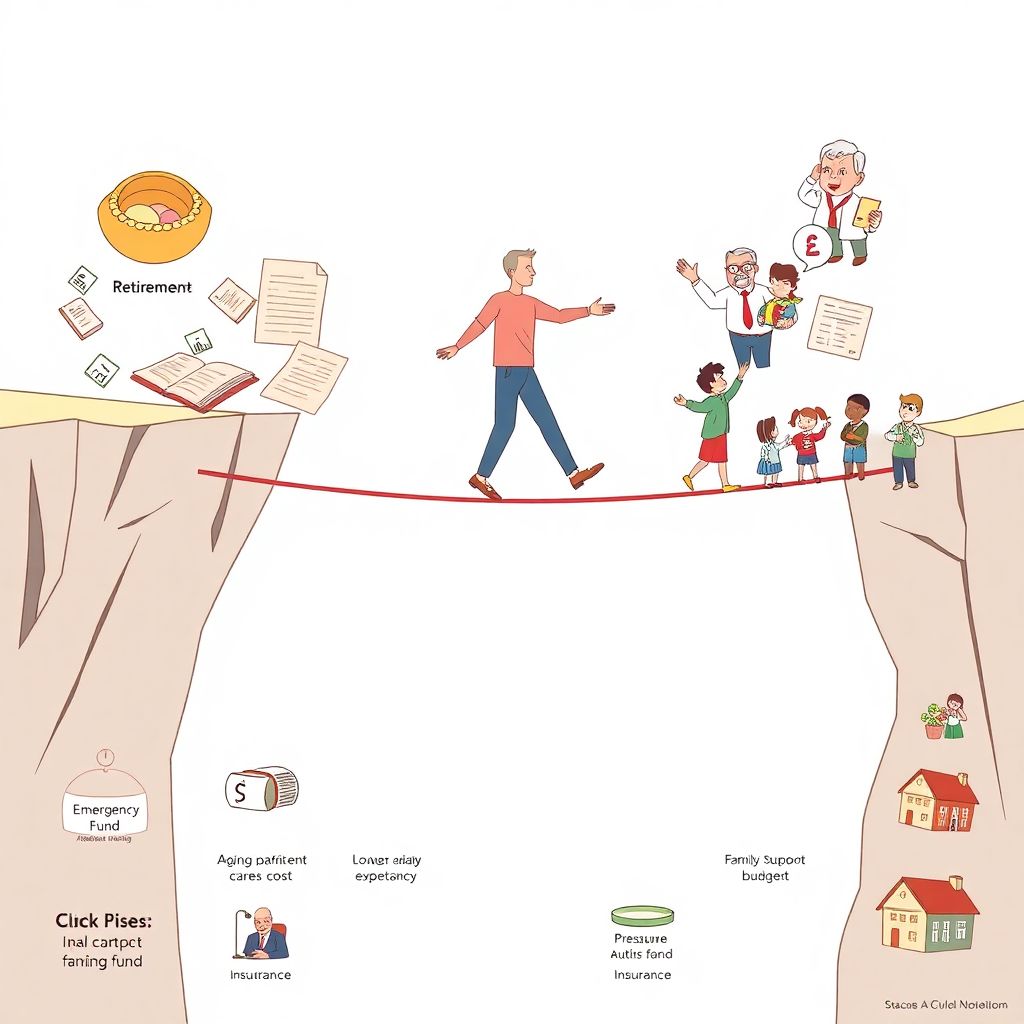

Balancing Your Own Retirement With Supporting the People You Love

Most people don’t picture retirement as a tightrope walk. Yet that’s what it feels like for anyone trying to save for the future while helping kids, parents, or other relatives right now.

You’re not imagining the pressure. It’s structural, not personal failure.

– In the U.S., about 48% of adults in their 40s and 50s are simultaneously supporting a child and at least one aging parent (Pew Research Center).

– In the UK and EU, around 20–25% of mid‑career workers provide regular financial support to relatives.

– Globally, life expectancy has risen by roughly 6 years since 2000, meaning retirements are longer and more expensive.

Let’s walk through how to save for retirement while supporting family, using numbers, real cases, and a clear framework instead of vague “just save more” advice.

—

The New Reality: Retire Later, Support Longer

Why the Old Model Broke

The old script was simple: work 40 years, kids become independent by their mid‑20s, parents die relatively early, pensions fill the gap. That world has vanished.

A few data points:

– Longevity: By 2050, the number of people aged 60+ is projected to double globally (WHO).

– Health costs: In many OECD countries, healthcare costs for retirees have been rising faster than inflation for over a decade.

– Housing & education: In many major cities, housing costs have outpaced wage growth, and student debt has become normal for younger generations.

Short version: parents are living longer, kids are more financially dependent for longer, and wages haven’t kept up with the cost of any of it.

So when you look at your paycheque and think, “There is no way I can fund retirement and also help everyone else,” that’s a rational reaction, not a moral failing.

—

Case Study 1: The “Good Daughter” Who Almost Delayed Retirement by 10+ Years

The Situation

Maria, 49, UK-based, mid‑level manager, two teenagers, widowed mother (78) with modest savings.

Money going out every month:

– £400 to help her mum with rent and meds

– £600 toward her son’s university expenses

– £200 on private tutoring for her daughter

– £300 into a general savings account “for retirement”

In her words: “I’m carrying three generations on one income.”

The Problem Under the Surface

On paper, Maria was “saving”. In reality:

– She had no dedicated retirement account.

– All savings sat in cash, losing to inflation over time.

– She assumed she’d “catch up later” once kids finished university.

A basic projection showed that if she continued like this, she’d need to work until 75 to maintain even a modest standard of living.

What Changed

Maria didn’t need a miracle; she needed structure.

After talking to a planner who specialised in retirement planning services for families, she shifted to:

– Diverting £450/month into a tax‑advantaged pension plan.

– Reducing uni support slightly, while helping her son apply for grants and part‑time work.

– Coordinating with her siblings so her mum’s costs were shared, not carried by Maria alone.

Result: projected retirement age improved from 75 to 66 without her feeling like she’d “abandoned” anyone. The key was reframing: “If I don’t secure my retirement, I become another dependent later.”

—

The Economics: Why Your Retirement Is a Family Asset

The Hidden Cost of “Self‑Sacrifice”

Economically, draining your retirement for loved ones looks generous—but often just delays the problem 20 years.

Think of three phases:

1. Working years: You’re the financial engine.

2. Early retirement (60–75): Ideally, you’re self‑funded and maybe even helping grandkids with gifts, not bailouts.

3. Late life (75+): Health issues spike and care gets expensive.

If you underfund phase 2, phase 3 doesn’t go away; it simply shifts the burden onto your kids or the state. Economists sometimes call this intergenerational risk transfer: risks you don’t fund now become someone else’s problem later.

In other words, a solid retirement pot is itself one of the best “family benefits” you can give: it prevents you from becoming financially dependent and provides optionality—maybe helping with a grandchild’s education, or stepping in during a crisis.

—

Case Study 2: The Couple Drowning in “Good Deeds”

The Situation

James (52) and Alisha (50), U.S. couple, two adult children, one grandson, both parents still alive.

They were:

– Paying $800/month toward their daughter’s student loans.

– Covering $600/month for James’s parents’ assisted‑living supplement.

– Giving $300/month to their son “until he finds a better job.”

– Contributing only 4% to their 401(k)s, with no other retirement savings.

They came to a planner looking for the *best financial advisors for retirement savings* because they felt “behind” and panicked.

The Planner’s Harsh but Honest Math

A comprehensive analysis showed:

– They were on track to replace only ~40% of their pre‑retirement income.

– At their current burn rate, they’d run out of retirement money by their late 70s if they retired at 65.

– They had no long‑term care plan, even though both sets of parents needed support, signaling high family risk.

The Redesign

Over 18 months, they restructured:

– Increased 401(k) contributions to 12% each, timed with annual raises.

– Capped parental support at a fixed dollar amount and helped their parents apply for benefits they were missing.

– Set a 12‑month “glide path” for their son—support tapered each quarter with clear milestones (job search targets, skills training).

– Shifted daughter’s support from “we’ll pay your loans indefinitely” to “we’ll match your extra payments for 24 months.”

Emotionally difficult, financially critical.

Three years later, their projected retirement income replacement rate rose from ~40% to ~70%, and they were on track for a realistic retirement at 67 instead of “never.”

—

Forecasts: What the Next 20–30 Years Mean for Your Plan

Demographic and Market Trends You Can’t Ignore

Several long‑term trends make planning more complex—but also more necessary:

– Longevity risk: In many developed countries, there’s a decent chance one partner in a couple will live into their 90s.

– Lower expected returns: Many analysts forecast that future stock and bond returns may be slightly lower than the historic 8–10% equity averages, especially in developed markets.

– Public systems under pressure: As worker‑to‑retiree ratios shrink, government pension systems may face cuts, higher retirement ages, or means testing.

That combination means:

– You may need to save a bit more than your parents did.

– Starting earlier matters much more than being perfect.

– Flexibility (in work, spending, and housing) becomes an asset.

—

How to Think About Priorities: A Practical Framework

A Simple Order of Operations

There’s no magical formula, but a priority framework helps when emotions run high:

1. Protect your ability to earn

– Emergency fund (3–6 months of expenses).

– Adequate health, disability, and life insurance.

2. Secure your own baseline retirement

– At least up to any employer match in workplace plans (free money).

– Slow, steady increases in contributions until you reach a sustainable savings rate (often 12–20% of gross income over time).

3. Support dependents in ways that don’t destroy #2

– Help with education through realistic caps and shared responsibility.

– Support parents with a mix of cash, time, and benefit optimisation.

4. Then consider extras

– Early mortgage payoff, larger gifts, helping kids buy homes, etc.

This isn’t “me first, everyone else later.” It’s “me stable, so I can actually help long‑term.”

—

Case Study 3: Using “Family‑Friendly” Retirement Products Wisely

The Situation

Sanjay (45) and Priya (43), based in Canada, two kids (8 and 11), supporting Priya’s parents abroad with occasional remittances.

Their question was very specific: “Are there retirement investment plans with family benefits that let us grow for retirement but also protect the kids if something happens?”

The Strategy

Working with an adviser, they:

– Maxed out employer retirement plans first (tax deferral + match).

– Opened a tax‑advantaged education account for each child, contributing a modest, fixed amount monthly.

– Added a permanent life policy *only* after modeling whether term insurance plus investments could do the same job more cheaply.

The “family benefit” angle was:

– If one of them died early, insurance plus existing savings would pay off the mortgage and fully fund kids’ education.

– If they lived to retirement, their core wealth would sit in investment accounts designed for their own old age.

The key lesson: “family‑friendly” doesn’t mean mixing everything into one complex product. Often, the most efficient route is clear roles for each tool—retirement accounts for you, education accounts for kids, insurance for contingencies.

—

Comparing Retirement Accounts and Plans Without Getting Lost in Jargon

What Really Matters When You Compare Options

People often freeze when trying to compare retirement savings accounts and plans because every provider throws a different set of acronyms at them.

Strip it down to four questions:

– Tax treatment:

– Do you get a tax break now (traditional) or later (Roth/post‑tax)?

– What are the withdrawal rules and penalties?

– Employer support:

– Is there a match or profit share you would lose if you don’t contribute?

– Costs:

– What are the fund fees and account-level fees? Even a 1% difference annually compounds massively over 25–30 years.

– Flexibility and access:

– How easy is it to adjust contributions?

– Are there loan or hardship withdrawal provisions, and should you actually use them?

When retirement planning services for families do their job well, they translate all of this into: “Here is your order: max this first, then this, then that. Here’s why.”

—

Industry Impact: How Your Situation Is Reshaping Financial Services

Products and Services Are Pivoting Toward Multi‑Generational Needs

Your tension—save for yourself, help loved ones—is now standard. The financial industry has noticed.

Several shifts are underway:

– Planning across three generations: Many firms now integrate parents and adult children into sessions, modeling cash flows for all three layers.

– Advisory niches: More advisers explicitly market as the *best financial advisors for retirement savings* for the “sandwich generation,” combining retirement, college, and eldercare planning.

– Hybrid products: Some providers push bundled accounts that blend investing, insurance, and education benefits. These can be powerful—or overpriced—depending on costs and structure.

– Tech platforms: Digital tools increasingly show you, in one dashboard, how changing support for a child or parent today affects your own retirement age.

Economically, this is a big deal: trillions in assets are expected to transition from baby boomers to their heirs over the next 20–30 years. Firms that can address family‑level decisions, not just individual portfolios, will capture a bigger share of those flows.

—

Case Study 4: Using a “Family Plan” Mindset Instead of Random Acts of Help

The Situation

Lina (38), software developer, single, supporting her younger brother (student) and occasionally sending money to her retired grandparents abroad.

She asked a very direct question: “Is there a way to turn our chaos into a plan? I feel like I just throw money at problems.”

The Approach

Rather than focusing only on her accounts, an adviser treated the family as an economic unit:

– Mapped out who needed what, when (brother’s graduation, grandparents’ health risk, Lina’s desired retirement age).

– Built a 10‑year “family cash‑flow roadmap” with ranges, not exact numbers.

– Identified triggers when support should decline (e.g., one year after brother’s first full‑time job).

They also walked through how to save for retirement while supporting family using specific rules Lina could follow:

– Minimum 15% of income to retirement, come what may.

– A fixed monthly “family support budget” she could distribute as needed, without guilt if it ran out.

– Separate savings bucket for ad‑hoc emergencies (medical issues, tickets for last‑minute travel).

The outcome wasn’t perfection. It was clarity. She stopped feeling like she was choosing between “being a good person” and “being financially sane.”

—

Practical Tactics You Can Use This Year

1. Set Non‑Negotiables

Define what you will not compromise, even for family:

– A target minimum percentage for retirement savings.

– A cap on monthly financial support to relatives.

– Boundaries around co‑signing loans or guaranteeing debts.

Write them down. Share them with your partner if you have one.

2. Use “Soft Landings” Instead of Sudden Cut‑Offs

When you need to reduce support:

– Give advance notice (“six months from now, support will be X instead of Y”).

– Offer help with planning: budgets, job searches, benefit applications.

– Explain your reasoning in terms of long‑term family stability, not just “I can’t.”

People handle change better when they see a path, not just a “no.”

3. Automate the Important, Humanise the Rest

Automation helps cut through emotion:

– Automatic transfers to retirement and savings accounts every payday.

– Automatic caps on transfers to family (a separate “support account” can help).

Then, when someone asks for help beyond that, you’re not negotiating from zero—you’re adjusting from a framework.

—

When Professional Help Makes Sense

You don’t need an adviser for everything. But there are situations where outside help is worth the cost:

– Complex tax situations or cross‑border family responsibilities.

– Aging parents with unclear or undocumented assets and benefits.

– Multiple competing goals on a tight income (retirement, debts, kids, parents).

Look for people or firms whose marketing clearly acknowledges multi‑generational trade‑offs, not just “maximize your net worth.” That usually indicates they’ve worked through these dilemmas in depth and can provide practical, not textbook, answers.

—

Final Thoughts: You’re Allowed to Plan for Your Own Future

Saving for a comfortable retirement while supporting loved ones is not a puzzle you “solve once and for all.” It’s an ongoing series of trade‑offs, re‑set every time life throws a curveball.

Two truths can coexist:

– Your family’s needs are real and often urgent.

– Your future self is also a real person who deserves security.

The aim isn’t to choose one over the other, but to design a structure where you don’t permanently sacrifice tomorrow for today. That might mean some tough conversations, some re‑negotiated expectations, and a more intentional use of tools and advisers.

But as the case studies show, once you treat your retirement as a family asset—not a selfish luxury—you can support others with far less guilt and far more stability.