Category: Debt Management

-

Personal finance for teens: a practical guide to money, saving and budgeting

Why Money Skills in Your Teens Change Everything Рersonal finance as a life skill, not a boring subject When подросток учится обращаться с деньгами, он фактически тренирует навык долгосрочного планирования, похожий на стратегическую игру с реальными ставками. Представьте девятиклассника Лиама, который подрабатывал на доставке еды и тратил всё на игры и фастфуд. В 16 лет…

-

Saving for college education with a flexible plan for your childs future

When people talk about paying for college, it can sound like you either need a trust fund or a lottery ticket. Reality is less dramatic: you usually need time, a clear goal, and a flexible plan that can bend when life doesn’t follow the script. Over the last few years, families have been mixing old‑school…

-

Financial planning for freelancers and gig workers to grow and protect income

Why Money Feels So Messy When You’re Self‑Employed When you’re freelancing or juggling gigs, money rarely arrives in neat, predictable paychecks. One month you land a huge project, the next you’re refreshing your inbox a little too often. That’s exactly why financial planning for freelancers feels tricky: there’s no HR department, no automatic pension, no…

-

What is a budget surplus and how to use it wisely for financial stability

Budget Surplus: Not Just “Extra Money” Budget surplus звучит сухо и скучно, хотя по сути это момент, когда вы наконец дышите свободнее: доходы превысили расходы, и у вас остаются деньги, которые не «съедены» обязательствами. Важно не просто порадоваться, а понять, как не превратить этот плюс в хаос из случайных покупок. В этой статье разберём, что…

-

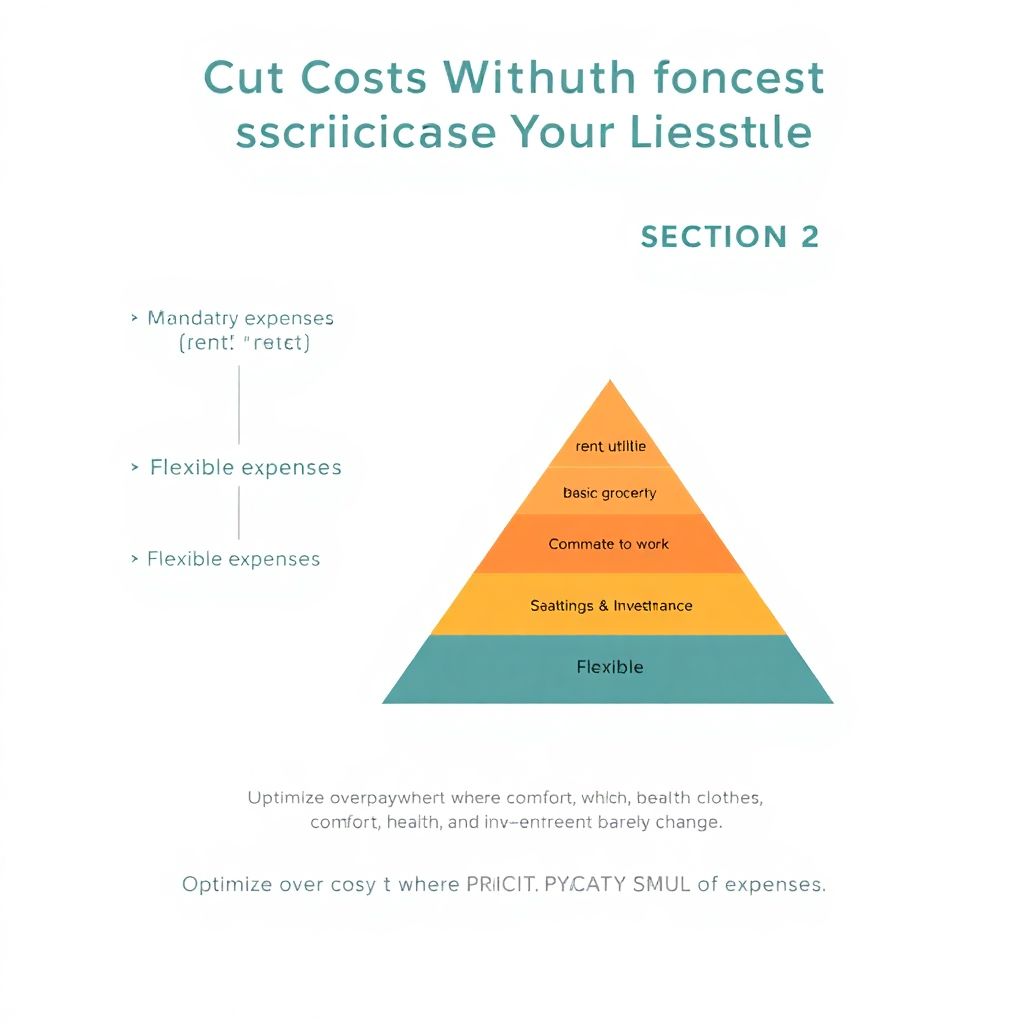

Smart ways to cut costs without sacrificing quality of life every single day

What “cutting costs without sacrifice” really means When people Google the best ways to save money without sacrificing lifestyle, они часто представляют магический лайфхак: пару кликов в приложении — и бюджет чудесно сходится. В реальности речь идет не о лишении, а об оптимизации. Дадим четкие определения: «качество жизни» — это не количество покупок, а степень…

-

Personal finance for solo entrepreneurs: how to budget smart and grow faster

Money as your quiet business partner Give every dollar a job If you run a one‑person business, your money already behaves like a teammate: it works, rests, disappears или приносит дивиденды, в зависимости от того, как вы им управляете. Самая действенная из всех personal finance tips for solo entrepreneurs звучит просто: каждый доллар должен иметь…

-

The beginner’s guide to tax-efficient investing: how to reduce your tax bill

Tax-efficient investing sounds like something only a CPA and a tax lawyer would enjoy, but in 2025 это уже must-have навык для любого частного инвестора. Алготрейдинг, неограниченный доступ к ETF и мгновенные брокерские приложения упростили покупку активов, но налоговые правила стали сложнее: больше порогов, тонкие различия по типам счетов, разные режимы налогообложения для криптоактивов и…

-

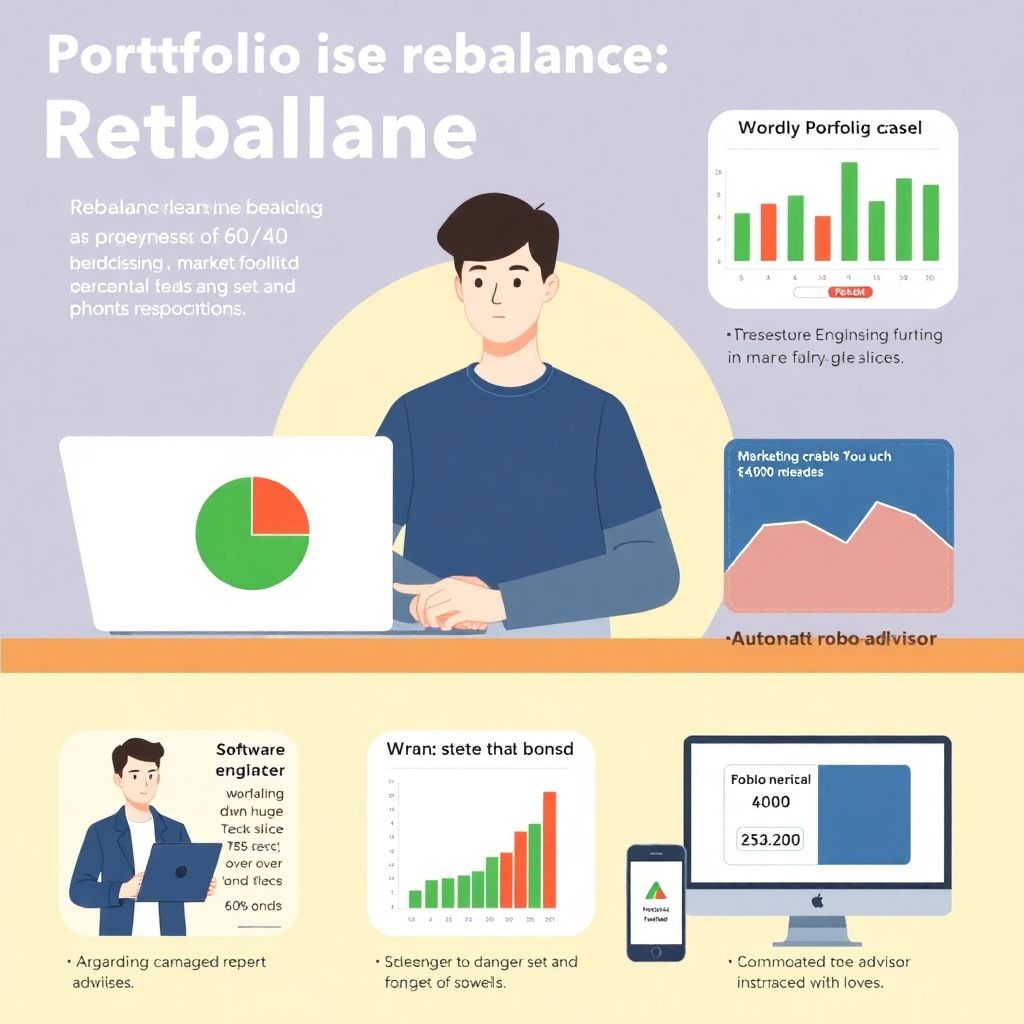

Portfolio rebalancing essentials for beginners: how to manage investments

Why Rebalancing Matters More Than Stock Picking Most beginners obsess over “the next big stock” and ignore the quieter question: what happens to your mix of assets after you buy them? That mix – your allocation between stocks, bonds, cash, maybe real estate or ETFs – quietly drifts over time. If markets boom, your stock…

-

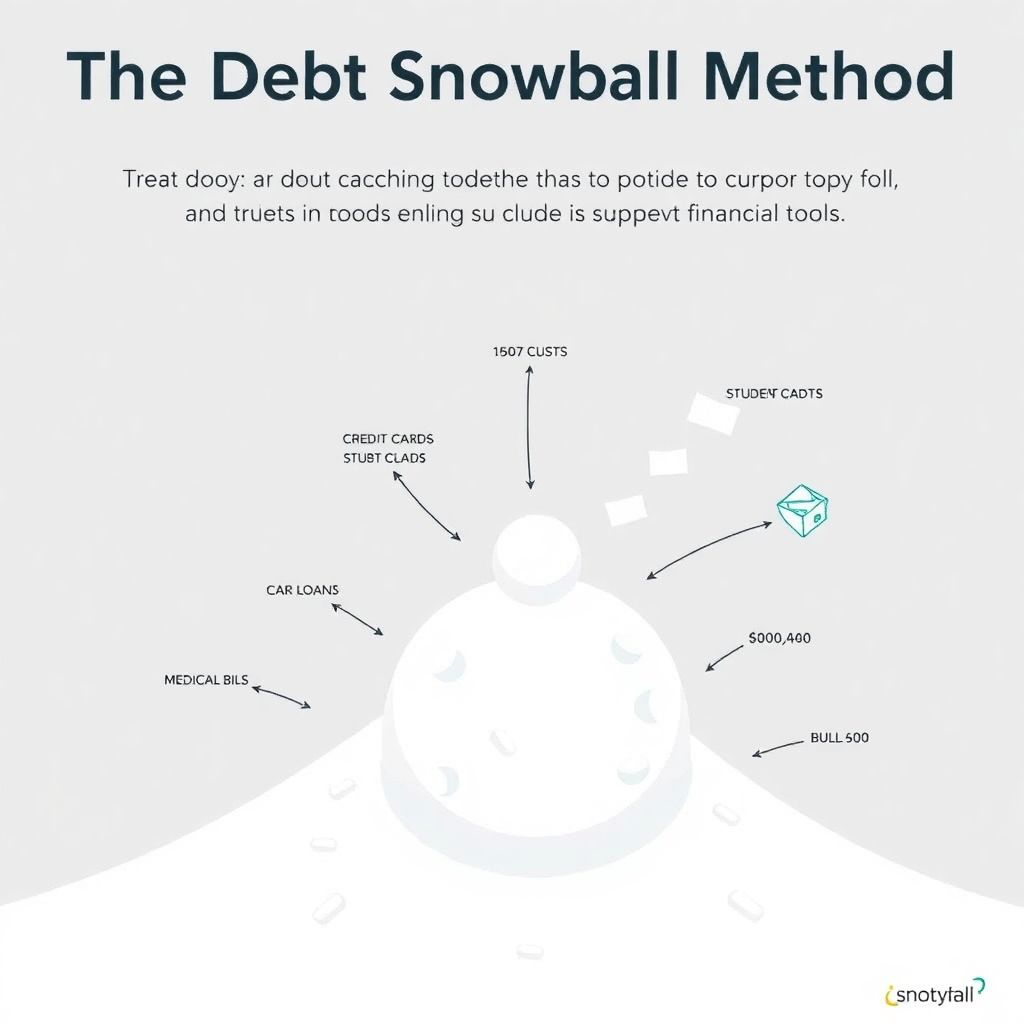

Debt snowball plan that works: how to create a strategy to pay off debt faster

Understanding the Debt Snowball Method: A Foundation for Financial Freedom The debt snowball method has gained popularity for a reason: it’s psychologically rewarding and relatively easy to implement. The basic idea is to list all your debts from smallest to largest balance, make minimum payments on all but the smallest debt, and allocate any extra…

-

The psychology of saving money: how to stay motivated and build consistent habits

The Psychology of Saving: How to Stay Motivated and Consistent Historical Context: From Frugality to Financial Freedom The human relationship with saving has deep historical roots. During the Great Depression of the 1930s, financial insecurity became a defining feature of life, reinforcing frugal habits in an entire generation. Post-World War II prosperity in the 1950s,…