The Psychology of Saving: How to Stay Motivated and Consistent

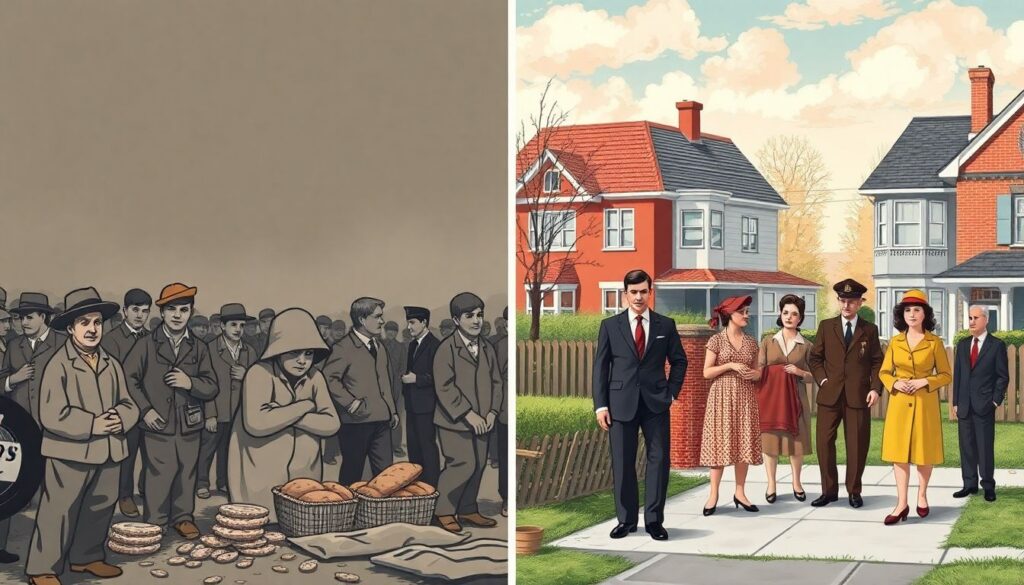

Historical Context: From Frugality to Financial Freedom

The human relationship with saving has deep historical roots. During the Great Depression of the 1930s, financial insecurity became a defining feature of life, reinforcing frugal habits in an entire generation. Post-World War II prosperity in the 1950s, especially in the West, allowed for a cultural shift toward consumerism, but saving remained a key pillar of financial stability. Fast forward to the early 21st century, the 2008 financial crisis reignited public interest in personal finance, fostering the emergence of the FIRE movement (Financial Independence, Retire Early). Now, in 2025, with inflation volatility and rapid technological disruption, the psychology behind saving has never been more relevant. Understanding not just *how*, but *why* we save is essential for long-term motivation and consistency.

Essential Tools to Build a Saving Mindset

To develop consistent saving habits, it’s crucial to use psychological and practical tools that align with intrinsic motivation. These instruments work not just as mechanisms of money management, but as behavioral nudges that align with how our brains make decisions.

– Automatic Transfers: Setting up automatic, recurring transfers to your savings account makes saving a default action rather than a conscious decision requiring willpower.

– Goal Visualization Platforms: Applications like YNAB or newer AI-driven platforms allow users to visualize future financial goals, making the reward feel more immediate.

– Spending Trackers with Feedback Loops: Tools that provide behavioral feedback (e.g., savings streaks, progress bars) help engage the brain’s reward system.

These tools leverage the principle of behavioral economics: we are more likely to act when the effort is reduced and the reward is clear.

Step-by-Step Process to Commit and Maintain

Staying consistent in saving requires more than just good intentions. It demands a structured process that integrates psychology with action. The following sequence helps reinforce behavioral patterns:

1. Define Emotionally Resonant Goals

Instead of abstract goals like “save more,” aim for emotionally connected targets such as “save $5,000 to start a freelance business” or “build an emergency fund for peace of mind.” Emotional resonance anchors motivation.

2. Break Down the Target

Our brains are prone to procrastination when faced with distant rewards. Monthly or weekly micro-goals create a sense of progress and satisfaction, sustaining momentum.

3. Use Commitment Devices

Commitment devices are agreements that make deviation from a goal harder. These include savings challenges with friends, or locking funds in penalty-free, time-locked digital vaults.

4. Reward Progress Systematically

Incorporate small, non-financial rewards as milestones are met—like a favorite experience or hobby-related splurge. Reinforcing positive behavior encourages repetition.

Troubleshooting: Tackling Psychological Roadblocks

Even with the right tools and process, saving can falter due to deep-seated cognitive biases. Understanding these challenges allows for more targeted interventions.

– Present Bias: The tendency to favor immediate gratification over long-term benefit sabotages savings. Counteract this by using “future self” visualization exercises to make tomorrow feel more tangible.

– Loss Aversion: People fear the idea of losing money, even if it’s just temporarily inaccessible in savings. Reframing savings as “protecting future options” rather than loss can shift this mindset.

– Decision Fatigue: Making repeated spending decisions drains willpower. Automating financial behavior reduces the mental load and makes consistency easier.

If motivation wanes, it’s helpful to revisit your original goals, adjust them if necessary, and reinforce your “why.” Life changes, and so should your savings strategy.

Sustainable Saving in a Rapidly Changing World

In 2025, individuals are navigating a complex financial terrain shaped by AI-driven labor shifts, environmental uncertainty, and new digital currencies. In this context, saving is no longer merely a domestic virtue—it’s a strategic life skill. By understanding the psychological principles underlying our behavior, we can harness motivation not as a fleeting emotion but as a sustainable force. Behavioral science, paired with modern tools and self-awareness, equips us not only to save more but to save smarter.