Getting Started with Budgeting for a New Car Purchase

Buying a car is one of the biggest financial decisions we make, right after purchasing a home. Whether it’s your first car or you’re upgrading to a newer model, planning your budget properly can save you from unnecessary debt and regret. According to Kelley Blue Book, the average price of a new car in the U.S. reached $49,075 by the end of 2024, up from $42,380 in 2022—a jump of over 15% in just two years. With rising prices and interest rates hovering around 6.9% on new auto loans (as of late 2024), it’s more important than ever to approach car buying with a solid financial strategy.

Essential Tools for Planning Your Car Budget

Before jumping into dealership visits or test drives, gather a few tools to set yourself up for success. A spreadsheet app like Excel or Google Sheets will help visualize your savings goals and monthly expenses. Next, use an online loan calculator to explore different financing scenarios. There are also budgeting apps like YNAB (You Need A Budget) or Mint that sync with your bank accounts, letting you track income and spending automatically.

Don’t overlook credit score tracking tools from services like Credit Karma or Experian. Your credit score directly affects the interest rate you’ll receive on a loan, and even a 0.5% difference can cost you thousands over the life of a 5-year loan.

Step-by-Step Process to Budget for a Car

So, how do you break down the budgeting process into manageable steps? Here’s a straightforward approach:

1. Determine What You Can Afford Monthly

Use the 20/4/10 rule as a guide: Make a down payment of at least 20%, finance the vehicle for no more than 4 years, and keep all automotive expenses (including insurance and maintenance) under 10% of your monthly income.

2. Check Your Credit and Get Pre-Approved

In 2023, the average interest rate for new car loans was 6.6%, according to Experian’s State of the Automotive Finance Market report. A higher credit score can reduce this rate significantly. Shop for pre-approvals from different lenders—don’t wait until you’re at the dealership.

3. Save for the Down Payment

Aim to save at least 20% of the car’s total price. For a $40,000 vehicle, that’s $8,000. Setting up an automatic transfer to a dedicated savings account can help you hit that target faster.

4. Estimate Ownership Costs Beyond the Sticker Price

Consider insurance, registration fees, routine maintenance, fuel, and depreciation. On average, Americans spent around $894 per month on new car ownership in 2024, including payments and operating expenses (AAA report).

5. Stick to Your Budget During the Purchase

Once you know your limits, resist upselling at the dealership. Extended warranties, dealer packages, and unnecessary add-ons can quickly inflate your costs by thousands.

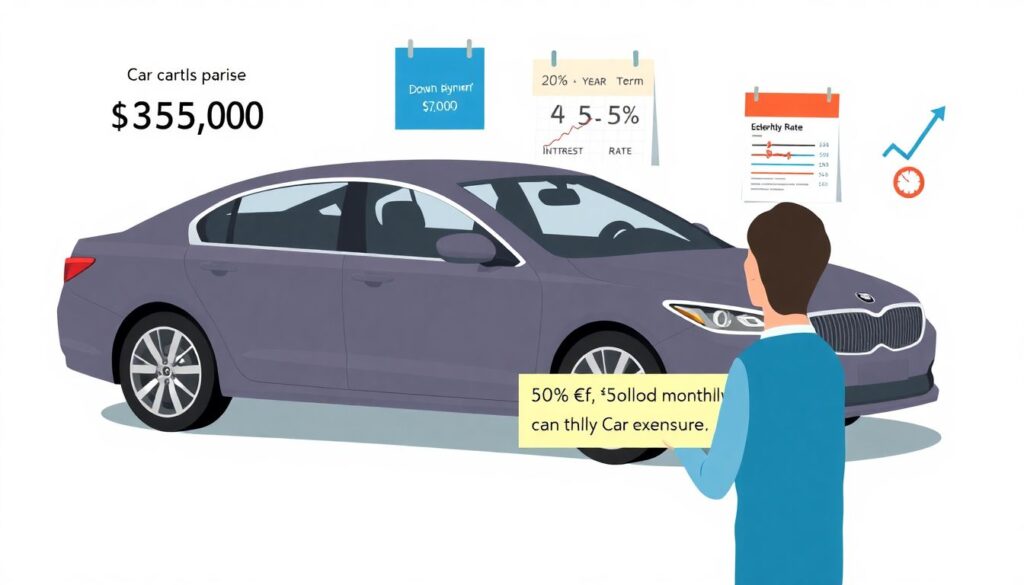

Example: Budgeting for a $35,000 New Car

Let’s say you’re eyeing a $35,000 sedan. You plan to put down 20% ($7,000), and your monthly income is $5,000. According to the 20/4/10 rule, your total car expenses, including loan payments and insurance, should not exceed $500 monthly. If you qualify for a 4-year loan at 5.5% interest, your monthly payment would be around $640—too high. This means either increasing your down payment or choosing a less expensive vehicle may be necessary.

Troubleshooting Common Budgeting Mistakes

It’s easy to go off track despite good intentions. Here are some common pitfalls to watch out for and how to avoid them:

1. Underestimating Total Costs

People often focus only on the monthly payment. Don’t forget depreciation—the largest cost of car ownership. A new vehicle loses roughly 20% of its value in the first year, and up to 60% in 5 years.

2. Ignoring Insurance and Taxes

Insurance premiums vary by age, location, and vehicle type. A sports car may look great but cost you double in premiums compared to a compact sedan. Also, don’t forget to include sales tax, which can be 5% to 9% depending on your state.

3. Overreliance on Financing

With interest rates increasing since 2022, stretching your loan term to reduce monthly payments can backfire. A 72-month loan may seem manageable, but you’ll pay more in the long run and stay in debt longer.

4. Not Shopping Around for a Loan

In 2024, the average interest rate on dealer-financed loans was 1% higher than those from credit unions. Always compare rates, and don’t be afraid to negotiate.

5. Impulse Buying at the Dealership

Tempted by a flash sale or “limited-time offer”? Step back and evaluate whether the vehicle fits your long-term needs and budget. It’s better to miss a deal than to drive off with a financial burden.

Final Thoughts: Make Saving a Habit, Not a Hurdle

Budgeting for a new car isn’t about limiting yourself—it’s about making informed, confident decisions. By understanding what you can afford and planning every step—from saving for a down payment to managing ongoing expenses—you set yourself up for financial stability, not stress.

Keep in mind: Prices have been steadily rising. In 2022, the average new car price was $42,380; it hit $46,800 in 2023, and by 2024 climbed to just over $49,000. With that trend, starting your savings early and staying disciplined can make a big difference. Use the tools available, avoid common financial missteps, and turn car buying into a smart, strategic move.