Historical Context of Personal Finance Media

The evolution of personal finance content has closely followed technological advancements. In the early 2000s, blogs emerged as a novel way for individuals to share financial strategies, often from a first-person perspective. As digital publishing became democratized, finance bloggers gained traction by offering transparent, real-life financial journeys. By the 2010s, the rise of smartphones and streaming platforms enabled podcasts to proliferate. With lower barriers to entry and growing listener engagement, personal finance podcasts carved out niches—from debt repayment stories to investment strategies. This progression reflects a shift from institutional advice to peer-driven content, making finance more accessible to broader audiences.

Fundamental Principles of Launching a Finance Platform

Starting a personal finance podcast or blog requires alignment between audience value and content integrity. The foundational components include: (1) content specialization (e.g., budgeting, FIRE movement, or passive income), (2) factual accuracy backed by research or professional credentials, and (3) sustainable publishing workflows. Technical setup demands selecting a reliable Content Management System (CMS) for blogs or podcast hosting platform for audio distribution (e.g., Libsyn, Buzzsprout). SEO optimization for blogs and RSS distribution for podcasts ensure discoverability. Monetization should follow value delivery, not precede it—via affiliate marketing, sponsorships, or digital products. Most importantly, transparency in financial disclosures and disclaimers is essential to build long-term trust.

Implementation Examples: From Concept to Execution

Consider three illustrative models of successful execution. First, a niche blog focused on college student budgeting can scale through long-form articles, downloadable templates, and affiliate links for student credit cards. Second, a podcast centered on financial independence (FI) could employ interviews with FI achievers, leveraging platforms like Spotify and Apple Podcasts for growth. Third, combining both formats—such as transcribing podcast episodes into SEO-friendly blog posts—offers content repurposing for greater reach. Notable examples include “Afford Anything” by Paula Pant, which started as a blog and expanded into a widely respected podcast, and “The Budget Mom,” a blog that transitioned to multimedia content delivery while retaining its core value proposition.

Common Misconceptions and Newcomer Mistakes

Beginners frequently misunderstand the time and consistency required to build authority in personal finance media. A prevalent error is overemphasizing monetization early on, which can compromise content quality and erode audience trust. Additionally, assuming domain knowledge suffices without understanding platform mechanics (e.g., SEO, audio editing, or distribution algorithms) leads to low engagement. Another common misstep is ignoring compliance—failing to include appropriate financial disclaimers or affiliate disclosures can have regulatory consequences. Novices also often create overgeneralized content, lacking a unique value proposition. Lastly, many underestimate the need for audience feedback loops, which are critical for iterative content improvement and sustaining relevance in a dynamic landscape.

Step-by-Step Launch Plan

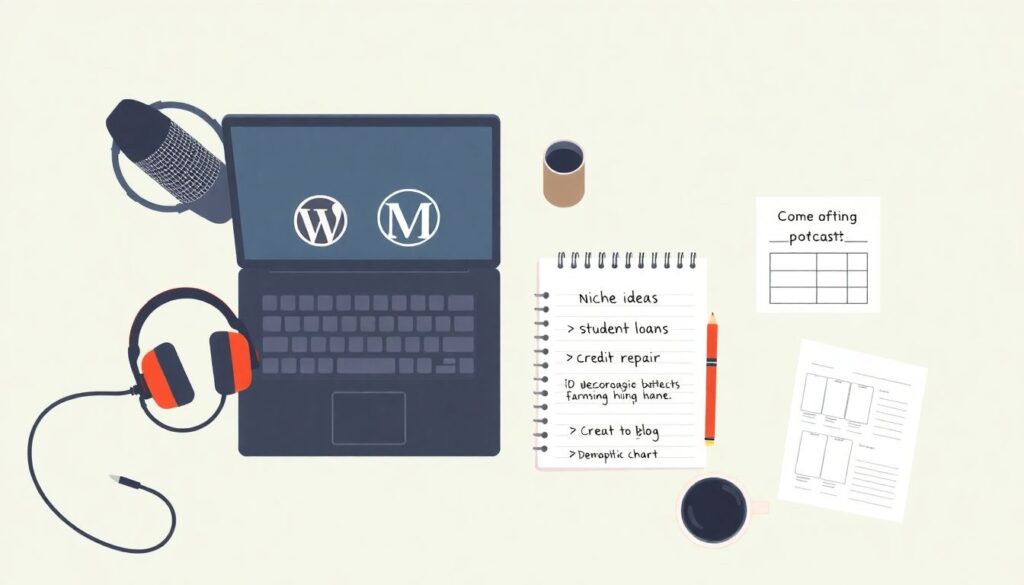

To initiate a personal finance podcast or blog effectively, follow this structured roadmap:

1. Define Your Niche and Audience: Identify a focused topic (e.g., student loans, credit repair) and profile your target demographic.

2. Select Your Platform: Choose between WordPress, Ghost, or Medium for blogging; or Anchor, Podbean for podcast hosting.

3. Develop Content Strategy: Plan thematic series or editorial calendars enabling consistent publishing.

4. Equip Technically: Invest in a quality microphone, audio editing software (e.g., Audacity), or blogging tools like Grammarly and Yoast SEO.

5. Publish and Promote: Disseminate initial episodes/posts, leveraging social media and community forums (e.g., Reddit’s r/personalfinance).

6. Iterate Based on Analytics: Use tools like Google Analytics or podcast metrics to refine strategy and improve audience engagement.

By adhering to these principles and avoiding common pitfalls, aspiring creators can launch credible, impactful personal finance platforms that educate and empower.