When people talk about paying for college, it can sound like you either need a trust fund or a lottery ticket. Reality is less dramatic: you usually need time, a clear goal, and a flexible plan that can bend when life doesn’t follow the script. Over the last few years, families have been mixing old‑school tools like the 529 college savings plan with newer, app‑driven investing to build a buffer against rising tuition and unpredictable markets. The trick is to understand how these options behave under stress: job loss, market drops, a kid who decides on trade school instead of a four‑year degree, or a surprise scholarship that changes the math at the last minute. Flexibility is not a bonus feature anymore; it’s the backbone of any realistic strategy.

At the same time, you don’t need to become a Wall Street analyst. You mostly need to match the right type of account to your risk level, your kid’s age, and how certain you are that “college” is actually the destination.

Why college savings still matter in 2025

Cost and debt snapshot 2022–2024

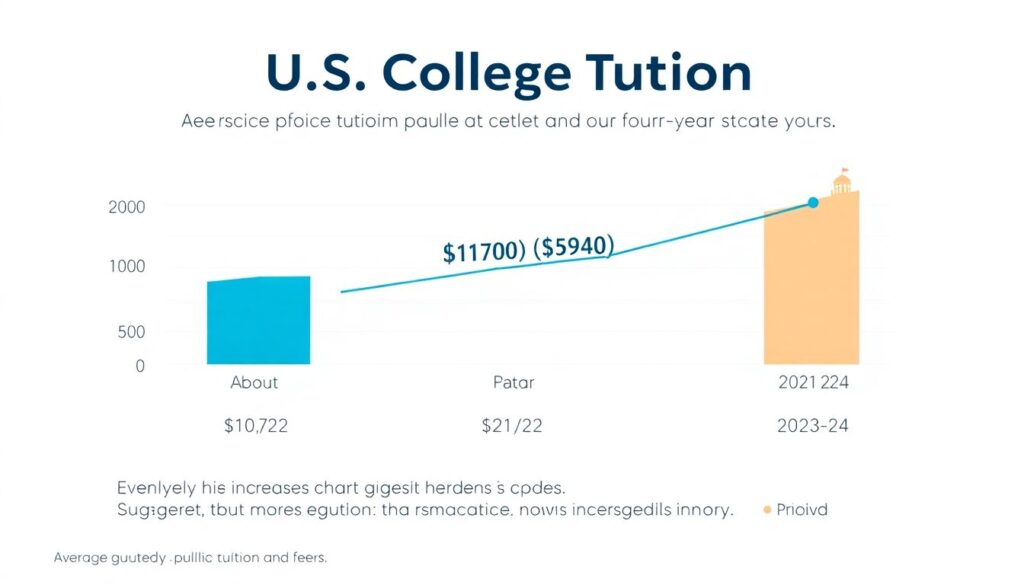

Over the last three academic years, college got a bit more expensive, but not as fast as headlines sometimes suggest. According to the College Board, average published tuition and fees for a U.S. public four‑year in‑state school rose from about $10,740 in 2021–22 to $10,940 in 2022–23, and then to roughly $11,260 in 2023–24. That’s a modest annual increase of around 2–3%, but room, board, and other costs push the average total budget for an in‑state student to roughly $28,000 per year. On the debt side, federal student loan balances have hovered around $1.6 trillion, and recent graduates from 2022 and 2023 left school with an average of roughly $28,000–$30,000 in debt. In short, the price curve is still sloping up, and borrowing is still the default “plan” for many families.

What changed since the pandemic years is awareness: more parents now see saving even a small amount as a way to buy choices later. Instead of asking, “Can we pay for all four years?” many now ask, “How much future debt can we prevent?” That mindset shift is exactly where flexible planning shines.

Comparing main ways to save

529 plans, ESAs, Roth IRAs and plain brokerage

When you compare education savings accounts and 529 plans, you’re really weighing three things: taxes, flexibility, and control. A 529 college savings plan gives you tax‑free growth and tax‑free withdrawals for qualified education, plus possible state tax deductions, which is why it’s often on every list of the best college savings plans for parents. But that tax break is basically a trade: in return, you accept rules about how the money can be used and potential penalties if you go too far off‑label. Coverdell Education Savings Accounts allow slightly more flexibility on K–12 costs but have low contribution limits and income caps, so they’re a niche tool. Roth IRAs are stealth college accounts: you can always take back your contributions tax‑ and penalty‑free, and earnings may be tapped for qualified education, but doing so competes with your own retirement. A regular taxable brokerage account is maximally flexible—any school, any timing, any person—but offers no special tax perks. The most resilient strategies for 2025 usually blend two or three of these, not just one.

A useful gut check: if college is almost certain and your child is still years away, leaning heavily on tax‑advantaged accounts usually makes sense. If your situation is unusually uncertain—unstable income, a child with an unclear path, or you value optionality above all—putting more in plain brokerage or Roth contributions can keep doors open without locking you into education‑only rules.

Pros and cons of “tech” behind modern college saving

Automation, apps, and micro‑investing

The past three years have seen a boom in flexible college savings plan options powered by fintech apps, robo‑advisors, and employer platforms. Many 529 programs now offer age‑based portfolios that automatically shift from mostly stocks to mostly bonds as your child nears 18, which can reduce the urge to constantly tinker and accidentally “sell low.” Some apps round up your debit card purchases and sweep the spare change into an investment account earmarked for education; others let relatives contribute digitally to 529s instead of buying yet another toy. The upside is behavioral: automation turns good intentions into real contributions, even if they’re small. Robo‑style portfolios standardize diversification and rebalancing, so you’re less dependent on your own timing decisions. The downside is that “frictionless” can become “thoughtless”—families may end up with scattered small accounts, overlapping fees, or portfolios that don’t match their true risk tolerance. Also, convenience tech doesn’t erase market risk: a 20% drop in stocks hurts, whether you invested via an app or a paper form. The smart play is to use automation for consistency, but still review once or twice a year with clear targets in mind.

There’s also a psychological twist: when saving becomes almost invisible, people sometimes underestimate how much they’ve actually put aside—or overestimate what small automatic transfers can achieve alone. Technology works best when it supports a written plan, not when it replaces one.

How to pick a flexible plan in real life

Turning rules of thumb into an actual setup

Building a flexible college strategy starts with two timelines: your child’s age and your own retirement horizon. If your kid is under 10 and you’re on track for retirement, it often makes sense to prioritize a 529 for the bulk of the goal, then keep some money in a taxable account or Roth contributions as a pressure valve in case plans change. If your child is in high school and you’re behind on retirement, you may flip the logic: focus aggressively on retirement accounts and use only moderate, targeted college saving, leaving room for scholarships, in‑state choices, or part‑time work to fill the gap. Risk tolerance matters too; for younger kids, stock‑heavy portfolios have historically offered better long‑term growth, but for juniors and seniors you generally want more safety to avoid being forced to sell after a market dip. A good practical sequence is simple: estimate a rough four‑year cost using current local tuition and a 3–4% inflation assumption, decide how much of that you realistically want to cover (maybe 50–70%), then back into a monthly savings number that feels ambitious but sustainable. If the math doesn’t work, adjust the college expectation before you stretch your budget to a breaking point.

For many families, checking in with a financial advisor for college savings planning once or twice around major milestones—a birth, the start of high school, and just before applications—can pay for itself by avoiding big, irreversible mistakes.

Trends to watch through 2025

Policy shifts, market reality, and family behavior

Looking toward 2025, several currents are reshaping how families think about college saving. First, policy: debates over student loan forgiveness and income‑driven repayment have made parents wary of relying exclusively on future borrowing, but they’ve also reminded everyone that rules can and do change. That uncertainty tends to push people toward flexible, multi‑account strategies rather than an all‑in bet on loans or a single savings vehicle. Second, the job market: between 2022 and 2024, wages for some skilled trades and tech‑adjacent roles without traditional degrees rose faster than many entry‑level “degree required” jobs. As alternatives like community college plus transfer, certificate programs, and apprenticeships gain traction, parents are increasingly planning for “post‑high‑school education” rather than just a four‑year campus experience. Third, markets themselves: after a bruising 2022 for both stocks and bonds, followed by partial rebounds in 2023 and 2024, savers have been reminded that even “safe” bond funds can be volatile over short windows. This is nudging plan designers to refine age‑based tracks and encouraging families to hold a bit more genuine cash in the final pre‑college years, trading some growth for sleep‑at‑night stability. Put together, these trends all point to the same conclusion: the winning move is not a perfect prediction of tuition in 2035, but a setup that can flex gracefully as prices, politics, and your child’s ambitions evolve.

In the end, saving for a college education with a flexible plan is less about chasing the single perfect product and more about building a toolkit you can actually use. Tax‑advantaged accounts buy you efficiency, plain brokerage and Roth contributions buy you freedom, and a bit of structure plus automation buys you consistency. Combine those with honest conversations about what you can afford—and what your child really wants—and you’ll be far closer to a workable plan than most families, no spreadsheets or crystal balls required.