Category: Investment Insights

-

Health and wellness costs explained: how to control expenses and spend smarter

Before we dive into numbers and Wellness Costs, let’s set the scene. You don’t have to be a huge corporation to think about wellness, но you do need to be deliberate. Costs can quietly разрастаться, если вы берёте модули «по чуть-чуть», не считая общую корзину. В этом гайде разберёмся, из чего складываются расходы, как не…

-

Budgeting for a healthier life: medical expenses and smart financial habits

Why medical budgeting matters more than ever За последние три года медицинские расходы росли быстрее инфляции почти во всех странах с развитой системой здравоохранения. В США, по данным CMS, совокупные health care expenditures выросли с примерно 4,4 трлн долларов в 2022 году до более 4,7 трлн в 2023‑м, а предварительные оценки за 2024‑й показывают дальнейший…

-

Investing in aerospace and defense: starter guide for beginner investors

Why the Aerospace and Defense Theme Matters Right Now За последние три года отрасль заметно сместилась из разряда «узких нишевых историй» в разряд стратегических направлений для частных инвесторов. С 2022 по 2024 годы глобальные военные расходы выросли более чем на 10%, по данным SIPRI, превысив отметку в 2.4 трлн долларов. США, страны НАТО и несколько…

-

Cons explained: understanding the drawbacks, risks and when they matter

Conventions – or just “cons” – look chaotic from the outside: crowds, lines, bright lights, people in armor made from yoga mats. На самом деле, если подойти с головой, это одно из самых дружелюбных и вдохновляющих мест, куда можно выбраться на выходных. Ниже — пошаговый гайд, который поможет спокойно и с удовольствием выжить на любом…

-

Getting started with robo-investing: key pros, benefits and beginner tips

If you’ve been hearing about robo‑investing everywhere and it still sounds like sci‑fi, you’re not alone. Since markets went fully digital and mobile apps became the norm, automated portfolios quietly turned into a mainstream tool, especially for first‑time investors. People google “best robo advisors for beginners” the way they used to search for budget spreadsheets,…

-

How to build a personal investment philosophy and grow wealth with confidence

Why a Personal Investment Philosophy Matters More Than Hot Tips Most people come к investing через случайные советы: ролики в TikTok, форумы, разговоры на кухне. Проблема в том, что чужие идеи не учитывают ваш доход, психику, горизонты и ответственность перед семьёй. С 2022 по 2023 год S&P 500 сначала упал примерно на 19% в 2022-м,…

-

The basics of annuities for beginners: find out if they fit your financial goals

Why Annuities Suddenly Matter Again Long before glossy brochures and online calculators, ancient Roman soldiers got something very similar to annuities: a lump sum paid to an insurer-like group, in exchange for lifelong income after service. Fast‑forward to the 18th–19th centuries, European governments used annuities to fund wars and big infrastructure projects. In the U.S.,…

-

Financial planning for immigrant families: path to prosperity and long term stability

Why financial planning works differently for immigrant families Immigrant families usually live в двух финансовых мирах одновременно: старые обязательства в стране происхождения и новые правила в принимающей стране. Из‑за этого классические советы по деньгам часто не срабатывают. Ваша отправная точка — не «начни инвестировать с 20 лет», а «разберись с документами, статусом и базовой безопасностью»….

-

Budgeting for a green home with smart energy-efficiency upgrades

Why budgeting for a green home really matters Want a greener house but scared it will eat your entire savings? You’re not alone. Many people dive into green home renovation budget planning with lots of enthusiasm and zero structure, then give up when quotes start flying. The trick is to treat energy upgrades like any…

-

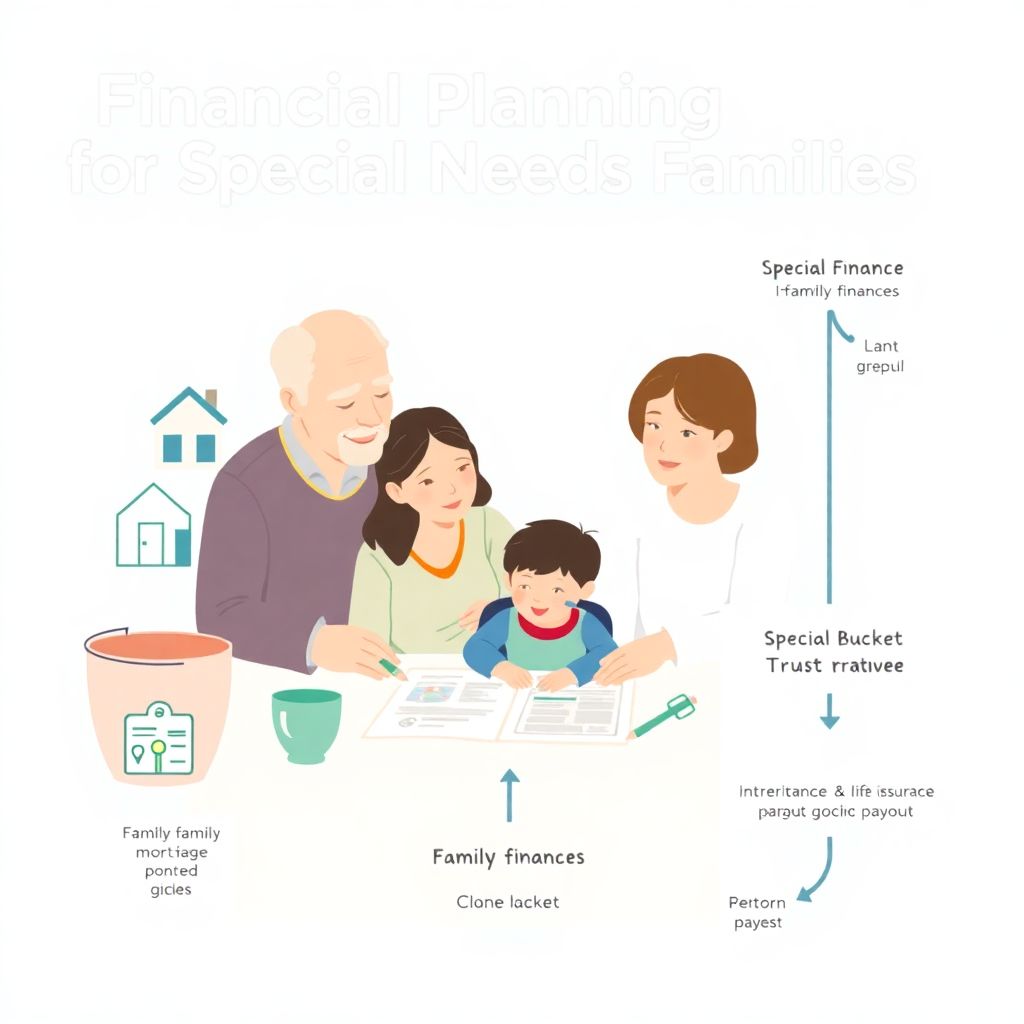

Financial planning for parents of children with special needs: key steps and tips

Why Financial Planning Is Different When Your Child Has Special Needs When you’re raising a child with disabilities, money stops being just about “retirement someday” and turns into a lifelong support question: “Who will take care of my child when I no longer can?” That’s the core of financial planning for parents of children with…