Category: Investment Insights

-

Financial planning for digital nomads: smart budgeting on the move

Why financial planning for digital nomads matters right now Over the past three years, remote work has turned from эксперимент into устойчивую норму. According to MBO Partners, the number of U.S. workers identifying as digital nomads grew from about 15.5 million in 2021 to 16.9 million in 2022 and around 17.3 million in 2023. Параллельно…

-

Investing in global equities: a beginner’s framework for building a stock portfolio

Why Global Equities Matter More Than Ever Сhanging the default: from “home bias” to global thinking Most new investors start by buying what они знают: родные компании, знакомые бренды, истории из новостей. Это естественный «home bias», но он создаёт перекос: экономика вашей страны — лишь часть мировой сцены. Представьте, что вы смотрите только местные сериалы…

-

How to use a financial advisory to reach your financial goals effectively

Understanding the Role of Financial Advisory in Goal Achievement In an era marked by economic volatility and growing financial complexity, the role of financial advisors has become increasingly pivotal. Between 2022 and 2024, the global financial advisory market expanded at an average annual rate of 6.8%, reaching a valuation of $270 billion by the end…

-

Smart ways to protect your finances during a market crash and avoid major losses

Historical Context of Market Crashes Throughout financial history, global markets have experienced numerous downturns, often triggered by macroeconomic imbalances, geopolitical crises, or systemic failures. The Great Depression of 1929, the Black Monday crash in 1987, the Dot-com bubble burst in 2000, the Global Financial Crisis of 2008, and the COVID-19-induced volatility in 2020 serve as…

-

Investment insights: how to read a prospectus and choose the right mutual funds

Understanding the Prospectus: Your Investment Decoder Let’s be honest—most people don’t read a fund’s prospectus. Why? Because it looks like a wall of legal text designed to bore you into submission. But here’s the thing: buried inside that document is everything you need to know about where your money is going and what risks you’re…

-

Budgeting for a new car purchase to save money effectively and avoid overspending

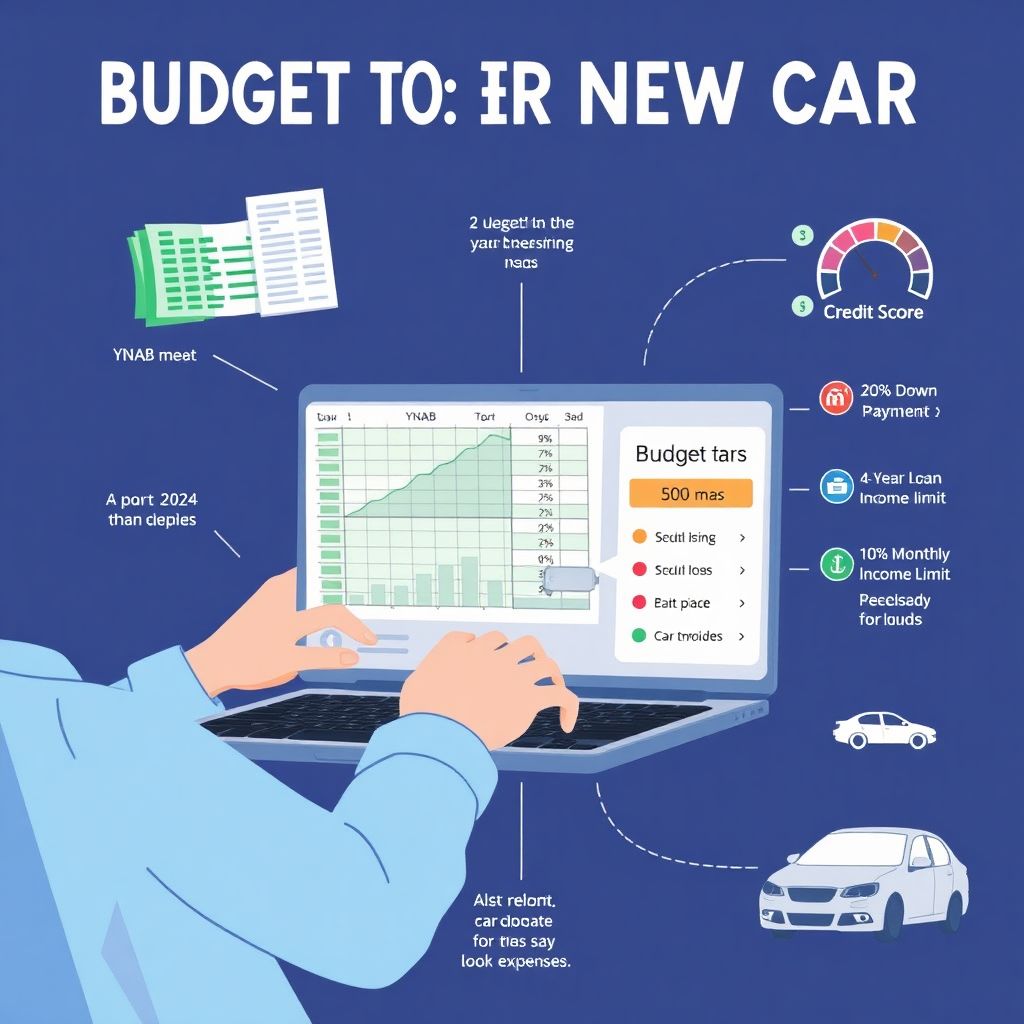

Getting Started with Budgeting for a New Car Purchase Buying a car is one of the biggest financial decisions we make, right after purchasing a home. Whether it’s your first car or you’re upgrading to a newer model, planning your budget properly can save you from unnecessary debt and regret. According to Kelley Blue Book,…

-

Investing in municipal bonds for tax-advantaged growth with lower risk

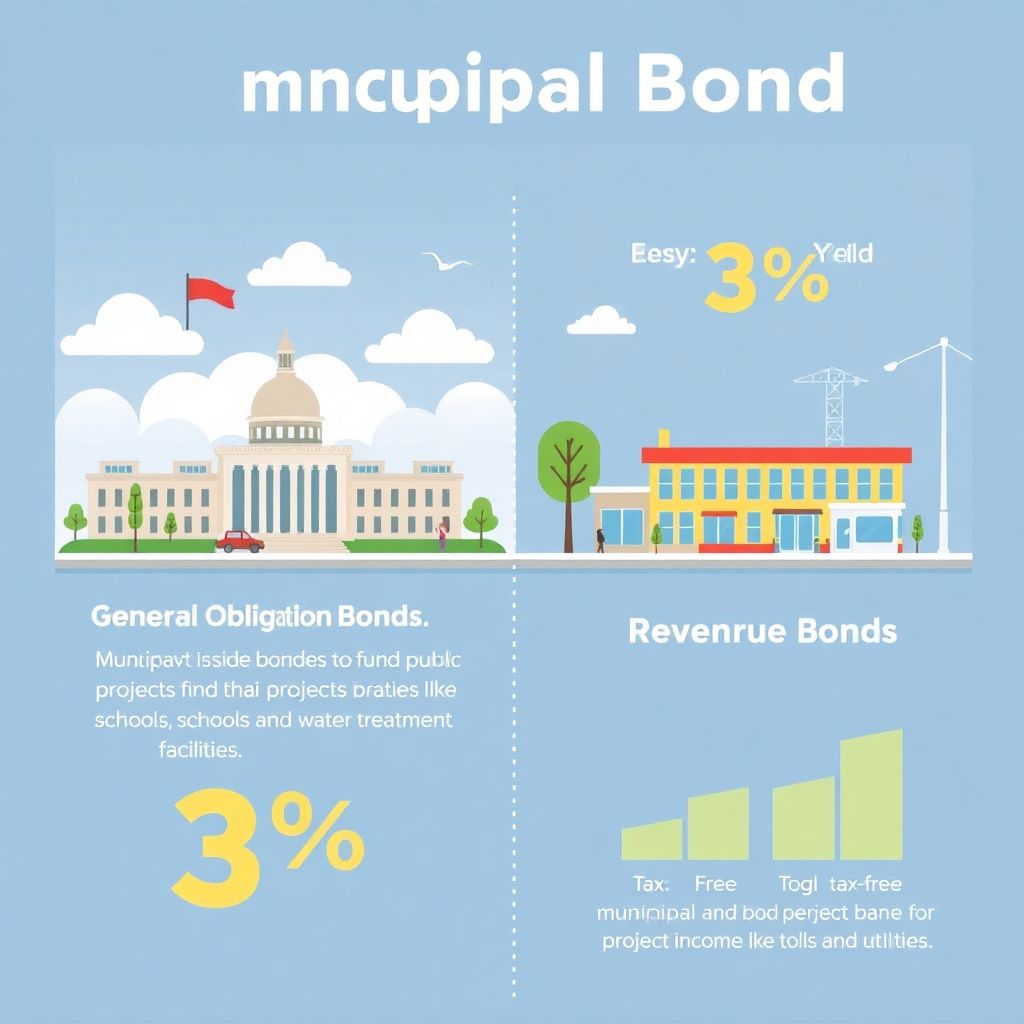

Understanding Municipal Bonds: What Are They? Municipal bonds, often referred to as “munis,” are debt securities issued by state and local governments or their agencies to finance public projects such as highways, schools, or water treatment facilities. When you invest in a municipal bond, you are essentially lending money to a government entity. In return,…

-

Automatic investing with robo-advisors: key essentials for smart portfolio growth

Understanding the Core of Robo-Advisors Automatic investing via robo-advisors has become a mainstream solution for individuals seeking efficient, low-cost, and algorithm-driven investment management. Robo-advisors use sophisticated algorithms to build and rebalance portfolios based on an investor’s risk tolerance, goals, and time horizon. According to Statista, the global assets under management (AUM) in the robo-advisory segment…

-

Smart strategies to save on groceries and household essentials without compromising quality

Rethinking the Weekly Grocery Run: Strategic Approaches That Work For many households, groceries and household essentials represent a significant portion of monthly expenses. While coupons and bulk buying remain common tactics, evolving technologies and shifting consumer behavior have introduced smarter, more dynamic ways to cut costs without compromising quality. This article analyzes various approaches, examines…

-

Smart ways to save on travel without missing out on fun experiences

Smart Ways to Save on Travel Without Sacrificing Fun Step 1: Plan Ahead, But Stay Flexible The most effective way to save on travel begins long before you pack your bags. Booking flights and accommodations several months in advance often unlocks lower prices. However, flexibility with your travel dates and destinations can make an even…