prepare for funding volatility, especially in environments influenced by geopolitical instability or economic downturns. Establishing clear budget ownership among department heads ensures accountability and facilitates cross-functional collaboration.

For optimal charity financial stewardship, it is advisable to adopt rolling forecasts updated quarterly, rather than relying solely on static annual budgets. This approach provides a continuous feedback loop and supports agile decision-making. Additionally, embedding key performance indicators (KPIs) into the budget—such as cost-per-beneficiary or program efficiency ratios—enables precise monitoring of resource utilization. Leveraging nonprofit budgeting strategies that emphasize outcome-based metrics over input-focused allocations can significantly enhance donor confidence and long-term funding stability.

Emerging Trends in 2025

In 2025, several macro trends are influencing nonprofit financial planning. First, the integration of artificial intelligence (AI) into financial modeling is becoming mainstream. AI-driven tools can detect anomalies, forecast income fluctuations, and recommend cost optimization strategies with increasing accuracy. Second, environmental, social, and governance (ESG) indicators are being incorporated into budgeting frameworks, particularly for organizations seeking funding from institutional donors with sustainability mandates.

Another trend is the rise of participatory budgeting, where stakeholders—including beneficiaries—contribute to budgetary decisions. This democratized approach fosters transparency and aligns resource allocation with community needs. Additionally, regulatory shifts are prompting nonprofits to adopt more rigorous compliance reporting, reinforcing the importance of robust internal controls and audit trails within financial systems.

Finally, in response to the digital transformation, there is a growing emphasis on cybersecurity and data integrity in financial management for charities. With increasing reliance on cloud platforms and digital transactions, safeguarding financial data has become a critical component of fiduciary responsibility. As such, budget allocations for IT security and compliance auditing are now standard line items in nonprofit budgets.

Conclusion

In the context of 2025, effective nonprofit budgeting strategies hinge on adaptability, transparency, and technological integration. As the sector continues to evolve, organizations must balance fiscal discipline with mission-driven agility. By leveraging modern nonprofit financial planning tools, aligning budgeting methodologies with strategic priorities, and staying attuned to emerging trends, charities can ensure sustainable impact and uphold the principles of responsible financial stewardship.