Category: Financial Planning

-

How to build a realistic budget you’ll actually stick to and grow your savings

Why “Realistic Budget” Means Something Different in 2025 В 2025 году бюджетирование перестало быть скучной таблицей в Excel и превратилось в динамичную систему управления денежными потоками в реальном времени. Контактless‑платежи, подписочные сервисы и микротранзакции размывают ощущение «настоящих» денег, поэтому классические методы уже не работают в чистом виде. Реалистичный бюджет теперь учитывает не только фиксированные расходы…

-

Investing in artificial intelligence etfs: a simple start for new investors

Why AI ETFs Are Suddenly Everywhere Artificial intelligence stopped being sci‑fi the moment algorithms began quietly deciding which posts you see, what prices you pay for flights and how your phone camera enhances your face. By 2025, AI is a full‑blown infrastructure layer, a bit like electricity 100 years ago. Instead of trying to pick…

-

Budgeting for seasonal promotions in e-commerce and retail: key strategies

Before we dive into the “how”, a quick reality check: in 2025 seasonal promos are less about shouting the biggest discount and more about precision—data, timing, and ruthless focus on ROI. Budgets are tight, tracking is messier (thanks, privacy rules), and customer acquisition costs keep creeping up. The good news: with a clear system, seasonal…

-

How to create an investment policy statement for smarter personal finance

Why an Investment Policy Statement Matters Today An Investment Policy Statement (IPS) sounds like something only a pension fund would use, but for personal finance it’s basically your written “money constitution”. Over the last three years the need for structure has only grown. According to the 2022 Federal Reserve Survey of Consumer Finances, about 58%…

-

Debt-free living for recent graduates: smart strategies to manage money

Why “Debt‑Free Living” Became a Big Deal for Recent Grads If you’re finishing college around 2025, you’re stepping into a world that’s been arguing about student debt for almost two decades straight. The 2008 financial crisis pushed a whole generation into the job market with weak salaries and record education costs. By the late 2010s,…

-

Financial education for employees: what employers should offer and why

Why Financial Education at Work Actually Matters Most people don’t learn how to handle money from school; they learn it from trial and error — чаще всего дорогостоящей. That’s where workplace financial education for employees can quietly transform both people’s lives and your business metrics. When staff understand budgeting, debt, investing and benefits, they feel…

-

Smart budgeting for tech purchases and gadgets to save money and avoid overspending

Why Smart Budgeting for Tech Matters in 2025 Smart budgeting for gadgets is less about being cheap and more about buying tech that actually pays off. За последние три года продажи потребительской электроники росли медленнее: по данным IDC и Statista, в 2022–2024 годах рынок смартфонов то падал, то отскакивал на несколько процентов, а продажи ноутбуков…

-

Investing in emerging markets: a cautious starter guide for new investors

Understanding Why Emerging Markets Still Matter in 2025 Investing in emerging markets in 2025 уже не выглядит как дикая авантюра, но и расслабляться рано. Экономики Индии, Индонезии, Вьетнама, Мексики и некоторых стран Африки растут быстрее развитых рынков, двигая вперед потребление, цифровизацию и инфраструктуру. При этом политические риски, слабые институты и валютные колебания никуда не делись,…

-

Loan guide: how to choose the best loan and avoid common borrowing mistakes

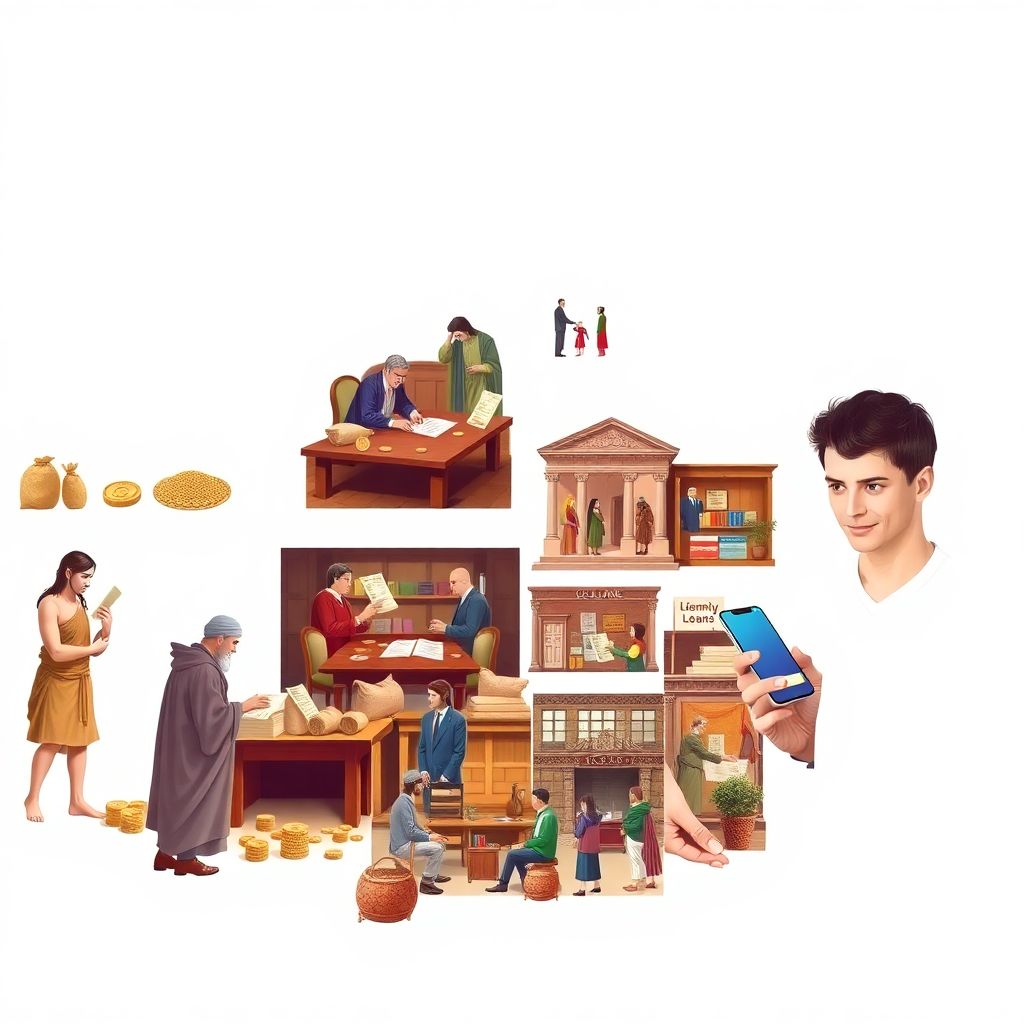

Историческая справка: от ростовщиков до онлайн-заявок If you strip away the glossy apps and bank branches with coffee machines, a loan is one of the oldest social technologies humans invented. Thousands of years ago в Месопотамии уже выдавали зерно «в долг до урожая», фиксируя сделки на глиняных табличках. Позже в Средневековье действовали ростовщики, монастыри и…

-

Budgeting for a side business: balancing passion and profit wisely

Why your “fun little project” needs a real budget A side business usually начинается с эмоций: «Я люблю это делать, а вдруг получится заработать?». Но очень быстро к кайфу от дела примешивается усталость от денег: непонятно, сколько тратить, сколько откладывать, и когда вообще это станет прибыльным. Вопрос *how to budget for a side business* возникает…