Category: Budgeting Basics

-

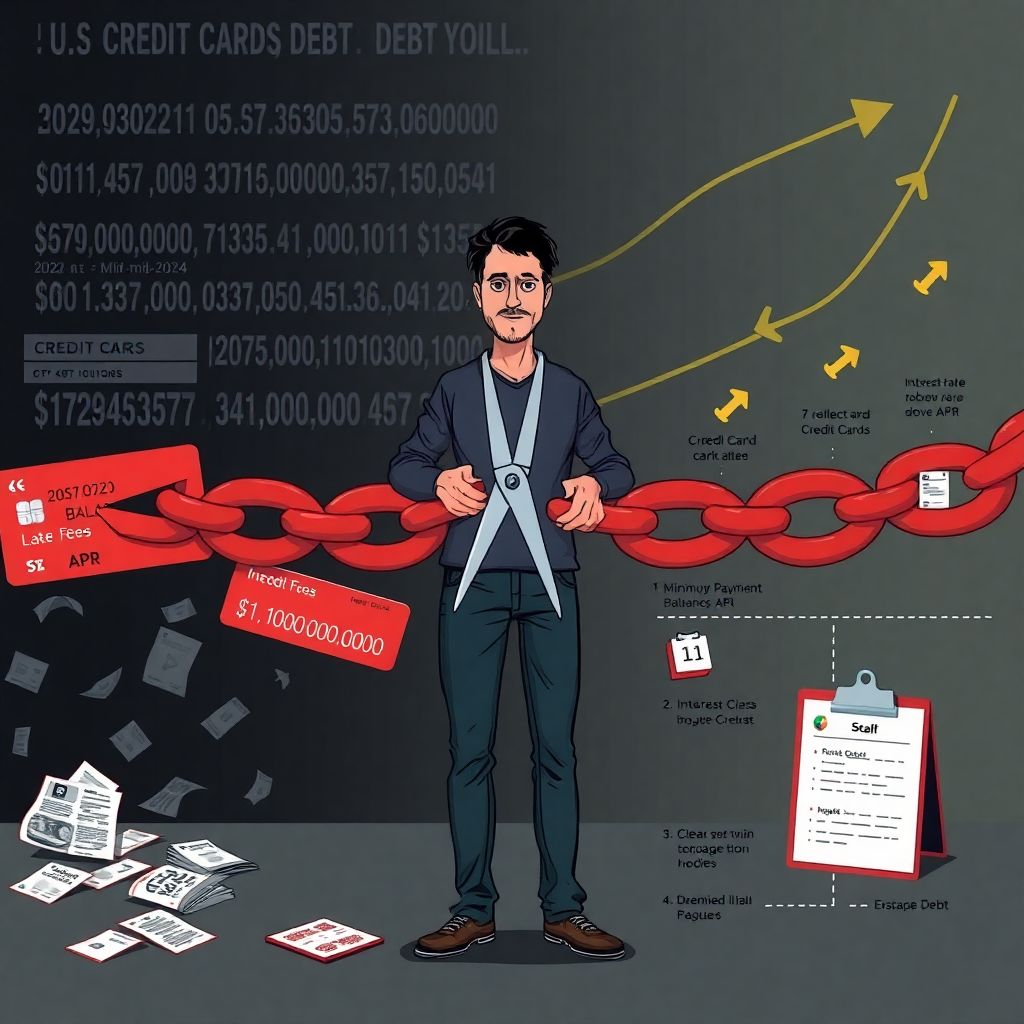

Breaking the credit card cycle: practical steps to stop living in the red

Credit cards were designed as a convenience tool, but for millions they’ve quietly turned into a permanent minus sign. By mid‑2024, U.S. credit card balances passed 1.1 trillion dollars, up roughly 20–25% from 2021. At the same time, interest rates on many cards jumped above 20% APR, so every month more income goes to servicing…

-

Debt snowball vs debt avalanche: choosing the right payoff strategy for you

Why payoff strategy suddenly matters a lot more in the 2020s Over the last three years долги подорожали буквально на глазах. В США общий объем кредитной задолженности домохозяйств, по данным New York Fed, превысил 17,5 трлн долларов к концу 2024 года, а кредитные карты в 2023‑м впервые пробили отметку в 1 трлн. Средняя ставка по…

-

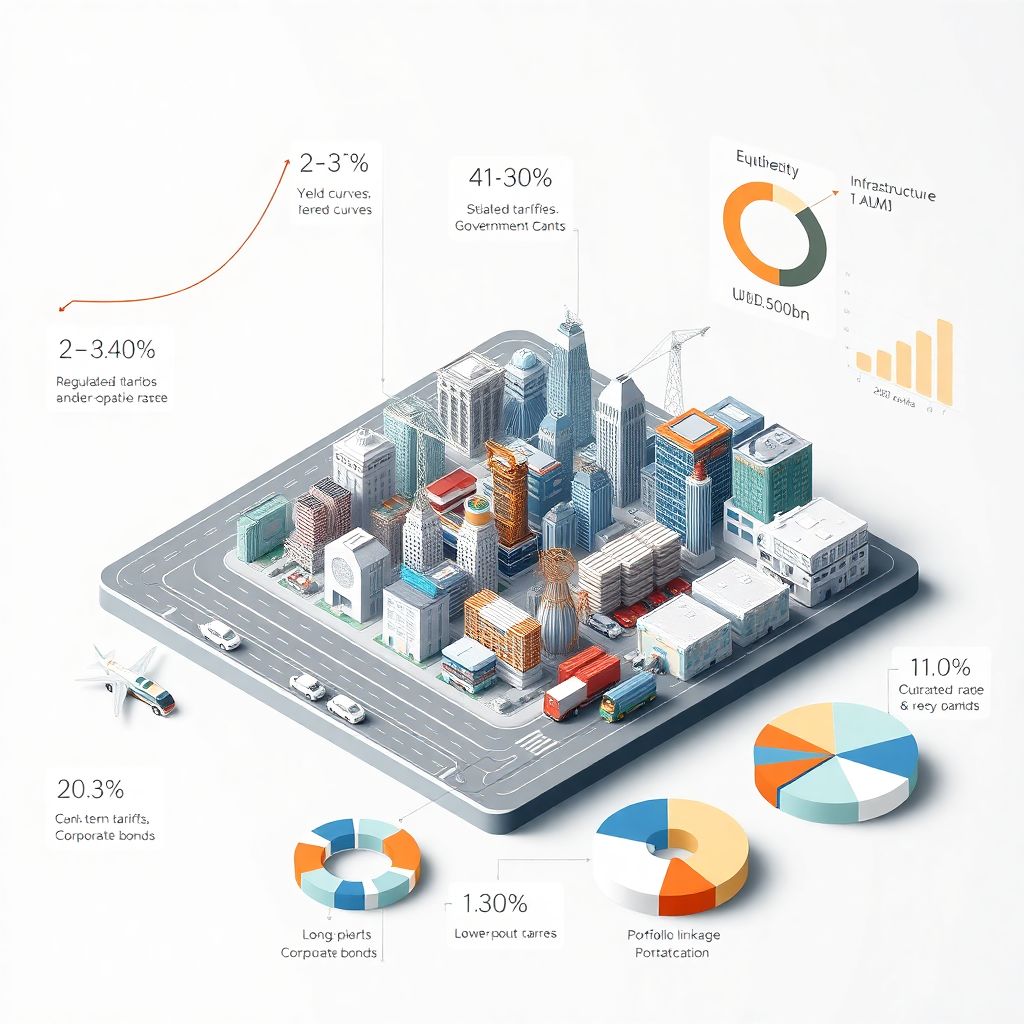

Investing in infrastructure bonds as a safe diversifier for your portfolio

Why infrastructure bonds suddenly look interesting again If you feel whiplash from markets over the last few years, you’re not alone. From 2022 to 2024, we went from “free money” rates to the fastest global hiking cycle in decades, then to sticky inflation and constant recession chatter. In that mess, a lot of portfolios ended…

-

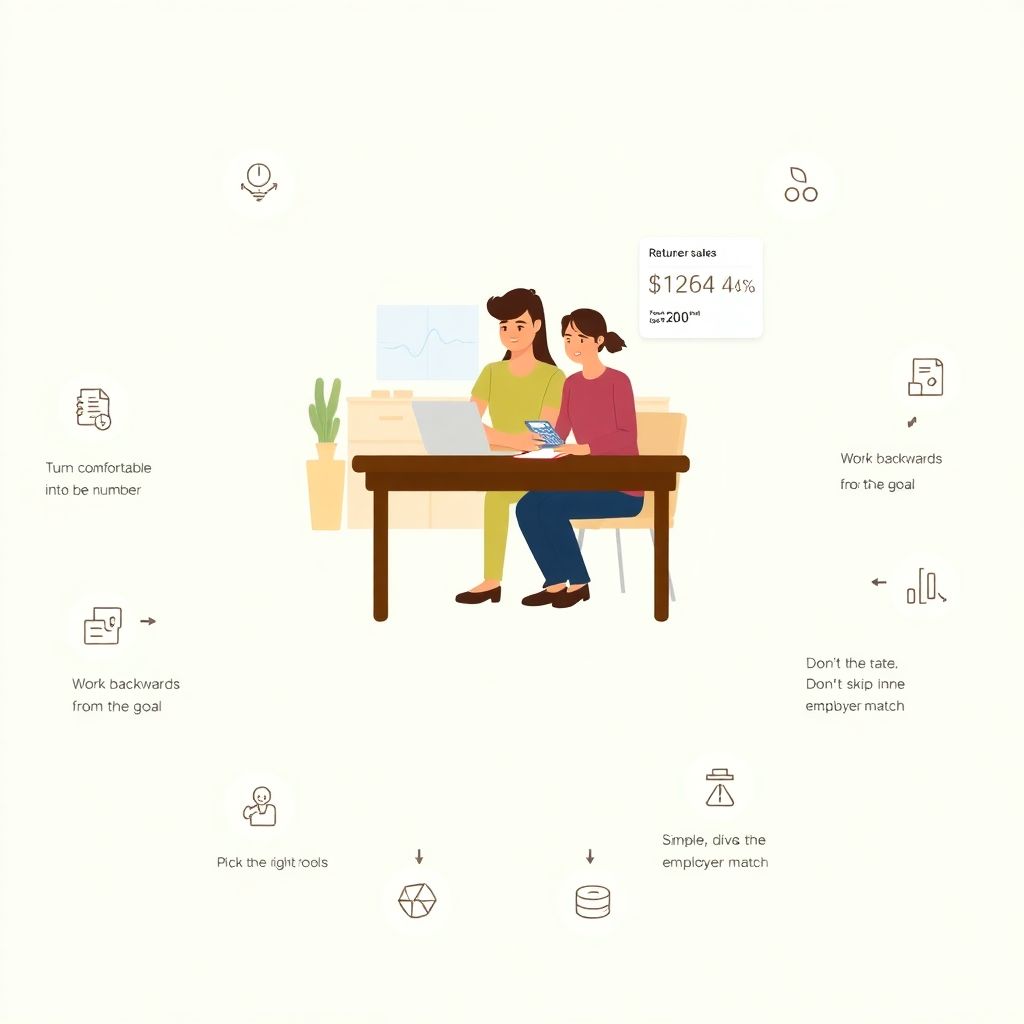

Saving for a comfortable retirement living: practical steps to secure your future

Why “Comfortable Retirement” Needs a Concrete Plan, Not Just a Hope Many people say, “I just want a comfortable living in retirement,” but almost no one can explain what that *actually* means in numbers. That’s how decades slip by and savings don’t appear. Let’s fix that. In this guide, we’ll walk step by step through…

-

Financial planning for rural economies: budgeting strategies for sustainable growth

Why Rural Financial Planning Matters in 2025 Rural communities have always lived with volatility: weather, commodity prices, migration of labor. What changed by 2025 — цифровизация рынков, климатические риски и скачки стоимости топлива — сделали ошибки в планировании особенно дорогими. Если раньше фермер мог опираться на опыт старших, сегодня без системного финансового подхода легко потерять…

-

Budgeting for a small apartment: smart space‑saving money tips

Why Small-Apartment Budgeting in 2025 Looks Different Living in a compact place in 2025 is less about squeezing in furniture and more about designing an efficient “system”: financial, spatial and digital. Rents, subscriptions, deliveries, remote work equipment — everything competes for square meters and for your wallet. That’s why small apartment budget tips today опираются…

-

Financial planning for a secure future: create your winning 5-year plan

Why a 5‑Year Financial Plan Matters in 2025 In 2025 личные финансы выглядят иначе, чем десять или двадцать лет назад. После кризиса 2008 года, пандемии 2020–2021 и волатильности рынков 2022–2023 стало понятно: импровизация больше не работает. Нужен формализованный 5‑летний финансовый план, привязанный к реальным целям и проверенным инструментам. Такой горизонт уже достаточно длинный, чтобы накопить…

-

Personal finance for busy students: quick and practical money tips

Why busy students need a simple money system, not a perfect one Between classes, part‑time work and a social life, most students don’t need a “perfect” budget – they need something that runs on autopilot. Over the last three years это стало особенно очевидно: по данным Federal Reserve, к 2023 году совокупный студенческий долг в…

-

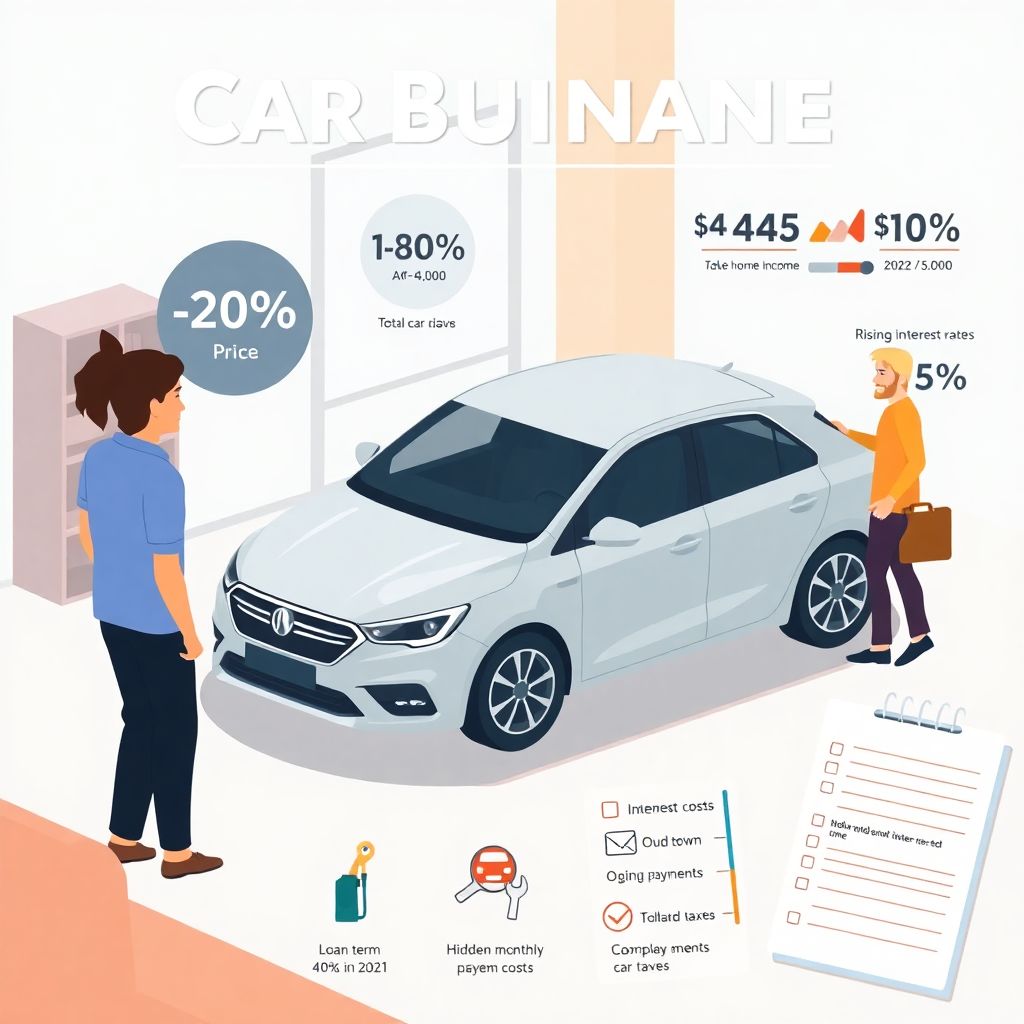

Financial planning for car buyers: how to create a realistic budget

Understanding Your Car Budget in Today’s Market Why Planning Matters More in 2025 Since 2022 автомобили резко подорожали, а вместе с ними выросли и затраты на владение. В США средняя цена нового авто держалась около 48 000 $ в 2022 году, затем немного снизилась до примерно 46 500 $ в 2024-м, но ставки по кредитам…

-

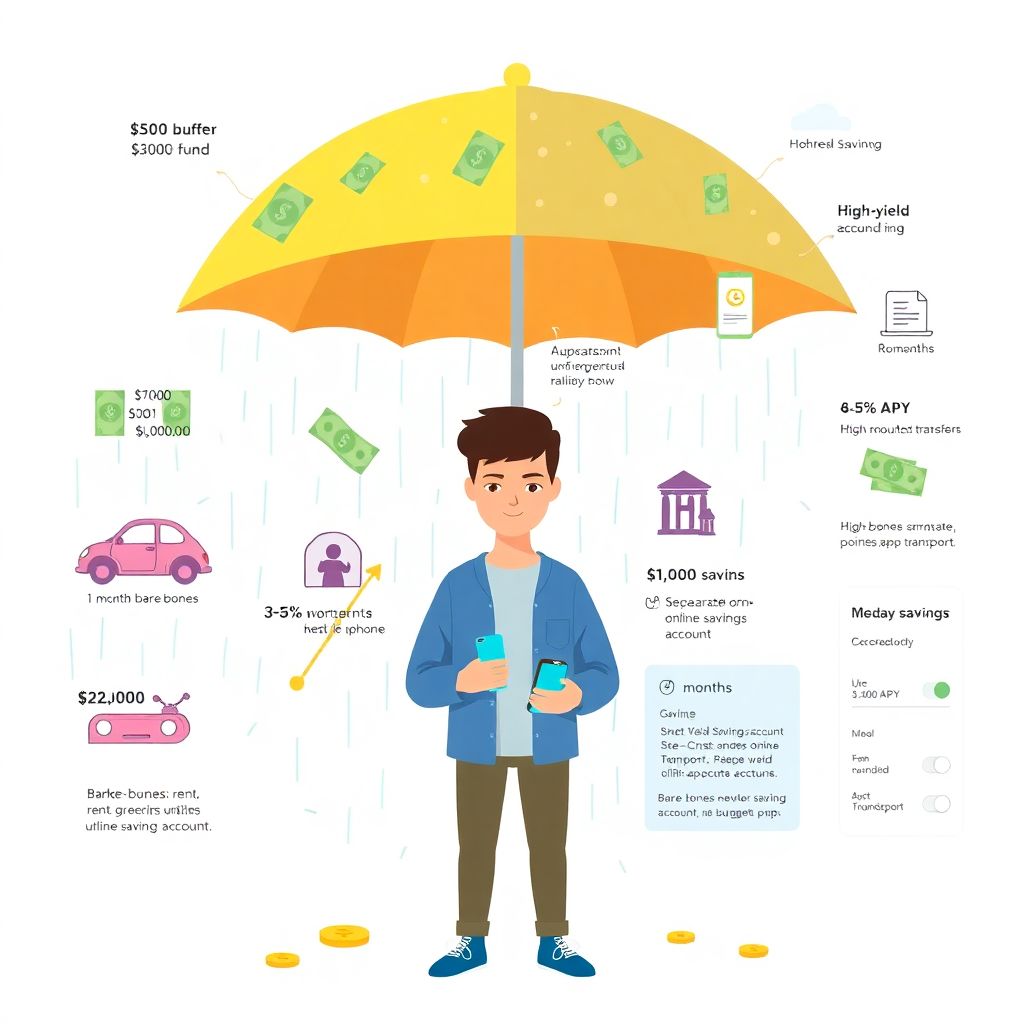

Saving for a rainy day: practical steps for everyday people

Why “Rainy Day” Money Matters More Than Ever We don’t live in a “$500 emergency” world anymore. According to recent data from the U.S. Federal Reserve, about 37–40% of adults would struggle to cover a $400 unexpected expense without borrowing or selling something. At the same time, surprise costs are getting larger: a minor car…