Category: Smart Saving Techniques

-

Investing in tax-managed funds for a smarter tax-efficient portfolio

Why Tax-Managed Funds Matter in 2025 Tax-managed funds sit at пересечении between classic asset management and real-world tax planning. Когда центральные банки в 2022–2024 годах повышали ставки, постналоговая доходность стала важнее номинальной. По данным крупных провайдеров индексов, за последние три года активы в tax efficient mutual funds и ETF росли двузначными темпами ежегодно, тогда как…

-

Budgeting essentials for a new business venture and smart financial planning

Why budgeting still matters in 2025 (even if everything feels real‑time) Budgeting for a new business in 2025 looks very different from the spreadsheets founders used ten лет назад, но суть не изменилась: вы заранее решаете, куда пойдут деньги, а не удивляетесь постфактум. Инвесторы, банки и даже фриланс‑подрядчики ожидают, что вы будете мыслить категориями бюджета:…

-

Budgeting for a medical startup: personal finance strategy for founders

Why your personal budget is secretly your first investor Launching a clinic, telemedicine platform, or diagnostics app feels like you’re building purely “for patients,” but in reality your first real stakeholder is your own wallet. Before you negotiate with VCs or banks, you’re negotiating with your personal cash flow, risk tolerance и time horizon. Smart…

-

Mastering cash flow as the cornerstone of personal finance success

Why Cash Flow Beats “Being Good with Money” Most people blame vague “bad money habits” when they’re stressed about finances, но the real culprit is usually cash flow. It’s not how much you earn or even your net worth that trips you up; it’s the timing and direction of money moving in and out. Cash…

-

What is dollar-cost averaging and how it works for long-term investing

Basic Idea of Dollar-Cost Averaging Dollar-cost averaging is a simple way to invest without trying to time the market. Instead of putting a big sum into stocks or ETFs at once, you split the money into equal parts and invest at regular intervals — for example, every month on the 5th, regardless of the price….

-

Understanding your paycheck deductions: a practical guide for employees

Why Your 2025 Paycheck Feels So Complicated If your first reaction to a new job is “why is my paycheck so low after deductions”, you’re not alone. Вetween remote work, side gigs and stock options, a 2025 pay stub packs far more information than it did even ten years ago. Taxes, health plans, student‑loan repayment,…

-

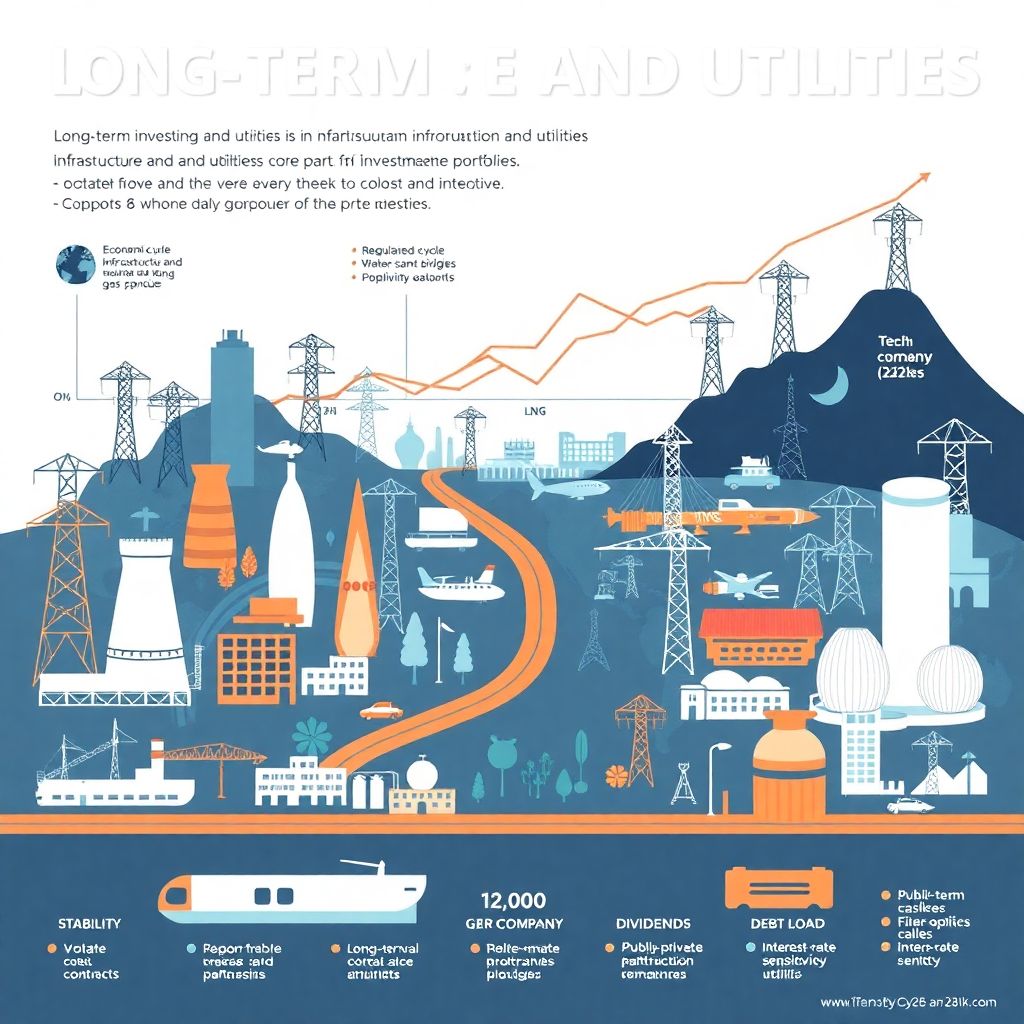

Investing in infrastructure and utilities as a resilient core portfolio play

Why Infrastructure and Utilities Belong in a Core Portfolio When investors talk about “defensive” assets, they often mean infrastructure and utilities, even if they don’t call them that. These компании опираются на базовые человеческие потребности: электричество, вода, транспорт, связь, хранение данных. Люди и бизнес продолжают платить за свет и интернет даже во время кризисов, поэтому…

-

Personal finance morning and evening routine: how to build daily money habits

Why a Daily Money Routine Matters Today Stats and Big Picture Most people don’t lose money on one huge mistake, they leak it through tiny daily decisions. По данным опросов Gallup и OECD, значительная часть домохозяйств не может покрыть внезапный расход в несколько сотен долларов без долгов. При этом проникновение финансовых приложений растёт двузначными темпами…

-

Parents and parenting skills: how to raise happy and confident children

How parenting is changing by 2025 Parenting в 2025 году выглядит совсем не так, как еще до пандемии. Родители стали гораздо более рефлексивными: по данным опросов UNICEF и OECD за 2022–2024 годы, от 55 до 65 % родителей в разных странах говорят, что регулярно читают материалы о воспитании и психологии детей, тогда как до 2020…

-

Managing money during a divorce: practical finances and smart planning

Divorce and money used to mean paper statements, tense meetings in law offices, и endless arguments about “who paid for what.” В 2025 году всё иначе: у вас криптокошельки, совместные подписки на стриминги, удалённая работа, опционы на акции и куча финансов в онлайне. Ошибка — пытаться решать новые задачи старыми методами, игнорируя технологичные инструменты и…