Why expat money feels harder than it should

Living abroad breaks all the default assumptions of personal finance. Your income may be in EUR, your rental contract in AED, your student loan in USD, and your future pension in GBP. Exchange rates, double taxation, and banking rules suddenly matter more than your Netflix password. That’s why financial planning for expats isn’t just “make a budget and invest the rest” — it’s about making sure cash flows, taxes, and risks line up across multiple countries and legal systems simultaneously.

Start with a base currency and map your cash flows

First step: choose a “home” currency for decisions, even if you don’t live there. For most people it’s either the currency of long‑term obligations (like a US mortgage) or of retirement plans. Then map monthly inflows and outflows in that currency. Use a conservative FX rate, not today’s optimistic spot quote. For example, assume EUR/USD at 1.05 when planning, even if the screen shows 1.10, to stress‑test your expat budgeting and offshore banking solutions against currency shocks.

Case study: The engineer paid in three currencies

David, a Canadian engineer in Dubai, was paid mostly in AED, did remote consulting in USD, and funded his parents in CAD. He felt rich but ended each year with nothing saved. Once we converted every cash flow to CAD and applied a “haircut” of 5% on income for FX noise and delays, his real savings rate was only 6%, not the 20% he assumed. Adjusting rent and discretionary spending pushed that to 18% within six months without a pay rise — just clearer multi‑currency budgeting.

Technical block: FX risk, not just FX noise

From a technical angle, your “real” budget is exposed to FX risk duration. Income in a volatile currency that is saved for use in a stable currency creates a structural short position. A practical rule: if you plan to spend money within 12 months, hold it in the currency of spending as early as possible. If the horizon is 5–20 years, diversify across major currencies aligned with your future lifestyle assumptions rather than speculating on one “winner” based on recent performance.

Building an expat budget that actually survives reality

A robust expat budget starts with higher safety margins. Relocation costs, flights home, visa renewals, international schools, and private insurance are chronic underestimates. Layer in 10–20% buffer over what locals pay for similar lifestyles. Many expats also forget “latent” costs: tax filing fees, document translations, and higher transaction charges on cards or ATM withdrawals. A line item labelled “mobility overhead” in your budget makes these visible instead of letting them quietly erode your savings rate in the background.

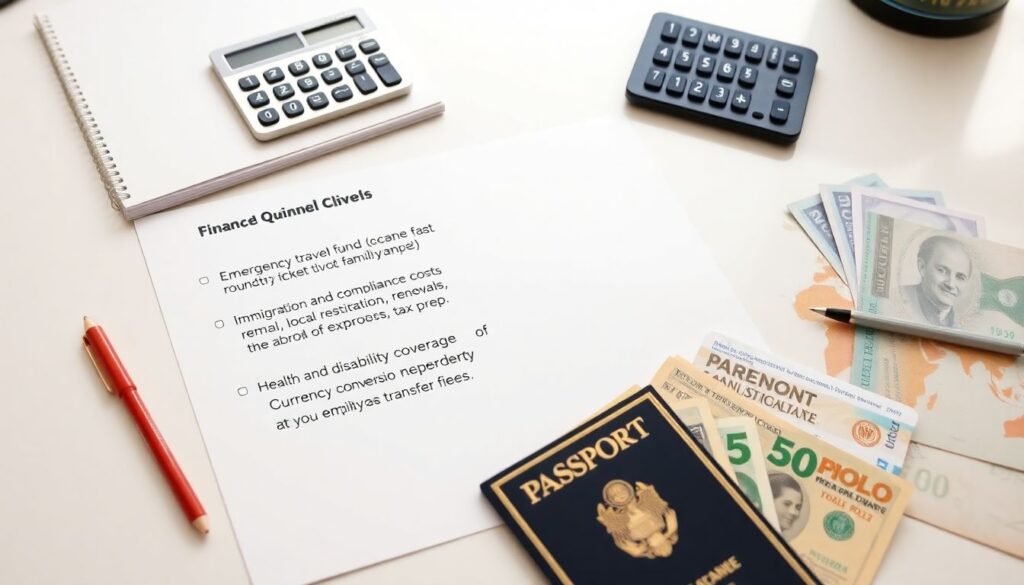

What to include in an expat‑grade budget

– Emergency travel fund (e.g., one last‑minute round‑trip ticket for each family member)

– Immigration and compliance costs (visas, renewals, local registrations, tax prep)

– Health and disability coverage independent of your employer’s policy

– Currency conversion and international transfer fees

– Annual trips home plus support for relatives, if that’s expected culturally

Case study: Relocation shock for a family of four

Maria and Tomas moved from Poland to Singapore with two kids. Their spreadsheet looked tidy: 7,000 SGD net income, 4,500 SGD expenses, 2,500 “savings.” Year one, their account barely grew. We reconstructed actuals: 800 SGD a month on flights and family visits averaged over a year, 250 on visa and agency fees, 150 on FX and bank costs, and 300 on unplanned school items. Once these went into the formal budget, “true” savings fell to 900 SGD, forcing them to downgrade housing to stay on track with long‑term goals.

Using banking architecture to support your plan

Expat banking isn’t only about fancy accounts; it’s about liquidity tiers in the right jurisdictions. A pragmatic structure is: one local current account for salary and bills, one hard‑currency account (USD, EUR, or GBP) for medium‑term reserves, and one “home country” account for legacy obligations and credit history. Avoid holding large idle balances in weak currencies when there are capital controls or inflation risks. Instead, transfer surplus monthly based on a rule, not on gut feelings about where FX is “going next.”

Technical block: How offshore banking fits in

Offshore accounts, when used correctly and reported properly, are just tools for jurisdictional diversification, not secrecy. The better expat financial planning services structure accounts in stable, regulated hubs (e.g., Luxembourg, Ireland, Jersey) to reduce political and banking‑system risk. For liquidity, maintain 3–6 months of expenses across onshore accounts tied to everyday spending, and 6–12 months in a high‑quality offshore money‑market or short‑duration bond fund denominated in your chosen base currency, subject to your home‑country tax rules.

Cross‑border taxes: the planning landmine

Most problems arise not from high tax rates, but from bad sequencing. You can be tax resident in one state, domiciled in another, and still liable for reporting to a third, especially as a US citizen or UK non‑dom. Cross border tax and wealth management therefore starts with mapping tax residency rules by days, ties, and intent. Simple moves like delaying share vesting, restructuring bonuses, or changing the type of investment account before leaving can save five figures over a few years, without aggressive schemes.

Case study: The US teacher in Germany

Emily, a US citizen teaching in Berlin, thought her German taxes “covered everything.” She ignored US filings for four years. When she finally met an international financial advisor for expats, they had to reconstruct income and foreign tax credits. Penalties were reduced under IRS amnesty programs, but she still paid over 6,000 USD in costs that could have been close to zero with timely forms. Her new process: annual joint review of German and US obligations, plus investment accounts chosen specifically for US‑friendliness to avoid PFIC pitfalls.

Investing when your life is portable

For mobile professionals, the best expat investment and retirement planning avoids products tied to one employer, one tax code, or one residency assumption. Instead of opaque, commission‑heavy “expat savings plans” with 20‑year lock‑ins, use liquid, low‑cost ETFs in globally diversified portfolios, held through platforms that remain accessible if you change countries. Focus on portability and clarity: can you explain in one paragraph what happens to your pension or brokerage account if you move again or return home earlier than planned?

Technical block: Asset location beats product marketing

The technical edge comes from asset location, not exotic wrappers. Allocate growth assets (equities, REITs) to tax‑advantaged accounts in your primary tax system where possible, and income‑heavy assets (bonds, high‑yield funds) where they are least penalized. Watch for local “tax traps,” like non‑reporting offshore funds that trigger punitive regimes. A disciplined international asset‑location strategy often saves 0.5–1.0 percentage point per year after tax, which compounds to 12–26% higher wealth over 20 years without changing your risk profile.

Risk management: insurance beyond borders

Employer health insurance usually doesn’t travel well. If you change jobs, countries, or visa type, coverage can vanish instantly. Portable life, disability, and international health policies become essential for anyone with dependants or long‑term financial commitments. Check not just coverage limits, but jurisdiction of the insurer, claims history across borders, and currency of benefits. The goal is simple: a serious event in one country should not force you to liquidate investments or take on high‑interest debt in another.

When to seek professional expat help

DIY works up to a point, but complexity scales fast with each extra passport, property, or pension. A credible international planner coordinates tax, investment, and legal input rather than pushing products. Good expat financial planning services usually start with detailed, paid advice separated from any implementation fees, then help you execute only what you understand. Red flags: long lock‑in periods, high surrender penalties, or pressure to sign during the first meeting. Genuine planning should leave you with a blueprint, not a mystery contract.

Checklist for your next 90 days abroad

– Define your base currency and rebuild your budget in that unit

– Segment accounts into local spending, hard‑currency reserves, and long‑term investments

– Confirm tax residency and filing duties for all passports you hold

– Review employer benefits and add portable insurance where needed

– Align investments with likely future countries, not just your current posting

Final case: Designing a portable money system

Jin, a Korean software architect, moved from Seoul to Toronto, then to Amsterdam. After three relocations, he had five pension pots, three legacy brokerage accounts, and no idea what his retirement looked like. A structured overhaul consolidated old accounts where possible, set one EUR‑based long‑term portfolio, created a CAD buffer for a potential return to Canada, and defined a clear savings target of 25% of net income. Within two years, Jin no longer cared where his next role would be; his financial system was finally geography‑agnostic.