Category: Investment Insights

-

How to build a personal finance roadmap for the next decade and reach your goals

Why a 10‑Year Roadmap Beats Short‑Term Money Hacks Thinking in decades, not paychecks Пeople usually ask how to create a 10 year financial plan when что‑то уже горит: долги, ипотека, ребёнок на подходе. Гораздо спокойнее и выгоднее выстроить маршрут заранее. Десятилетний горизонт даёт время исправить ошибки, пережить кризисы и воспользоваться сложным процентом. Вместо бессмысленной экономии…

-

Investing in renewable energy stocks: a beginner’s path to green profits

Why Renewable Energy Stocks Are So Hot in 2025 Renewable energy stopped being a niche theme and turned into крупный мейнстрим‑сектор рынка к 2025 году. За последние пять лет совокупная установленная мощность солнечной и ветровой генерации выросла более чем на 60%, а доля ВИЭ в мировой выработке электроэнергии приблизилась к 35%. На фондовом рынке это…

-

Smart ways to save on water bills without sacrificing home comfort

Why Saving on Water Bills Doesn’t Have to Hurt Most people hear “save water” and instantly imagine cold two‑minute showers, unwashed cars and a garden that looks like a desert. That’s not what we’re doing here. The real trick is learning how to reduce water bill at home without feeling like you’re punished for it….

-

Investing in miners and metals made simple: a beginner’s guide

Why Miners and Metals Still Matter in 2025 Mining stocks look boring… right up until they move 50–100% in a year. Metals sit на стыке нескольких трендов: энергетический переход, оборона, инфраструктура, цифровизация. Поэтому investing in miners and metals в 2025 году — это уже не «олдскульная история про золото», а ставка на то, как будет…

-

How to create a family finance schedule that works and builds stability

Why a Family Finance Schedule Matters More Than Ever In 2025 семейный бюджет управлять сложнее, чем когда-либо: подписки, онлайн‑покупки в один клик, дети с банковскими картами, инфляция, нестабильный рынок труда. При этом базовая задача не изменилась со времён первых домохозяйственных книжек XIX века: понять, сколько денег входит в дом и куда они утекают. Разница лишь…

-

Debt-free roadmap: how to climb out of the hole and rebuild your financial life

Debt‑Free Roadmap: Climbing Out of the Hole Without Losing Your Mind Why traditional advice often isn’t enough Most guides tell you the same thing: “Cut lattes, make a budget, stop using credit cards.” Technically correct, but about as helpful as telling a drowning person to “just swim better.” Debt today is entangled with algorithms, push‑notifications,…

-

Investing in artificial intelligence stocks: a gentle intro for new investors

Why AI Stocks Matter for Everyday Investors A Short History of AI on Wall Street For decades, AI sounded like science fiction, and early “AI stocks” in the 1980s were mostly niche software firms that rarely met expectations. The real turning point came when cloud computing made it cheap to train huge models, and smartphones…

-

Investment fees explained: practical guide to understanding what you really pay

Why Your Investment Fees Deserve More Attention Most people focus on returns and barely glance at costs, yet fees quietly decide who gets rich: you or your provider. Think of them as friction: small in the moment, brutal over decades. With investment fees explained clearly, it becomes obvious why a “tiny” 1–2% annual charge can…

-

Budgeting a car lease vs buy decision to plan your long‑term auto costs

Understanding the lease vs buy dilemma Why this decision matters for your budget Choosing between leasing and buying выглядит как простой вопрос про “платить меньше в месяц или владеть машиной”. На самом деле вы выбираете финансовую стратегию на несколько лет вперёд. В 2025 году машины дорожают, а страховка и обслуживание тянут всё больше денег, поэтому…

-

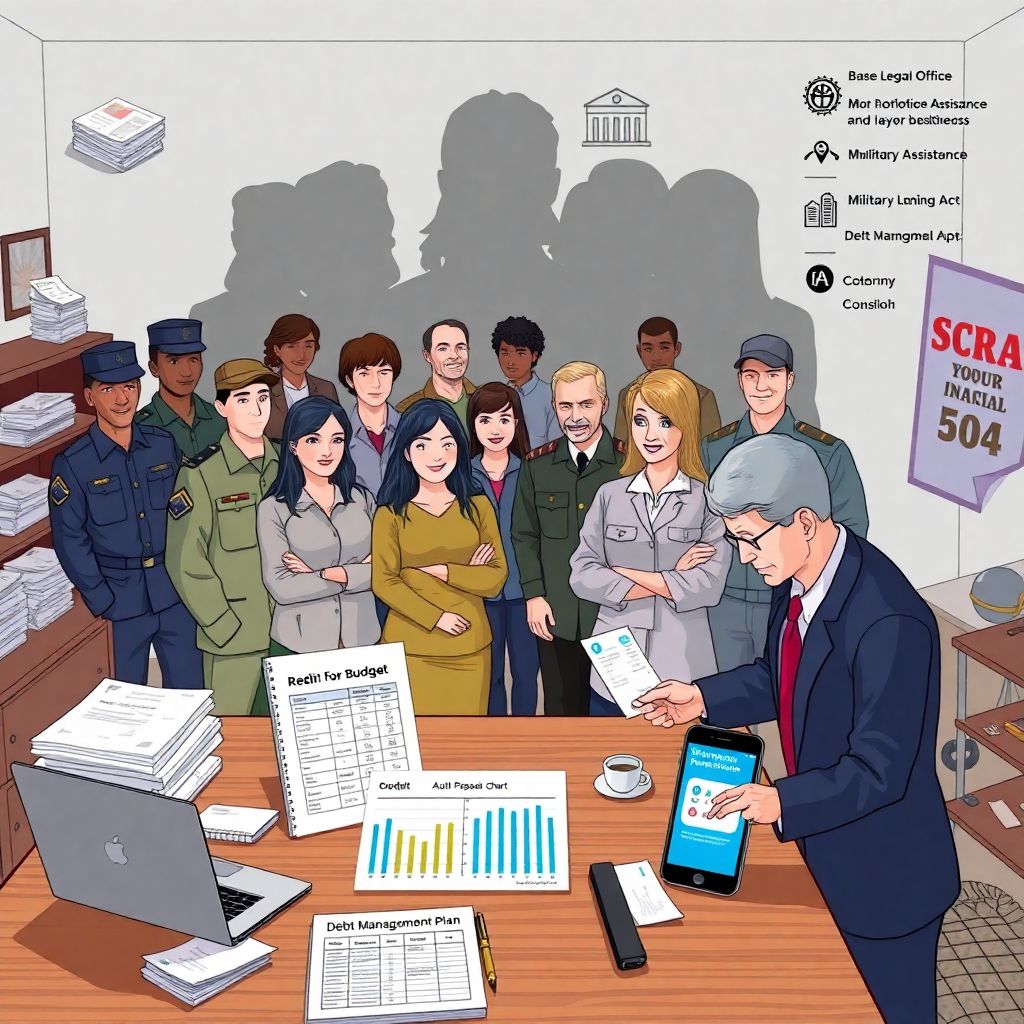

Debt management for military personnel: strategies to regain financial control

Why debt hits military families differently If you talk to enough service members, you’ll hear the same quiet worry over and over: “I’m serving my country, so why am I still drowning in bills?” Debt management for military personnel — whether active duty, Guard, Reserve, or veterans — has its own twist. Frequent PCS moves,…