Understanding the Foundations of a Sustainable Debt Repayment Schedule

Developing a debt repayment schedule that endures over time requires more than basic budgeting. The foundation lies in accurately assessing total liabilities, distinguishing between types of debt (e.g., revolving vs. installment), and aligning repayment strategies with cash flow realities. Misjudging monthly affordability or underestimating interest accumulation can lead to default cycles. A sustainable plan must account for fixed and variable income, interest rates, and psychological triggers that influence spending behavior. Many beginners skip these diagnostics, which leads to unrealistic goals and rapid burnout.

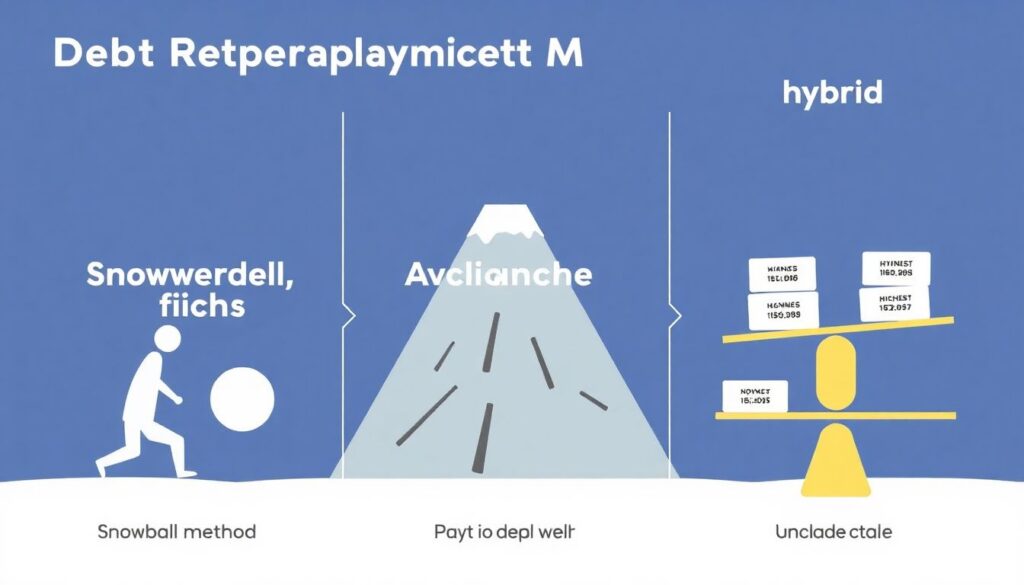

Comparing Repayment Strategies: Snowball vs Avalanche vs Hybrid

The two most prominent debt repayment methodologies are the Snowball and the Avalanche methods, each with distinct operational mechanics. The Snowball method prioritizes clearing the smallest balances first, while the Avalanche targets debts with the highest interest rates. A third, hybrid approach merges psychological motivation with financial optimization.

1. Debt Snowball: Builds momentum by quickly eliminating minor debts.

2. Debt Avalanche: Minimizes total interest paid over time.

3. Hybrid Approach: Starts with small balances for motivation, then shifts focus to high-interest accounts.

While the Avalanche is mathematically superior, beginners often struggle to stay motivated when progress seems slow. Conversely, the Snowball may cost more in interest but provides quicker psychological wins. Selecting the right method depends on one’s financial discipline and emotional resilience.

Technology: Tools That Aid—or Hinder—Progress

Modern fintech solutions offer automated tools for tracking, scheduling, and visualizing debt repayment. Apps like YNAB, Undebt.it, and Tally integrate budget synchronization and AI-driven recommendations. However, overreliance on automation without understanding the underlying financial logic can be counterproductive. Moreover, some platforms promote credit usage under the guise of optimization, which may sabotage long-term goals.

Pros of debt management software:

– Real-time progress tracking and alerts

– Customizable repayment scenarios

– Integrated budgeting and expense categorization

Cons:

– Subscription costs may offset savings

– Limited adaptability for non-standard debts (e.g., medical bills or informal loans)

– Users may become passive participants, reducing accountability

Common Mistakes Novices Make

Many individuals new to debt management fall into predictable traps:

1. Neglecting Emergency Funds: Allocating all disposable income towards debt leaves no buffer for unexpected expenses, leading to re-borrowing.

2. Overestimating Monthly Contributions: Setting unsustainable payment targets often results in missed payments or financial stress.

3. Ignoring Interest Rate Structures: Failing to distinguish between APR and nominal interest skews repayment prioritization.

4. Lack of Regular Review: Static plans become obsolete with income changes, new debts, or rate adjustments.

5. Emotional Decision-Making: Reacting to stress by abandoning structured plans in favor of quick fixes.

Avoiding these missteps requires financial literacy, regular audits, and clear performance benchmarks.

How to Choose the Right Debt Repayment Plan

Choosing a viable approach depends on a combination of financial metrics and personal behavior patterns. Begin with a complete liability assessment, including minimum payments, terms, and interest rates. Next, conduct a net cash flow analysis to determine safe repayment thresholds. Finally, use a decision matrix to weigh the benefits of Snowball vs Avalanche, factoring in psychological endurance and financial literacy.

Key selection criteria:

1. Total interest exposure

2. Debt-to-income ratio

3. Motivation style (results-driven vs. cost-driven)

4. Risk tolerance for variable income

5. Existing financial obligations and priorities

2025 Trends in Debt Repayment Strategies

Looking forward to 2025, several trends are reshaping how individuals approach debt repayment. AI-driven financial coaching is becoming mainstream, offering personalized repayment schedules based on behavioral analysis. Additionally, embedded finance within banking apps now enables proactive debt management—such as rounding up purchases to automate micro-payments.

Decentralized finance (DeFi) is also influencing repayment models, particularly in peer-to-peer lending ecosystems where terms are more flexible. Finally, there is a growing emphasis on “financial wellness” programs offered by employers, which include debt counseling and payroll-integrated repayments.

The convergence of these developments underscores a shift from reactive to proactive debt management, empowering users to build repayment schedules that adapt dynamically to life changes.