Budgeting for seasonal employees is one of those topics everyone nods about…and then quietly hopes spreadsheets will figure out on their own. They don’t. If вы rely on summer staff, holiday hires, harvest crews or project‑based teams, your profit and your stress level are both driven by how well you plan their costs. Let’s walk through a practical, real‑world way to create stability in uneven times, using concrete cases, non‑obvious solutions and a few tricks that seasoned CFOs rarely put in presentations.

—

Why Seasonal Staff Break Otherwise Good Budgets

The Real Problem Behind “Expensive” Seasonal Labor

The headache usually isn’t the hourly rate. The real trap is volatility: a sudden spike in hours, overtime nobody forecast, onboarding costs that hit right when sales are still ramping up, and then a painful cash dip just before money from peak season arrives. When people talk about budgeting for seasonal employees, they typically add up wages and multiply by months. In practice, cash leaves your account weeks before revenue settles, payroll taxes don’t line up neatly with sales cycles, and managers keep “just adding two more people” because demand feels urgent. The result is a business that looks profitable on paper but feels broke in the bank every quarter.

In other words, you can be right in your P&L and still wrong in your cash account.

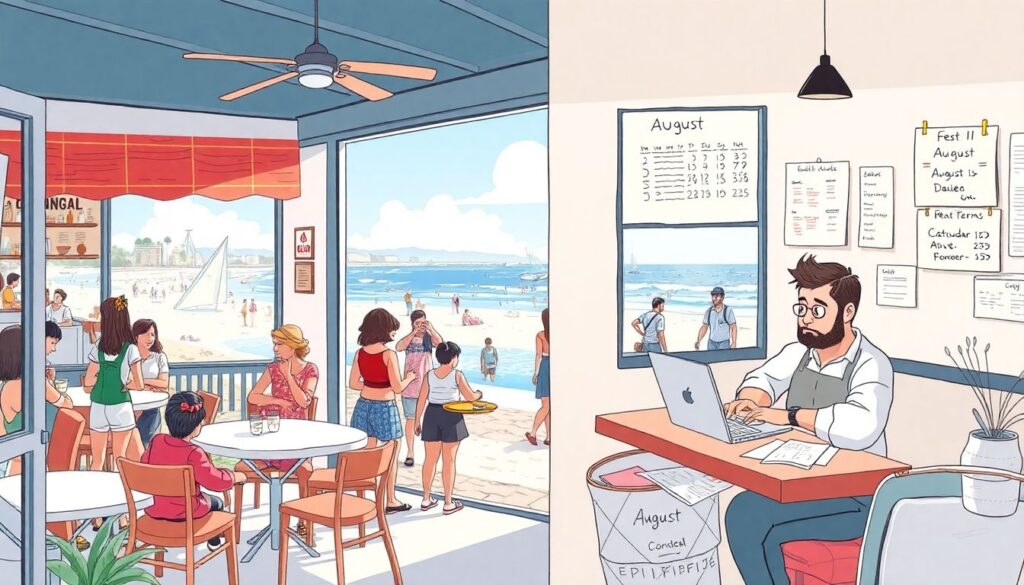

Case: The Beach Café That Was Always Late on Rent

A small coastal café in Portugal doubled its staff from 5 to 10 every summer. Revenue soared, yet every August the owner begged the landlord for a few extra days to pay rent. On paper, margins were fine. But payroll for seasonal workers went out weekly, suppliers demanded shorter terms during peak demand, and tourists paid mostly by card with a two‑to‑three‑day delay in settlement. Nobody tracked this timing. Once we rebuilt the plan around how to manage cash flow with seasonal workers—not just total costs—the café shifted payroll runs by three days, renegotiated supplier terms by just one extra week, and added a small working‑capital line with a fixed fee. Same staff, same prices, but rent was paid on time every single month.

—

Building a Seasonal Budget That Actually Reflects Reality

Break Even by Role, Not Just by Month

Typical financial planning for businesses with seasonal employees starts with one big revenue forecast, one big labor percentage, and a hopeful shrug. A more accurate (and still simple) method is to calculate break‑even by role. Instead of saying, “Labor will be 28% of sales,” ask: “At what weekly revenue does each additional seasonal hire pay for themselves, including payroll taxes, training, uniforms and supervision time?” For that café, each server needed to generate roughly €1,400 in gross margin per week to justify a full schedule. We plotted expected foot traffic versus staffing, and instantly saw two weeks where they were planning extra shifts purely “just in case.” Those shifts moved to the busiest weekends, cutting idle payroll by roughly 8% without touching hourly wages or service quality.

Once you see staff as micro‑investments that must earn their keep week by week, overhiring becomes harder to justify emotionally and financially.

Seasonal Workforce Payroll Budgeting Tips That Go Beyond “Cut Overtime”

When people search for seasonal workforce payroll budgeting tips, they usually get the same advice: cap overtime, cross‑train, start hiring earlier. All valid, but surface‑level. A more nuanced trick is to model “labor elasticity” for each task: how much revenue really moves when you add or remove one person from a shift or project. In a ski resort we advised, cutting one lift attendant from a low‑traffic weekday barely touched guest satisfaction but saved thousands over the season. By contrast, under‑staffing rental fitting rooms on weekends slashed upsell opportunity on lessons and gear. When managers saw this spelled out, staffing conversations moved from emotion to measured trade‑offs. Payroll stayed roughly flat, but profit per guest rose because hours were redistributed toward high‑leverage moments.

—

Designing Cash Flow Around Uneven Payroll

Map Timing, Not Just Totals

Knowing the annual cost of seasonal staff is almost useless if you don’t know the timing. One of the most overlooked best practices for budgeting seasonal staff costs is to create a simple “cash calendar”: a one‑page view of every week, showing expected inflows (sales, tax refunds, grants) and outflows (payroll, tax deposits, big supplier bills). A landscaping company in the Midwest used this method and discovered a recurring crunch: first payroll for new crews fell two weeks before their first round of large commercial payments, every single year. The owner used to plug the gap with high‑interest credit cards. Once the pattern was visible, they shifted contract terms by just 10 days for new clients and negotiated biweekly supplier billing during start‑up months. Same revenue, same wage rates, but a permanent fix to an “annual surprise.”

If you can’t see your cash on a weekly grid, you’re not really managing it—you’re reacting to it.

Micro‑Reserves: A Non‑Obvious Buffer That Actually Gets Used

Traditional advice tells you to build a big generic emergency fund. Nice idea, rarely implemented. A more realistic, non‑obvious solution is a set of micro‑reserves targeted to payroll. One resort group we worked with created three envelopes in their accounting system: “Pre‑Season Training,” “Peak Payroll Buffer,” and “Post‑Season Wind‑Down.” Each envelope had its own target amount and rules for when funds could be tapped. Throughout the year, a fixed slice of off‑season profits automatically flowed into these buckets. Because the reserves were labeled for specific seasonal uses, executives were far less tempted to drain them for unrelated projects. When a slow snow season hit, they still covered all seasonal wages on time, kept morale high and negotiated calmly with lenders instead of panic‑cutting hours.

—

Alternative Methods to Pay and Motivate Seasonal Staff

Variable Pay Linked to Capacity, Not Just Sales

Bonuses for seasonal workers often mirror full‑time models: hit a sales target, get extra cash. That’s risky when weather, tourism flows or global events are outside employees’ control. An alternative method we’ve seen work is capacity‑linked variable pay. For a regional events company, we designed a scheme where staff earned bonuses based on show‑ready readiness metrics: tents up on schedule, zero last‑minute rentals, rework rates below a threshold. This aligned costs with operational stability rather than raw revenue and made budgeting for seasonal employees far more predictable. Labor bonuses got triggered by metrics the company could influence more directly, which made both workers and managers feel less at the mercy of external shocks. The bonus pool itself was pre‑funded as part of the seasonal budget, so there were no nasty surprises for cash flow.

People still felt rewarded for performance, but the business avoided promising payouts it couldn’t always afford.

Case: From Hourly to Hybrid in a Warehouse Operation

A fulfillment warehouse that relied on holiday temps kept missing its labor budget by 15–20%. Volume was wildly unpredictable. Instead of purely hourly pay, they shifted part of compensation to a hybrid model: a guaranteed base of hours plus modest per‑order incentives once a threshold was crossed. Critically, the incentives only kicked in when order volume exceeded the level already assumed in the budget. That meant extra pay coincided with extra gross margin. The company could forecast max seasonal labor cost as “base plus incentive cap,” and staff still had upside in busy periods. Turnover fell because reliable base hours removed the fear of dead weeks, while cost variability above plan was tightly controlled. For the first time in five years, peak‑season payroll landed within 3% of forecast.

—

Planning Before Season, During Season, and After Season

Pre‑Season: Lock Assumptions, Not Just Headcount

Before the season begins, most owners rush to finalize hiring numbers. A more analytical, yet still practical, pre‑season move is to lock assumptions: average ticket size, expected hourly footfall, likely conversion rate, realistic absenteeism. One coastal hotel we helped used three scenario bands—pessimistic, expected, optimistic—rather than a single forecast. For each band, they built a pared‑down seasonal staffing plan, associated training spend and marketing spend. As bookings started to come in, they matched reality to one of these bands and automatically adopted the relevant plan. This avoided the chaos of mid‑season redesigns and gave HR and finance a clear script. Once the system was in place, discussions shifted from “we feel it’s busy” to “we are tracking between expected and optimistic; switch to Plan B staffing.”

You want decisions to be triggered by thresholds, not frustration.

In‑Season: Run a Weekly “Labor Check‑In” Ritual

Mid‑season, budget discipline collapses without a simple rhythm. A practice I see work repeatedly is a 20‑minute weekly labor check‑in between operations and finance. One retail chain with heavy holiday peaks routed three key numbers into this meeting: labor cost as a percent of sales, hours worked versus plan, and revenue per labor hour. No slides, no speeches, just: “Where did we over‑ or under‑staff, and what do we change next week?” Over time, managers got comfortable tweaking rosters rapidly—cutting or adding 3–4 shifts instead of reacting with big, clumsy changes after month‑end. That tiny ritual turned seasonal chaos into a set of small, continuous corrections that preserved margins without burning people out.

The trick is consistency: same day, same format, no excuses.

—

Non‑Obvious Levers Professionals Use

Re‑Timing Fixed Costs Around Peak Seasons

Experienced CFOs quietly use a lever that rarely appears in basic guides on how to manage cash flow with seasonal workers: shifting the timing of non‑labor fixed costs to create space for payroll. A winery with a big harvest crew renegotiated its insurance renewal from September to May, when cash was more stable. They also moved a major equipment maintenance window to late winter. These two calendar changes didn’t reduce total cost by a cent, but they pulled large invoices out of their most payroll‑intensive weeks. Suddenly, protecting harvest workers’ hours felt feasible instead of heroic. When you map all major fixed costs and ask, “Can any of these be moved 60–90 days in either direction?” you often free just enough liquidity to avoid high‑interest borrowing.

It’s still budgeting, but with the calendar as your main tool rather than the calculator.

Treat Training Spend as a Capital Investment

Another professional‑grade move: treat pre‑season training for seasonal employees more like capex than a pure expense. A theme park we advised spread certain training costs over three seasons in their internal metrics. Not for tax purposes, but for managerial clarity. They invested heavily in first‑year training, knowing a solid share of seasonal staff would return. Internally, finance evaluated ROI across multiple years of smoother operations, lower accident rates and higher guest spend. This shift in thinking justified better training while keeping leaders honest about payback. It also led to a deliberate strategy of rehiring past staff, since “returners” carried a much lower effective cost per productive hour. The budget reflected not just what was spent now, but what value those skills would generate over several cycles.

When talent returns, training is no longer a sunk cost; it’s an asset you deliberately build.

—

Practical Hacks You Can Implement This Quarter

Three Simple Changes With Outsized Impact

Here are a few grounded, pro‑level hacks that don’t require new software or a finance degree, yet align with best practices for budgeting seasonal staff costs:

First, set a “labor floor and ceiling” as percentages of weekly sales. If labor drops below the floor, check quality and service; if it crosses the ceiling, you must explain and consciously approve the overage. This forces intentional decisions instead of passive drift. Second, maintain a live list of “hours you can cut first” if revenue underperforms—less critical tasks, not core service. Decide this before the season, not in a panic. Third, pre‑approve a small pool of flex hours you can deploy without a meeting when demand spikes; this avoids managers quietly over‑scheduling out of fear, while still giving them tactical autonomy on busy days.

These constraints sound rigid but actually reduce friction, because everyone knows the rules in advance.

Case: The Micro‑Franchise That Stopped Drowning in Data

A micro‑franchise network of cleaning crews tried to roll out a complex budgeting template for each region. Adoption was terrible. We stripped it down to four weekly numbers: total hours, revenue, labor cost, and revenue per labor hour. Franchisees texted these to head office each Friday. Finance used this lean data stream to adjust high‑level seasonal hiring plans and marketing pushes. Instead of chasing perfect accuracy, they focused on fast feedback and directional correctness. Within two seasons, cash crunches before holidays were nearly gone, and the company finally understood where its seasonal model was genuinely profitable versus where it was merely busy. Seasonal planning stopped being an annual guessing contest and became a rolling, data‑backed conversation.

The lesson: your system doesn’t need to be sophisticated; it needs to be used.

—

Bringing Stability to Uneven Times

Seasonal businesses don’t have to live in permanent crisis mode. With sharper assumptions, weekly visibility and a few alternative methods of paying and scheduling staff, budgeting for seasonal employees becomes less about fear and more about controlled bets. You won’t eliminate volatility—weather, tourism and global shocks will still loom—but you can decide in advance how those shocks ripple through your payroll, cash flow and hiring choices.

If you start by mapping timing, building micro‑reserves, and turning staffing decisions into explicit trade‑offs rather than gut calls, your seasonal workforce stops being a recurring emergency and becomes a designed system. That’s the real definition of stability in uneven times: not flat lines on a chart, but the confidence that when the peaks and valleys come, your numbers and your people are both prepared.