Why Your Kid’s Education Needs an “Investment Case”, Not Just a Piggy Bank

Paying for college or any serious education is no longer about casually tossing coins into a piggy bank. Tuition rises faster than inflation, and relying on last‑minute loans can chain your kid to debt for years. Thinking in terms of an “investment case” means you treat education like any other long‑term project: with goals, timelines, numbers and strategy. You’re not just asking how to save for kids college education, but how each dollar today can work harder for tomorrow. This isn’t about being rich; it’s about being intentional early enough so compound interest does most of the heavy lifting instead of your future salary.

Step 1. Define the Goal: What Are You Actually Saving For?

Before picking accounts or funds, you need a rough price tag. That doesn’t mean predicting the exact university, but outlining scenarios. Public vs private, local vs abroad, bachelor only or master’s as well. Use current tuition data and add a conservative annual increase; many families underestimate future costs by assuming today’s prices will stay put. Estimating a range gives you a target monthly contribution instead of a vague hope. Treat this as a living document: review every couple of years as your child grows, your income changes and the education landscape shifts.

Step 2. Time Horizon and Risk: How Long Will Your Money Work?

The age of your child is your built‑in clock. A newborn gives you nearly two decades; a teenager buys you only a few years. That timeline dictates how much risk you can sensibly take. With 15+ years, you can tolerate stock market ups and downs in exchange for higher expected returns. With 5 years or less, capital preservation becomes more important than chasing yield. Many of the best investment plans for child education blend these approaches over time, starting more aggressive and then gradually shifting to bonds and cash as enrollment day approaches.

Step 3. Budgeting: Finding Realistic Money to Invest

No strategy works if there’s nothing to feed it. Instead of promising yourself “whatever’s left at the end of the month,” treat contributions as a fixed bill, like utilities. Start by choosing a modest, non‑scary amount you can automate right now, even if it feels small. Then increase it each year with salary raises or bonuses. Beginners often wait for a “perfect moment” to start, but markets reward time, not perfection. A disciplined, boring monthly transfer beats heroic one‑off deposits that never happen because life keeps throwing you new expenses and excuses.

Approach 1: Cash and Basic Savings Accounts

Parking money in a plain savings account feels safe and familiar. You see the balance, it never goes down, and withdrawing is simple. For very short horizons, like paying for a course next year, that’s absolutely fine. But as a long term investment for children’s education, cash has a hidden enemy: inflation. If your account earns 2% while college costs grow 5% annually, your “safe” money silently loses purchasing power. Cash works best as the conservative slice of your education portfolio, a buffer for near‑term expenses rather than the main engine for a 10–15 year plan.

Typical Mistakes with Cash‑Only Strategies

Relying solely on savings accounts or certificates of deposit is common, especially among risk‑averse parents. The main error is confusing stability of the number on the screen with stability of what that number can buy. Over a decade or two, inflation can erode a shocking portion of real value. Another trap is procrastination: telling yourself you’ll “switch to investing later” and never doing it. If your entire plan is cash, acknowledge its role honestly: you’re choosing certainty today over growth tomorrow, and that trade‑off will likely require higher monthly contributions to hit the same target.

Approach 2: Investment Accounts and Market‑Based Plans

If you’ve got several years ahead, using diversified stock and bond funds is usually more effective. These can live in regular brokerage accounts, tax‑advantaged education accounts, or a mix. The idea is straightforward: own small pieces of many companies and governments instead of guessing individual winners. Over long stretches, markets have historically outpaced both inflation and plain savings accounts. A sensible child education investment plan comparison weighs expected returns against volatility and fees. You don’t need to be a stock‑picking genius; low‑cost index funds and age‑based portfolios already package diversification in a beginner‑friendly way.

Education Savings Plan vs 529 Plan: What’s the Real Difference?

In many discussions, you’ll see phrases like “education savings plan vs 529 plan” thrown around as if they’re identical. A 529 plan is a specific type of education savings plan in the US with tax advantages when used for qualifying expenses. Other countries offer their own flavors, such as education ISAs, junior investment accounts or government‑matched schemes. The real question is which wrapper gives you the best mix of tax benefits, flexibility and fees in your jurisdiction. Some are stricter but more tax‑efficient, others looser but less generous. Don’t just look at headlines—check costs and rules.

Step 4. Comparing Options Like an Analyst

Think of yourself as the family’s CFO doing a child education investment plan comparison. Line up each option on a few simple axes: tax treatment, flexibility, investment choices, fees and complexity. You might find that a tax‑advantaged education account plus a regular brokerage account offer a good blend: the first for predictable college costs, the second for additional goals or if your child chooses a non‑traditional path. Avoid being dazzled by glossy marketing. A plan with fewer bells and whistles but lower fees often outperforms fancier products over 15–20 years simply because less money leaks out in charges.

- Tax‑advantaged plans: Often best for predictable, formal education; check penalties for non‑education withdrawals.

- Regular investment accounts: More flexible, can fund gap years, business ideas or housing, but usually taxed less kindly.

- Government‑linked schemes: May offer matching contributions or grants, yet come with specific eligibility rules and paperwork.

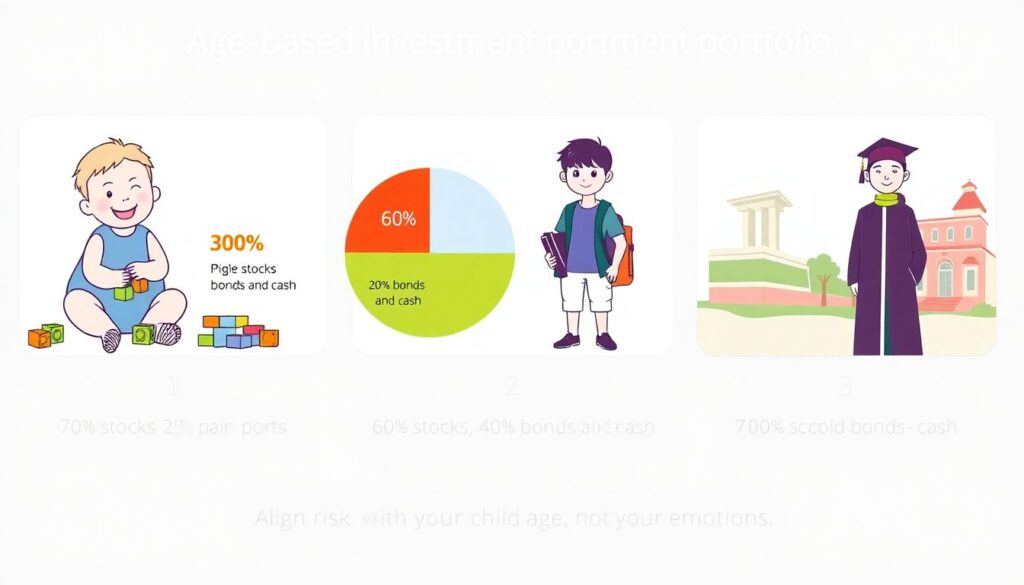

Risk Levels and Age‑Based Strategies

A practical way to manage risk is to align it with your child’s age rather than your emotions. Many providers offer age‑based portfolios that automatically shift from stocks to bonds and cash as college nears. For example, a portfolio might be 80% stocks for a toddler, 60% for a pre‑teen and 30% for a high‑school senior. This systematic glide path keeps you from panicking during market swings or, on the flip side, staying too aggressive close to enrollment. Even DIY investors can copy this pattern by gradually rebalancing once a year toward safer assets.

Step 5. Building Your Personal “Investment Case”

An investment case is just a structured story about why this plan makes sense. Write it down in plain language. Start with your target cost, the time horizon, your chosen accounts and expected monthly contribution. Add your reasoning for each decision—for instance, “We’re using a 529‑type plan because of tax benefits, plus a small flexible account for other goals.” This might feel overkill, but it helps you avoid knee‑jerk reactions when markets are rough. When doubts creep in, revisit the document and ask: has my logic changed, or am I just reacting to noise?

- Clarify the purpose of each account so you know which pot to tap first.

- Set review dates (e.g., every January) to check progress and adjust contributions.

- Note deal‑breakers, like maximum acceptable fees or risk levels you won’t exceed.

Common Pitfalls When Crafting the Plan

Several traps trip up beginners. One is building a beautiful spreadsheet and then forgetting to automate the monthly transfers that give it life. Another is chasing last year’s top‑performing fund, turning a long‑term plan into a series of short‑term bets. Some parents also overestimate their future discipline, planning big future contributions instead of starting smaller now. The safest antidote is simplicity: fewer accounts, broader funds, clear rules and automatic payments. If a product is so complex you need a seminar to understand fees and risks, it’s usually designed to benefit the seller more than your child.

Step 6. Adjusting Over Time Without Overreacting

Life will not stick to your spreadsheet. Jobs change, kids switch interests, markets wobble. Your investment case should evolve, but not swing wildly with every headline. A practical rhythm is to review once a year and after major life events. Check if you’re roughly on track, then tweak contributions or asset allocation instead of tearing up the plan. When assessing long term investment for children’s education, think in decades, not days. A bad week in the market is meaningless against a 15‑year horizon, but stubbornly ignoring rising income or tuition trends can quietly derail your goals.

When to Seek Professional Advice

If you feel lost comparing products, or your situation includes complex taxes, inheritance issues or multiple children with very different needs, speaking with a fee‑only financial planner can be worth it. Look for someone who explains trade‑offs in plain language and is paid by you, not by commissions on products. Bring your rough numbers and questions: “how to save for kids college education efficiently in my country,” “which are the best investment plans for child education here,” or “how do I balance this with retirement?” A brief, focused consultation can save years of trial and error.

Final Thoughts: Start Small, Stay Curious, Keep Going

You don’t need the perfect product, exact tuition forecasts or a big starting sum. What matters most is starting early, contributing regularly and giving your plan a clear, written logic you can return to when emotions run high. Treat this as an ongoing experiment in responsible parenting and financial literacy, not a one‑time decision carved in stone. Your child may never see the spreadsheets or policy documents, but they will feel the difference between entering adulthood with options and entering it weighed down by debt. That gap is precisely what your investment case is designed to create.