Category: Investment Insights

-

How to build a credit repair plan after financial setbacks and regain stability

Why a Credit Repair Plan Matters More Than Ever When money blows up — job loss, medical bills, divorce, collections — it’s easy to think your credit is permanently ruined. Но это не так. В США более 30% взрослых имеют кредитный рейтинг ниже 670, и миллионы уже прошли через банкротства и просрочки и все же…

-

Financial planning for immigrants: how to adapt your money to a new country

Starting Over: Why Money Feels Different After You Move Moving to a new country rewires your relationship with money. Even если вы прекрасно управлялись с финансами дома, в новой системе всё кажется чужим: другие налоги, странные кредитные баллы, незнакомые термины в банке, страх что‑то подписать не так. И при этом финансовое планирование — одна из…

-

Saving for a child’s college education: smart tips and tricks for parents

Why Saving for College Matters So Much Many parents underestimate how aggressively tuition grows, assuming scholarships or future salary jumps will magically solve everything. In reality, starting a dedicated college fund shifts the burden from last‑minute borrowing to long‑term compounding. When you think through how to start saving for child’s college, you’re really designing a…

-

How to use a cash budget for better financial control and smarter money management

Why a Cash Budget Still Matters in 2025 In 2025 люди привыкли говорить о крипте, высокочастотной торговле и нейросетях в банках, но большинство финансовых провалов до сих пор происходят из‑за банальной вещи: нехватки живых денег в нужный момент. Можно иметь прибыльный бизнес или приличную зарплату и при этом постоянно сидеть “в нуле” на счёте. Cash…

-

Investing in precious metals for beginners: a simple guide to starting safely

Core ideas and main approaches Investing in precious metals путает новичков, потому что вариантов слишком много: физические монеты, ETF, фьючерсы, накопительные счета, пенсионные схемы. По сути есть три ключевых подхода. Первый — классическое владение слитками и монетами, когда вы контролируете актив и решаете вопросы хранения. Второй — «бумажное золото»: биржевые фонды и акции добывающих компаний,…

-

Investment strategy for a young family: practical steps to grow your wealth

Why a Young Family Needs an Investment Strategy Right Now When two people move from “you and me” to “we” (and maybe “we plus kids”), money decisions stop being абout today and start being about the next 10–30 years. A proper investment plan for young families is not about chasing the hottest stock, but about…

-

Financial planning for athletes: maximizing earnings and long-term wealth

Money in sports looks glamorous from the outside, but the reality is closer to a fast‑moving startup than a stable paycheck. Income spikes early, careers end quickly, и every wrong step is дорого. So financial planning for athletes isn’t about “being rich” — it’s about turning a short, risky earning window into a lifetime of…

-

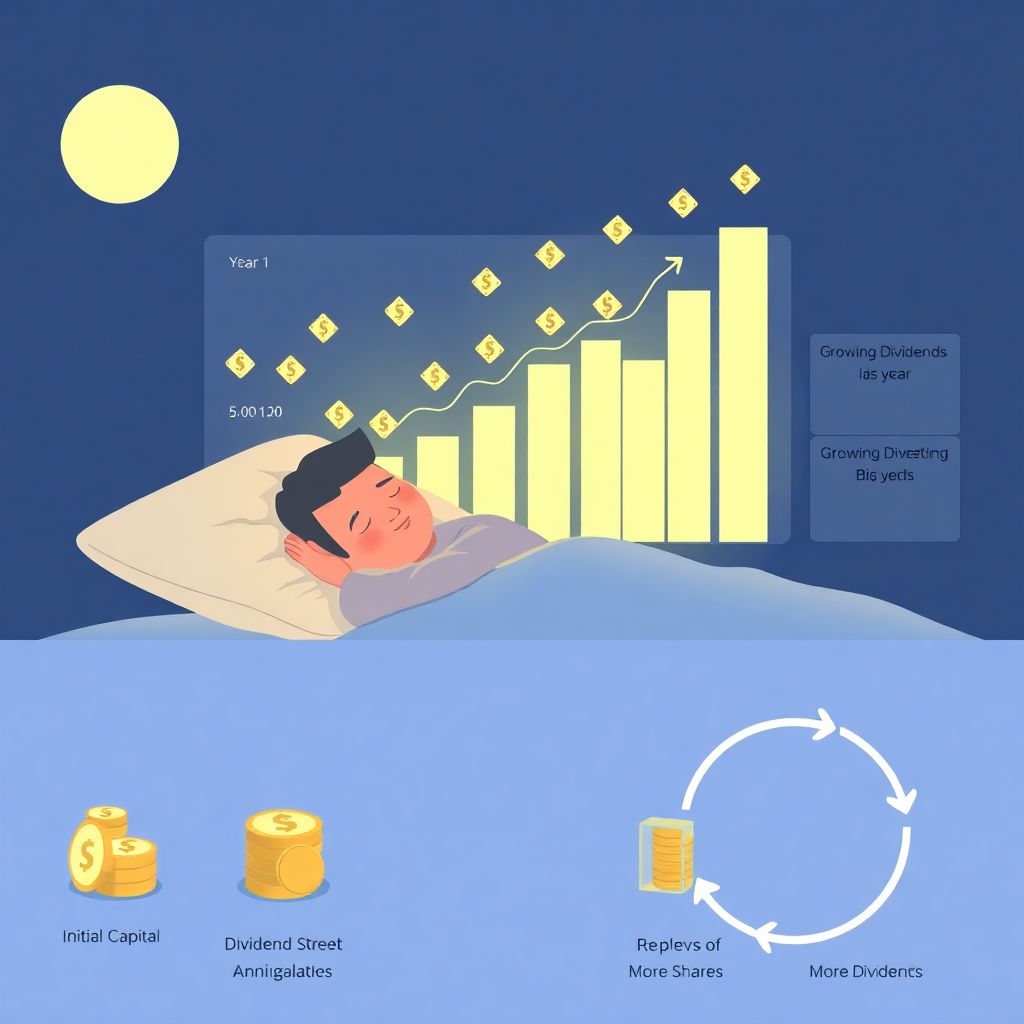

Investing in dividend growth for a steady income strategy and long-term wealth

If you like the idea of your money working quietly in the background while you sleep, dividend growth investing is one of the cleanest ways to get there. Instead of betting on the next hot stock, you focus on businesses that steadily raise the cash they send you every year. As of 2025, after years…

-

Smart budgeting for seasonal work and holidays to manage income and expenses wisely

Seasonal work can feel like riding a financial roller coaster: big paychecks in peak months, then long quiet stretches where every bill looks louder than the last. Smart budgeting here is less про “be more disciplined” and more про “build a system that works with your income, not against it”. Below мы разберём разные подходы,…

-

Emergency financial cushion in 30 days: how to build your safety net

Why an Emergency Cushion in 30 Days Is Realistic An emergency fund sounds like a long, boring marathon, but 30 focused days can give you a real safety net. Think of it less как «идеальный запас на 6 месяцев», и больше как «подушка, которая спасёт от паники в следующем форс-мажоре». When people ask, “emergency fund…